China woes create Asian buying opportunity

test2

Chart 2: Four stages of EM Crisis

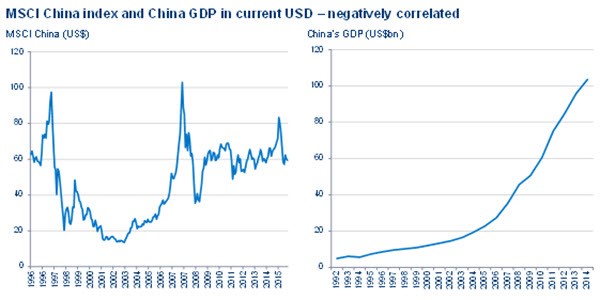

Chart 3: Maybe a ‘new’ China economic model will lead to better stockmarkets

Despite recent market events, not that much has changed in China. It’s more a case of the 'chickens coming home to roost' as policy mistakes and major policy contradictions come to a head. Elsewhere in Asia, it could be an opportunity to pick up bargains.

What’s happening with China’s currency?

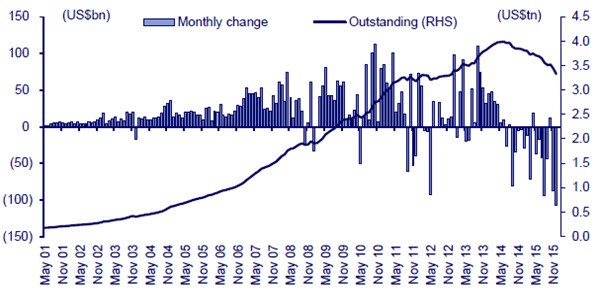

The immediate cause of the current wobbles or “crisis” in China is the currency, which has now fallen quite sharply. Fear is rising that the authorities are losing control over the renminbi exchange rate and that this will prompt a further rise in capital outflows. Capital flight has been significant over the last few months with $108 billion flowing out in December alone (Chart 1) and we are now rapidly approaching the $3 trillion level of foreign exchange (FX) reserves, which in the past some China commentators have indicated to be a significant mark.

Why does all this matter so much? Primarily because China has a pegged exchange rate (even if it is trying to move to a “dirty” float). As all long-term investors in Asia know, trying to run an independent monetary policy with a pegged exchange rate is a contradiction in terms and what caused the Asian financial crisis in 1997/98. Because China is trying to defend the renminbi in the face of mass capital outflows we have reserve money shrinking as the authorities buy renminbi and sell dollars.

Despite significant intervention the currency is still falling. This is not a good place for any central bank to be in, particularly when you are coming off the end of one of the largest credit bubbles ever seen in the history of modern finance. The tightening of liquidity is of course raising worries about the fragile financial system and causing a selloff in risk assets. Chart 2 sums up the situation well - China has now moved into the bottom left quadrant.

Where next?

So where does China go from here? If the outflows continue, we think the consequences could be significant. The problems of an over-lent banking system and, in particular, a weak and overleveraged corporate sector will soon become apparent.

We now think the authorities are running out of options (hence the policy flip-flops and uncertainty). However, with equity markets in China off very sharply we have at last moved on from the false belief that many pundits in financial markets used to peddle that the authorities had some magic wand to make all the problems disappear.

The end game looks increasingly clear – a more material fall in the renminbi is likely, significant bad debts will start to appear, and nominal GDP growth will be sub 5% (at best). We are likely to see further falls in A-share equity markets which still look very materially overvalued and we can in due course expect volatility in the Chinese bond markets both on and offshore.

No full-blown financial crisis

We plan to discuss in more detail how we see the Chinese credit bubble potentially unravelling in our soon-to-be-published “Year of the Monkey” annual report. We should, however, highlight that we still think a full-blown financial crisis is unlikely in China unless we see further significant policy mistakes and flip-flopping. China still controls the banks, runs a large current account surplus, has a starting point of relatively low central government debt/GDP so can absorb some of the bad debts and has a high savings rate with a partially closed capital account. On a positive note, we are also seeing some rebalancing in China as services growth outstrips industrial growth, and the Eastern seaboard (the “good” provinces) look much healthier than inland and Northern provinces.

Asian equity valuations reflect gloom

With markets starting to discount a very gloomy outlook for China and panic setting in we have started to raise the equity exposure of some of our portfolios. The outlook for the region may be poor but as mentioned above, we don’t forecast a renewed financial crisis. Lower commodity prices should eventually help Asian economies and Asian stockmarkets are now back to the levels they fell to during the eurozone crisis of 2011.

In a nutshell, we increasingly believe a pessimistic outlook is discounted in the region. We have reduced our hedges and started to accumulate selected blue chip names in Taiwan and Hong Kong – mostly Asian-listed global leaders in the technology and manufacturing space, often stocks that should benefit from a falling renminbi. We have also added to defensive yield names, some of which have been sold off heavily due to redemption pressures on income funds.

We remain cautious on ASEAN equities, however, where valuations in the main look high and earnings expectations are still unrealistic (consensus expectations are for an acceleration in 2016 earnings growth despite rising deflationary pressures and sluggish economies). China is relatively easy – we are staying very much on the sidelines. We are happy to wait and see if “good” China (private sector technology, internet, service, consumer related) names come our way as the panic and turmoil spreads.

Overall we will use further falls in Asian equities as an opportunity to invest in good quality businesses. The situation is not pretty and China is truly in a difficult spot but investors should always remember there is no correlation between GDP growth and stockmarket returns in Asia – least of all in China as Chart 3 most dramatically shows.

Rising bad debts, collapsing Asian equity markets and turmoil in China are, we believe, a buying opportunity as the long awaited economic cycle and creative destruction kick in.

*Chart sources: Chart 1 - Source: PBOC, CEIC data, CLSA; Chart 2 - CHA-AM Advisors; Chart 3 - MSCI, Factset.

Important information from ASX: Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. Where the information includes articles authored by third parties, the views or opinions expressed in such articles are solely those of the author and do not in any way reflect the views or opinions of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information