Hard earned but decent returns: 2016 AUD corporate bond outlook

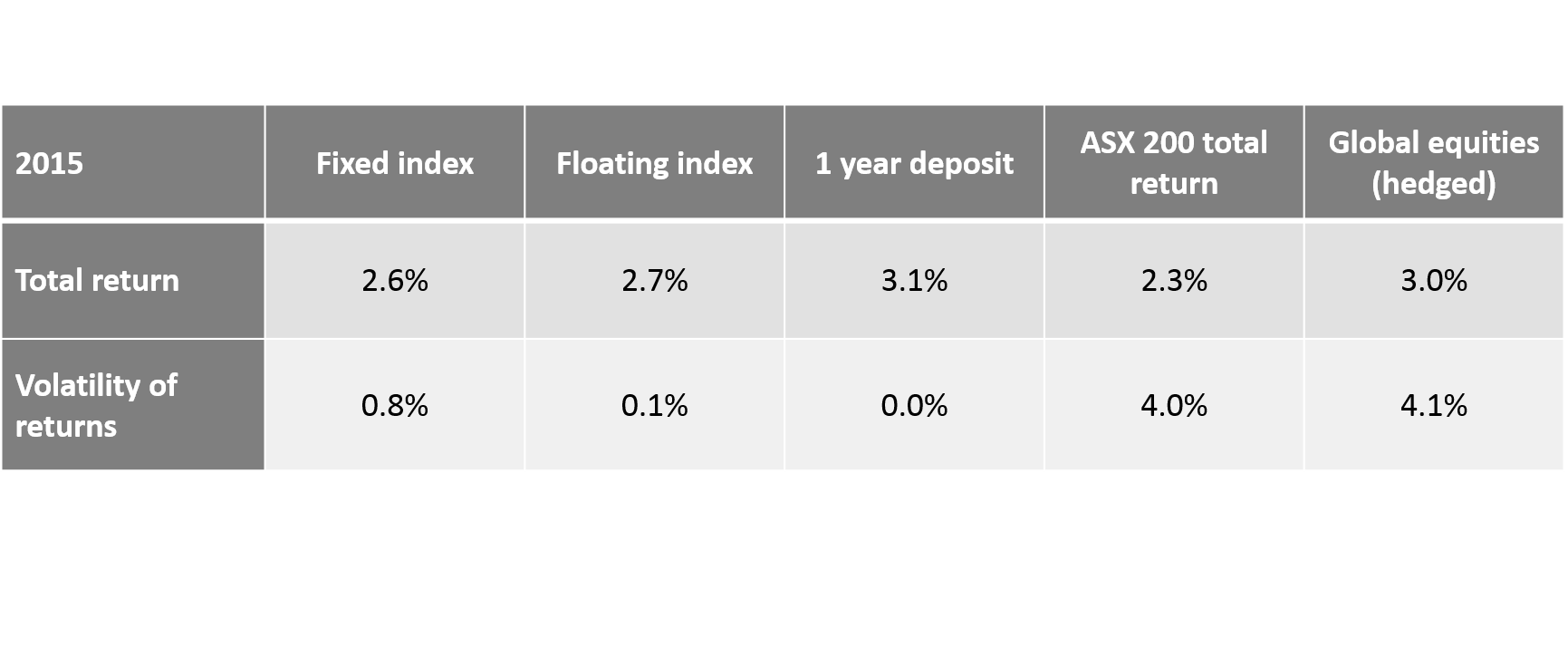

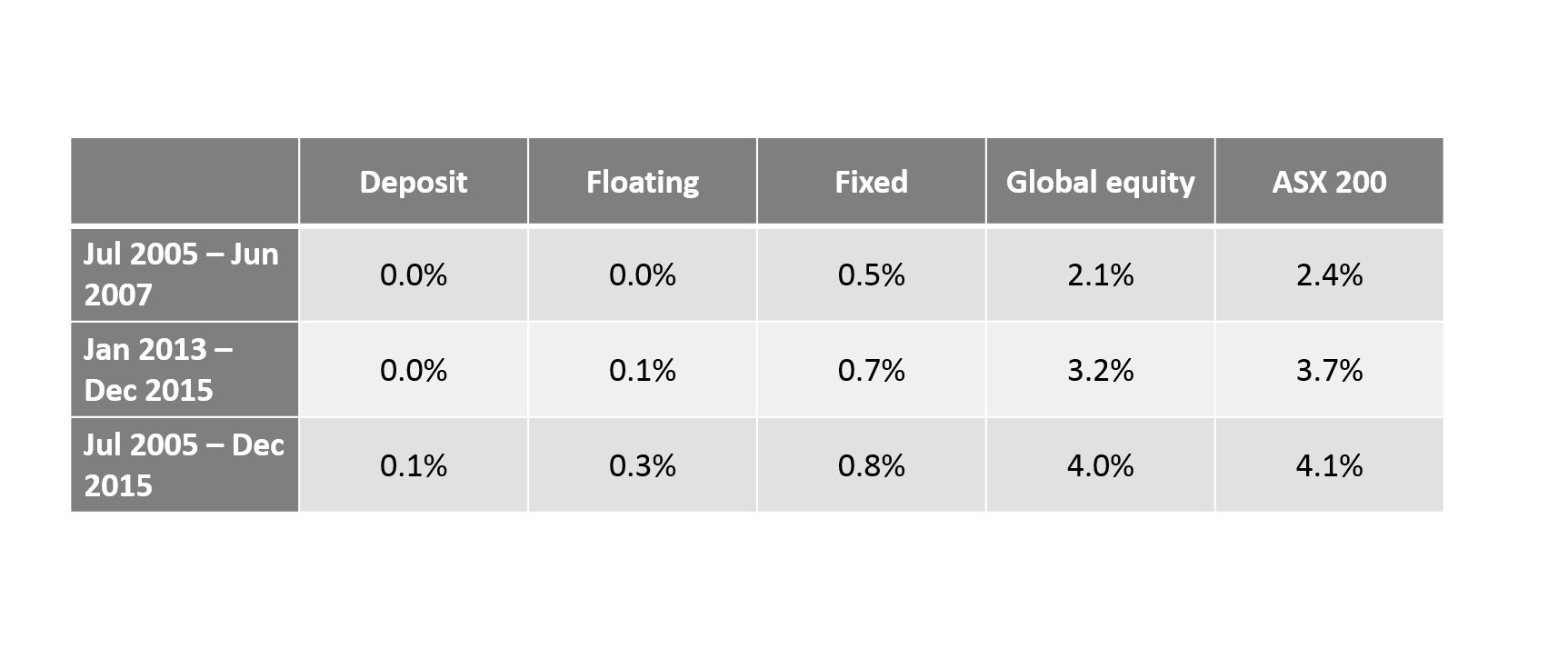

Chart 1: Modest returns in 2015*

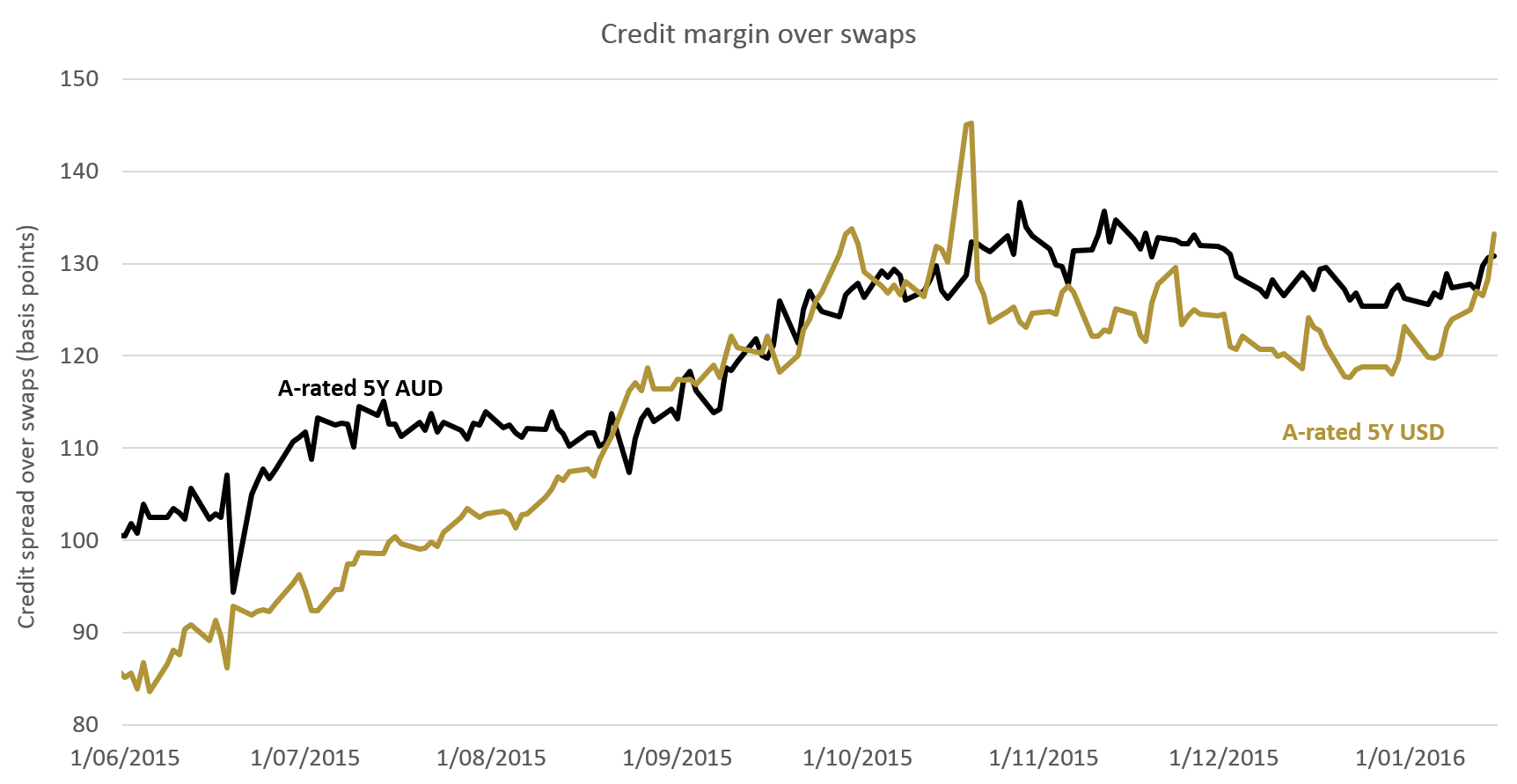

Chart 2: USD and AUD credit spreads widen in 2H15*

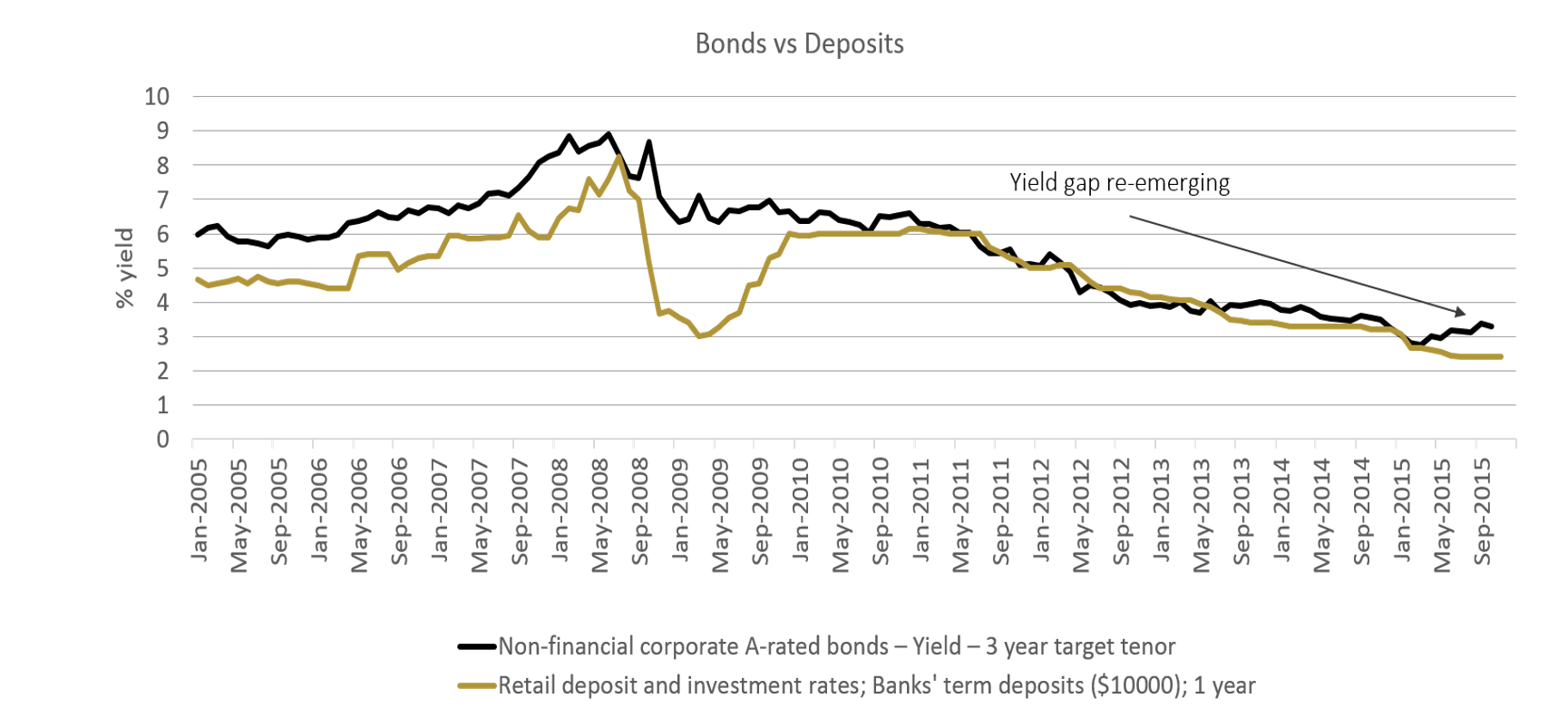

Chart 3: Yield premium returning to "normal"

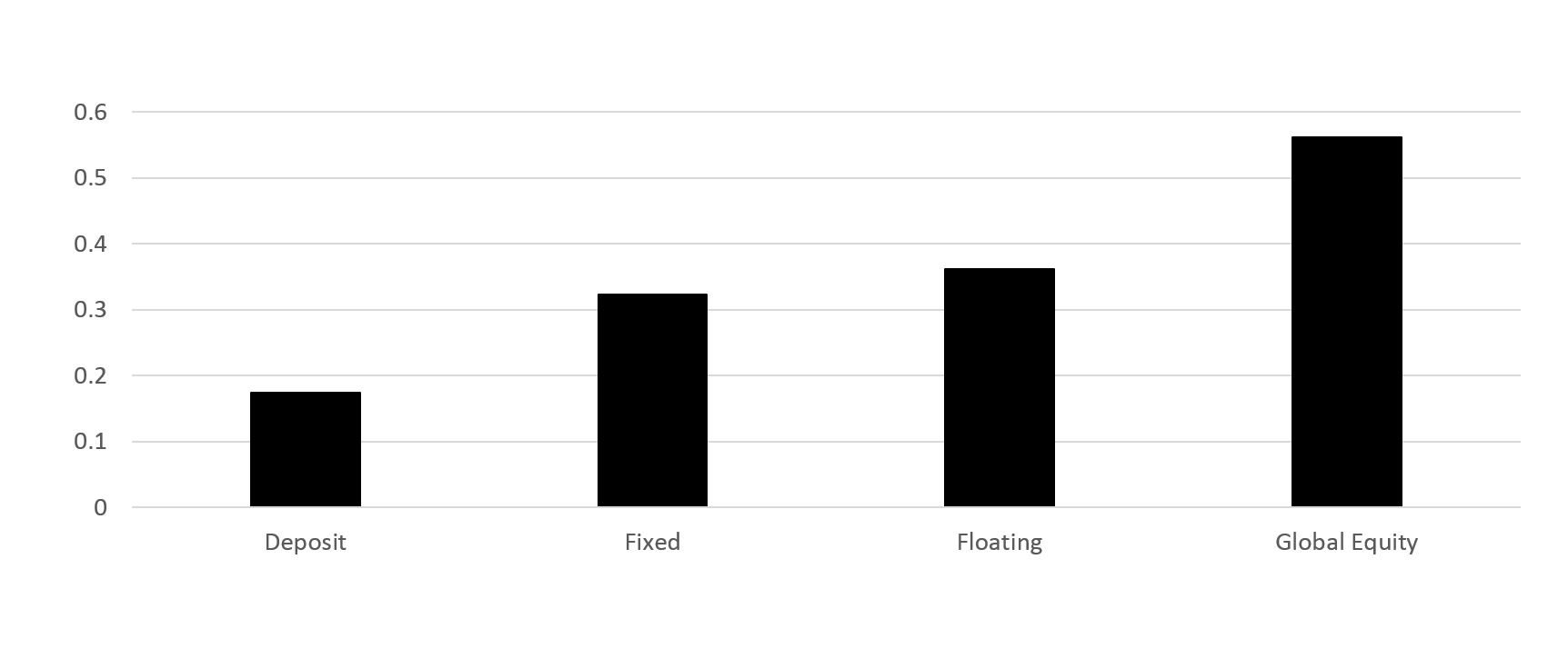

Chart 4: Correlation with ASX 200*

Chart 5: Volatility of monthly returns (SDEV)*

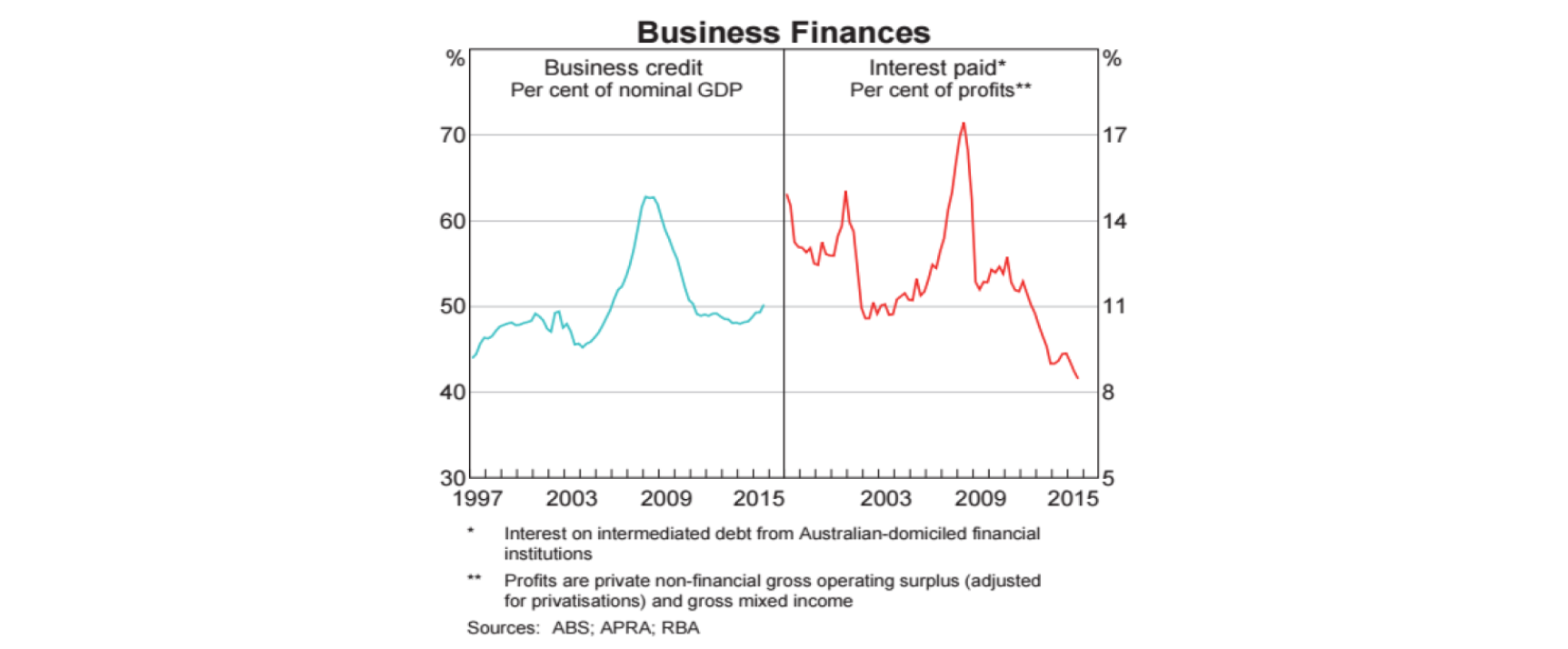

Chart 6: Business finances*

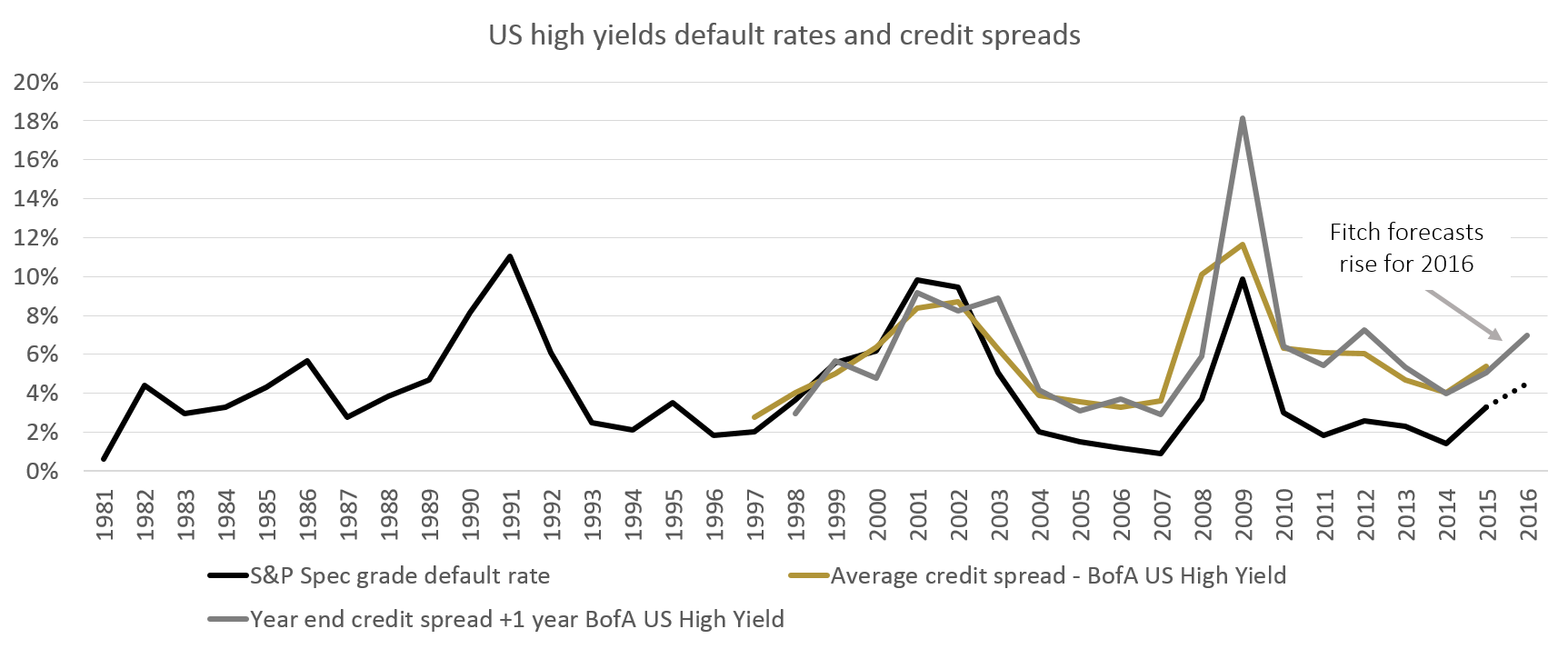

Chart 7: Falling commodity prices causing financial stress*

Chart 8: Rising defaults, rising spreads*

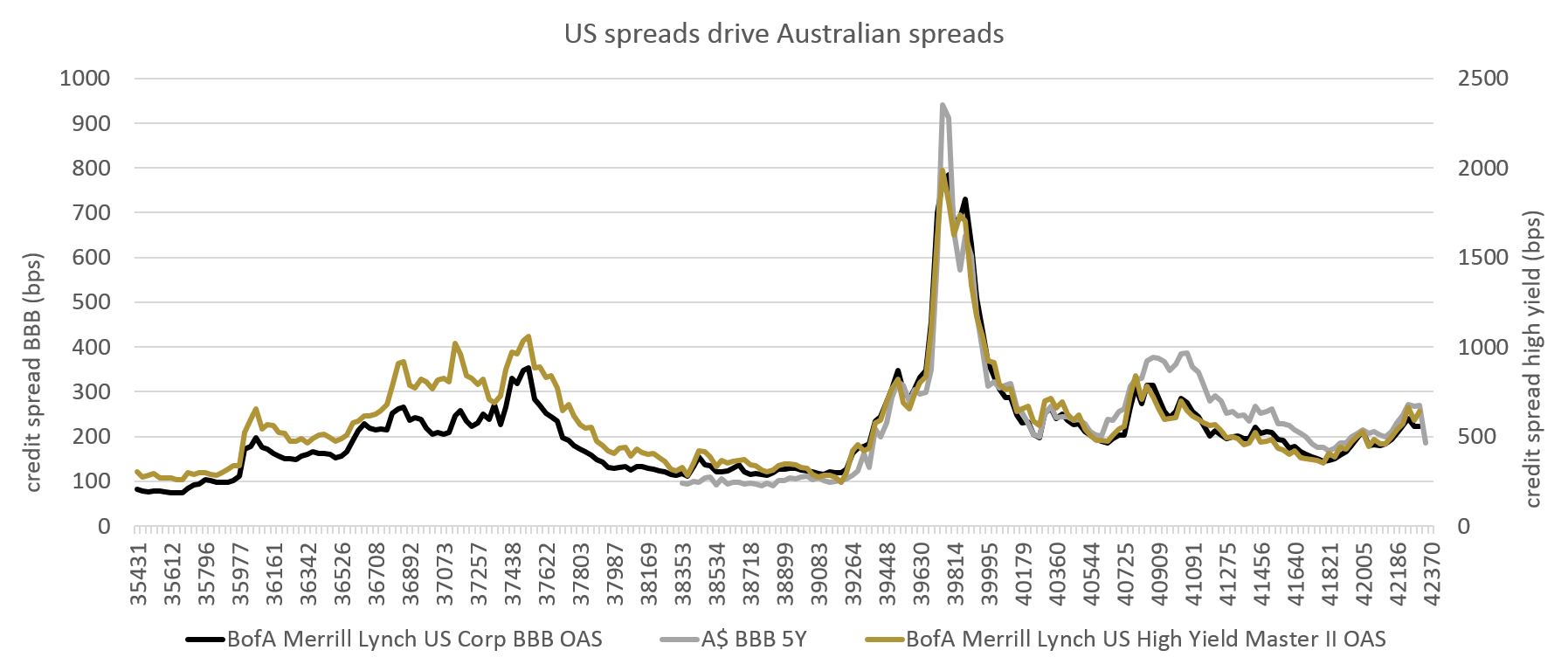

Chart 9: Problems from abroad - rich pickings on shore?*

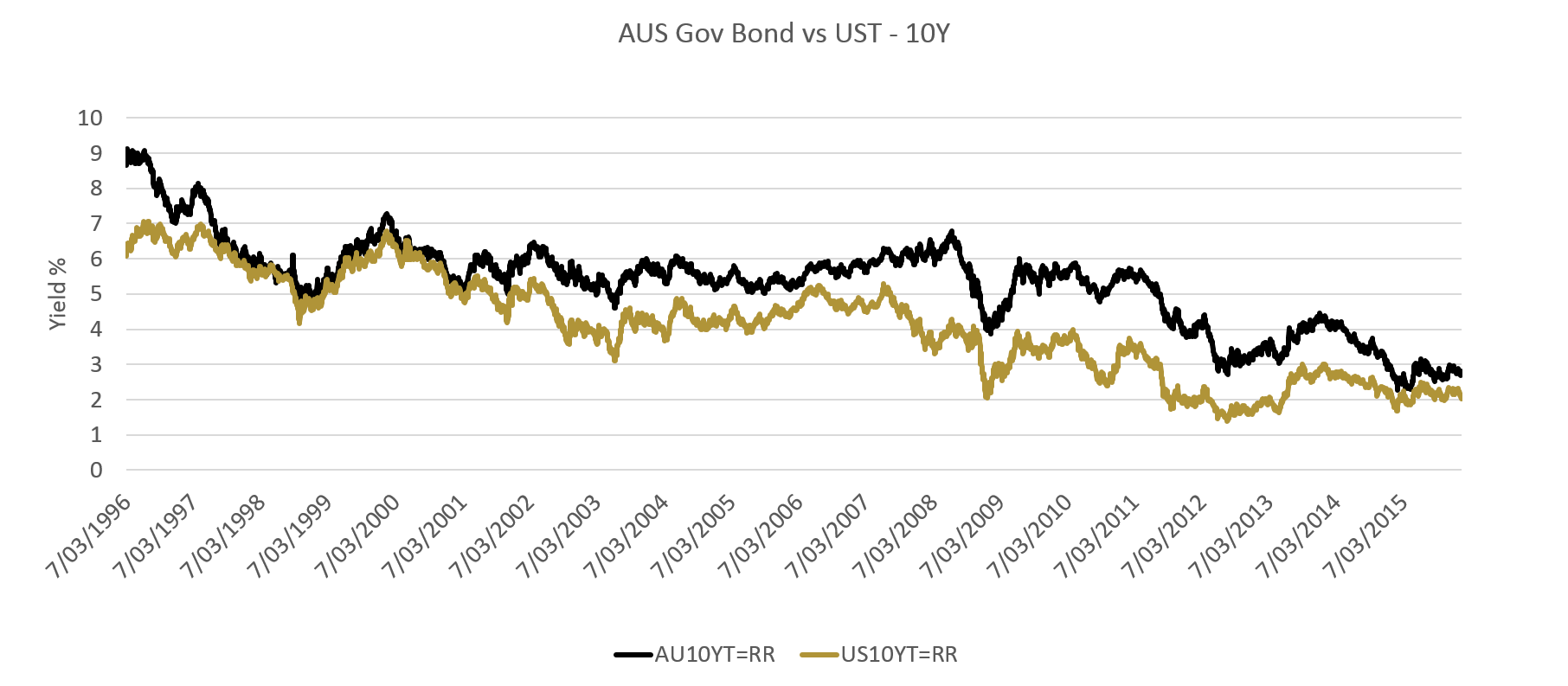

Chart 10: UST's influence Australian Government Bonds*

The year 2016 looks like being a battle between greed and fear with regards to Australian dollar corporate bonds’ performance.

Greed will be driven by investors increasingly frustrated by falling deposit yields. Fear looks most likely to come from abroad, namely, prevailing low commodity prices causing rising defaults in the U.S and problems from emerging markets. The good news is that AUD credit spreads already capture some of this external fear. At the same time, the chance of widespread AUD bond defaults appears low.

Investors in well-managed credit funds are set to get healthy returns for the default risk taken. The earnings, though, may be hard earned. Contagion from outside Australia could make for a bumpy, albeit ultimately rewarding, ride this calendar year.

Corporate AUD bonds – what’s the attraction?

There are several key reasons why investors may consider AUD corporate bonds as an investment for 2016.

- Income: For example, a 3 year A-rated bond in AUD now yields around 3.5%. This is not great but is looking increasingly attractive when compared to the prevailing deposits rates, as Chart 2 illustrates. As we noted in No corporate bonds? Time to reconsider, post-GFC, Australian banks were engaged in a deposit gathering war. This was to appease regulators and rating agencies who wanted them to reduce their reliance on offshore lenders. The war has now ended. The premium that corporate bonds provide over bank deposit rates is more typical, and Spectrum believes this may improve in the coming year.

- Diversification: Corporate bonds have given investors a degree of diversification from their local stock market holdings. We believe this will continue in 2016. If investors are worried about rising US government bond yields and their impact on Australian government bonds and local equities, as we are, then floating rate corporate bonds should provide additional price insulation against this.

- Less volatility: Corporate bonds have provided investors with less volatility than equities in the past, as shown in the table below. We expect this to continue in 2016, in particular, floating rate notes.

- Value: Australian credit spreads start at a fairly attractive level. Note that credit spreads are ultimately to compensate investors for the risk of default. Implied default for the next 5 years for Australian BBB corporates at a credit of around 180bps is around 5%1. Defaults are rare in AUD notes. This is mainly due to the fact that the vast majority of issues are investment grade, and, most issuers are Australian-domiciled and Australian has not had a recession since the early 1990s. Looking forward, the risks look low as well. At present, the Australian corporate sector, overall, appears to have strong credit profiles, as illustrated in Chart 7. Spectrum believes that the implied default rates for AUD issuers are a large overstatement of what the actual levels will be.

What are the risks?

Of course, risks exist for any asset class. Our key concerns for AUD corporate bonds are as follows:

- US default rates soar to recession-like levels, say 8% as opposed to 4.5-5% base case. We consider this to be a low risk, say 5%.

- US high yield market’s spreads markedly overshoot realised defaults. This is a higher risk, say 20%, but its impact will be transitional.

- Emerging market problems, including those from China, skyrocket. For example USD bond issue default rates climb from the current 4% to, say, 10%. We consider this to be a 20% chance and, again, its impact will be transitional.

- US treasury yields rise, say 0.5% to 1%, causing government bond yields in Australia to rise and inflicting losses to fixed rate investors. We consider this to be a 35% chance.

- A surge in AUD bond defaults to say 3% default rate. We consider this to be a 5% chance.

Plummeting commodity prices are the primary reason behind these concerns over rising defaults. Many projects were funded by bond issues on the basis of commodity prices, in particular oil prices, at far higher levels than the prevailing levels. However, the expected increase in the supply of oil and some other commodities in 2016 does not bode well for a recovery in prices. Add to this mix, the surge in debt issuance from these sectors in recent years, and the foundation has been laid for a rise in defaults among second tier commodity-linked issuers.

Fitch, a major credit rating agency, forecasts speculative grade defaults from the US to increase from 3.3% in December 2015 to 4.5% by mid-2016. In the past, credit markets have tended to reasonably anticipate rising defaults but only up to 12 months in advance. We presume this relationship will broadly persist.

Unfortunately, Australian credit markets tend to be highly influenced by what happens abroad, in particular in the U.S., even if domestic credit conditions are robust.

How to reduce these risks

- Credit risk: First and foremost, avoid investing in issuers whose bonds default.

- Credit spread risk: Second, maintain a relatively high proportion of short-dated notes in the portfolio to reduce the contagion impact of deteriorating offshore credit markets.

- Interest rate risk: Third, maintain the bulk of corporate bonds in floating rate notes to shelter from rising US Treasury (UST) yields.

The truth of corporate bonds

An oft used quote from Warren Buffet is, “Price is what you pay, value is what you get.” The beauty of corporate bonds is that you have a finite time of realizing this value. Each interest payment is an affirmation you are on the right track and repayment of the principal is the confirmation. In contrast, an equity price can remain at odds with your views ad infinitum. Right now, investors are getting value, well-rewarded for the AUD credit risk taken in our view. The year 2016 may produce relatively high volatility but if one’s credit calls are right, attractive returns look set to follow for well-managed credit funds.

About the author

Damien joined Spectrum in 2014 and manages the research function. Damien has around 25 years’ experience in global credit markets. He has worked in Sydney, London, Hong Kong and Singapore. Damien was Head of Asia Pacific Fixed Income Research from 2004 to 2012 at Credit Suisse in Singapore and Sydney. He also led the credit research teams of ING Barings and Barclays Capital in Asia and was part of the credit team at AMP in Sydney.

Damien holds a Masters of Business Administration from the University of Queensland, a Bachelor of Financial Administration from the University of New England and a Graduate Diploma in Applied Finance from the Securities Institute of Australia.

About Spectrum Asset Management

Spectrum Asset Management manages the Spectrum Strategic Income Fund, available through mFund. This fund invests in AUD corporate securities of which the majority are floating rate notes. The intention is to make this portfolio relatively immune from the bond yield volatility which can, in turn, hit equity and fixed income markets. The fund is also designed to deliver an income stream while generating capital gains from time to time. For more information and how to invest please contact your mFund broker.

1Spectrum presumes a 50% recovery rate and incorporates other contributors to credit spreads such as price volatility, rating volatility, liquidity premium and time value

*Chart sources: Chart 1: Spectrum, Reuters, Investing.com; Chart 2: Reuters; Chart 3: RBA, Reuters; Chart 4: RBA, Reuters; investing.com; Chart 5: Spectrum, Reuters, RBA, Investing.com; Chart 6: ABS, APRA, RBA; Chart 7: RBA; Chart 8: St Louis Fed, S&P, Fitch; Chart 9: St Louis Fed, S&P, Fitch; Chart 10: Reuters.

Important information from ASX: Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. Where the information includes articles authored by third parties, the views or opinions expressed in such articles are solely those of the author and do not in any way reflect the views or opinions of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

Important information from Spectrum Asset Management: This report has been prepared by Spectrum Asset Management Limited (ABN 31 096 442 198, AFSL 225069).It is for information purposes only and does not constitute or form part of, and should not be construed as, an offer, invitation or inducement to purchase or subscribe for any securities or funds nor shall it or any part of it form the basis of, or be relied upon in connection with, any contract or commitment whatsoever. It also does not constitute a recommendation regarding any securities or funds. he information in this document has been obtained from sources believed to be reliable but no representation or warranty, express or implied, is given hereby as to the fairness, accuracy or completeness of the information or opinions contained herein. This presentation reflects the information available as of the date this presentation was prepared and is subject to change without notice to the recipient. Past performance may not necessarily be repeated and is no guarantee or projection of future results. This report is intended solely for the information of the person to whom it has been delivered. It is not an advertisement and is not intended for public use or distribution. No part of this report may be reproduced or distributed in any manner without prior written permission of Spectrum Asset Management Limited.