Four things retirees should remember about shares

Aussie retirees have a love affair with shares, but not all share portfolios are created equal when it comes to providing sustainable income.

This article focusses on the four things that pension-phase investors need to consider when investing in equities: tax, income, growth and regulations.

1. Tax matters – but not in the way you think

Retirees have different needs to accumulation phase investors, and tax is one of the big differences. In particular, the role of franking credits is crucial, while capital gains tax is not an issue at all.

One failure of the Australian investment industry is that franking is largely invisible, with investment returns conventionally reported pre-tax, excluding franking. For a pension-phase investor, the difference is significant.

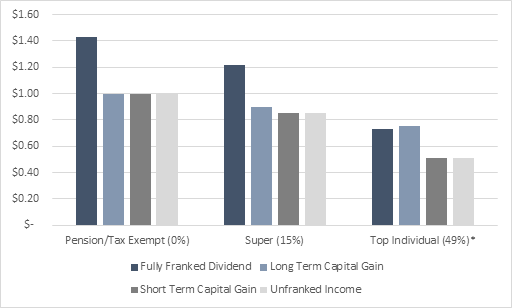

Chart 1 highlights the tax differences between pension, super and the highest individual tax rate. For the pension investor, $1 of pre-tax capital gain (short or long term) or unfranked income (interest, rental, overseas dividend, unfranked dividend) is worth $1. However, $1 of fully franked dividend is worth $1.43 since the pension investor gets a $0.43 franking credit refund. Franked dividends are also worth the most for super investors at $1.21, with long-term capital gains worth $0.90 whilst the other two returns are worth $0.85.

This clearly highlights why taxed investors would prefer low turnover strategies to reduce the time value of capital gains tax (CGT). However, for pension investors there is no cost to realising or delaying realising a capital gain, as they pay no CGT. So the common perception that low turnover strategies are tax efficient is not correct for pension investors.

Chart 1. The after-tax value of $1 of pre-tax return

Source: Plato, ATO using current tax rates, including Medicare and Federal Deficit Levies

2. Income matters – and so do franking credits

Retirees have different needs to accumulation phase investors. They need income to live off, are likely to be less risk tolerant than working investors, and their pension income is tax free.

This should be reflected in both the design of retirement-phase products, and in the way they’re measured. Generally, income returns are calculated without regard to tax or franking credits, while observations that Australian shares have suffered from a ‘lost decade’ of poor returns don’t give sufficient credence to the income generated.

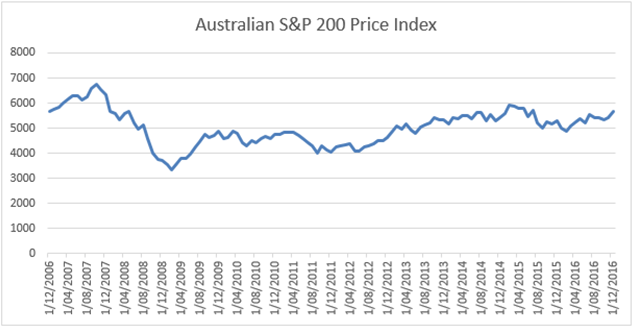

On its own, price growth of Australian shares is underwhelming. Over the 10 years to the end of 2016, the ASX/S&P200 price index has tracked predominantly sideways, as highlighted in Chart 2. In price terms, it still hasn’t returned to its pre-GFC highs recorded on 1 November 2007.

Chart 2. Australian shares over the past 10 years to 31 December 2016

Source: S&P

But equity investing is not all about capital growth. When dividend income is added, the Australian ASX/S&P200 has actually returned 4.5% p.a. over the 10 years to 31 December 2016. Not a great return, in our opinion, but certainly better than the capital growth suggests. The official overnight cash rate averaged 3.8% p.a., whilst the average 1 year term deposit interest rate averaged the same 4.5% p.a. as the dividend yield over the same 10-year period.

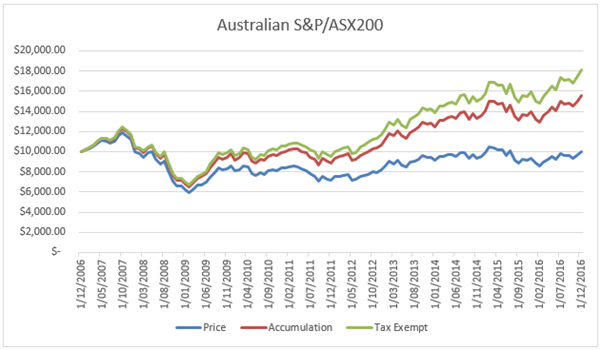

However, the 4.5% p.a. term deposit income didn’t include franking credits, which the dividend income stream did. Australian pension phase superannuation investors get a full refund of franking credits, so franking credits represent extra income.

Using the S&P/ASX 200 Franking Credit Adjusted Annual Total Return Index (Tax-Exempt), the total return for tax-exempt investors like pension-phase super, charities and low income Australian investors increased by 1.6% p.a., giving a tax exempt total return of 6.1% p.a., over the 10 years.

Chart 3 highlights the differences in index returns including franking for tax exempt investors.

Chart 3: Australian S&P/ASX200 cumulative returns with and without dividends and franking credits – 10 years to 31 Dec 2016 based on investment of AUD$10,000

Source: S&P. Price = return on Australian S&P/ASX200 Index; Accumulation – return on S&P/ASX200 Accumulation Index; Tax Exempt = return on S&P/ASX200 Franking Credit Adjusted Annual Total Return Index (Tax Exempt)

Dividend income and franking credits are an important part of the total return for share investments. For the 10 years to 31 December 2016, income has represented all the return from Australian S&P/ASX200 Index.

Many investment products aren’t structured to distribute regular income, and in the current low interest rate environment we believe many traditional cash, bond or annuity based products are unlikely to be able to deliver the minimum 5% p.a. income stream that a 65-74 year-old retiree requires.

3. Growth matters – even in retirement

Ultimately income has to be generated from underlying capital, so most pension-phase investors need to protect - and even grow - their nest egg. This total return focus is key to managing longevity risk and when done well, it’s why shares play an important role in retirement portfolios.

Even as an income-focused investor, we believe in building portfolios that generate capital growth over longer time periods despite the subdued capital growth of the Australian market over the past decade. For instance since the start of 1980 to the end of December 2016 Australian shares have risen approximately 10 fold in capital value, with dividend income growth generally keeping pace with that capital growth. Shares enable both income and capital potential to be captured over the longer term.

4. Regulation matters – pension asset tests have moved the goalposts

The last 12 months have presented a number of challenges for self-funded retirees. The government’s asset test changes have crimped part-pensions for many people in addition to the raft of new superannuation rules set to take effect on 1 July 2017.

We estimate that a home-owning couple with $800,000 in other assets had (until 2017) received $567.15 per fortnight in part pension and we expect this will fall to just $47.70 per fortnight, a reduction of over $500 per fortnight or $13,500 per annum. Similarly a single home-owner part pensioner with $550,000 in assets will miss out completely on a part pension, losing some $365 per fortnight or nearly $10,000 per annum.

What can pensioners do to offset the pension changes? The government suggested that part pensioners can make up for the loss of income by drawing down on their assets. For instance in the $800,000 couple example, the pension reduction can be offset by drawing down 1.7% of that $800,000 in assets each year.

Alternatively, if the $800,000 in assets earns 7.8% p.a., then based on our calculation the pensioner can offset the loss in part pension without drawing down. We think this is a better option, and is more consistent with the way pensioners behave.

Can a 7.8% p.a. return be achieved in the current low yield environment with Australian official cash rates currently at 1.5% and 10-year Australian Government Bonds currently yielding less than 3%?

It will certainly be difficult, particularly for conservative strategies with large weightings to cash and bonds.

Thankfully Australian equities provide some of the strongest income opportunities available in the world today. For an Australian pension-phase investor who gets a full refund of franking credits, we’ve shown that the S&P/ASX200 yielded approximately 6% p.a. in income in the decade to end 2016, with about a quarter of this due to franking credits.

But high yield Australian equities have potential to earn even higher rates of income. For instance, Australian banks currently yield around 8-10% p.a. on a grossed-up basis for franking.

However, pension investors need to balance risk and return, and so putting all their eggs in the Australian banking sector may not be a wise strategy. Pensioners investing at least part of their assets in well-diversified equity products (both Australian and global) that produce the required returns should help preserve their capital base over a long-term investment horizon.

Important information from Plato Investment Management: Plato Investment Management Limited ABN 77 120 730 136 (‘Plato’) is a Corporate Authorised Representative (No. 304964) of Pinnacle Investment Management Limited ABN 66 109 659 109 AFSL 322140. Past performance is not a reliable indicator of future performance. Any opinions or forecasts reflect the judgment and assumptions of Plato and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in the information are estimates only. Such projections or estimates are subject to market influences and contingent upon matters outside the control of Plato and therefore may not be realised in the future. The information is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. This communication is for general information only. It has been prepared without taking account of any person’s objectives, financial situation or needs. Any persons relying on this information should obtain professional advice relevant to their particular circumstances, needs and investment objectives. Plato believes the information contained in this communication is reliable, however its accuracy, reliability or completeness is not guaranteed and persons relying on this information do so at their own risk. Subject to any liability which cannot be excluded under the Competition and Consumer Act 2010 and the Corporations Act, Plato disclaims all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this document is prohibited without obtaining prior written permission from Plato. Plato and their associates may have interests in financial products mentioned in the presentation.

Important information from ASX: Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. Where the information includes articles authored by third parties, the views or opinions expressed in such articles are solely those of the author and do not in any way reflect the views or opinions of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.