Diversification is one of the simplest paths to achieve investment returns while mitigating risk. In this article, we reveal a theory that can help protect your wealth from volatile markets.

Most investors aim to generate healthy investment returns but are concerned about the risk to their portfolio. Fortunately, there is a theory that allows investors to reduce overall portfolio risk: diversification.

Diversification is a central tenet of well-balanced portfolios and one of the ways investors manage the inevitable ups and downs of share investing. The strategy works when those ups and downs strike different assets at different times, lowering overall portfolio volatility.

Yet many investors are prone to playing favourites and invest too heavily in particular asset classes, notably Australian blue-chip stocks or low-returning assets such as cash and fixed income. But putting all your eggs in one basket remains may be less preferable to diversification, which can offer a way to reduce risk.

Behavioural finance sheds some light on why we are all prone to make such decisions: overconfidence (as we feel comfortable with a particular asset class), preferring the status quo, and putting too much weight on short-term events when making long-term investment decisions.

Take the example outlined in Burton G Malkiel’s enduring work on randomness in stock markets: A Random Walk Down Wall Street.

An investor in an island economy is faced with two options: invest in a resort owner or invest in an umbrella manufacturer – there is a 50:50 chance the season will be sunny or rainy.

During warm seasons the resort delivers a 50 per cent return as people flock to enjoy the beach but during rainy seasons the resort loses 25 per cent. Conversely, the umbrella manufacturer delivers a 50 per cent return during rainy seasons when its goods are in demand but loses 25 per cent when people are instead enjoying the sunshine at the resort.

An investor can try to pick the winner each season and experience boom or bust.

However, another option would be to split the portfolio between the two stocks which would guarantee the same 12.5 per cent return without the volatility.

It is a highly simplified example but the concept, first expressed in Harry Markowitz’s Modern Portfolio Theory in the 1950s, won Markowitz a Nobel Prize.

Diversification works where investment returns of the different asset classes are not correlated.

Applying the strategy to your portfolio

Between 1980 and 2014, a portfolio consisting entirely of Australian shares delivered an average annual compound return of 11.8 per cent a year . However, the difference between the best and worst years was enormous: the highest return in a single year was almost 90 per cent while the worst return resulted in an approximate one-third loss. In other words, an undiversified portfolio experiences significant volatility.

An alternative approach is to split the portfolio equally between bonds and shares. During the same time period this would have produced a slightly lower 11 per cent average compound annual return but at significantly less risk. The highest return over the period fell to 51 per cent while the worst return was negative 16 per cent.

Superannuation is particularly important to consider: at risk is the quality of an investor’s lifestyle in retirement.

Self-managed superannuation fund (SMSF) investors allocated just 0.8 per cent of their portfolio to global shares compared to large super funds’ 22-27 per cent allocation, according to the latest data from government regulators . Rather, SMSFs showed a distinct preference for Australian shares and cash or term deposits.

The correlation between Australian equities and global equities is relatively low. By investing in both asset classes, volatility can be lowered, achieving a better balance between risk and return.

Consider a SMSF comprising 50 per cent Australian equities, 1 per cent global equities, and 49 per cent cash. A mean-variance analysis by risk management firm Milliman suggests that a more highly diversified portfolio (with similar volatility) would deliver an expected 0.7 per cent per annum higher return (or an 11 per cent increase) . An investor could also target the same initial return with a more diversified portfolio while achieving a lower 1.6 per cent volatility (a 24 per cent decrease in risk).

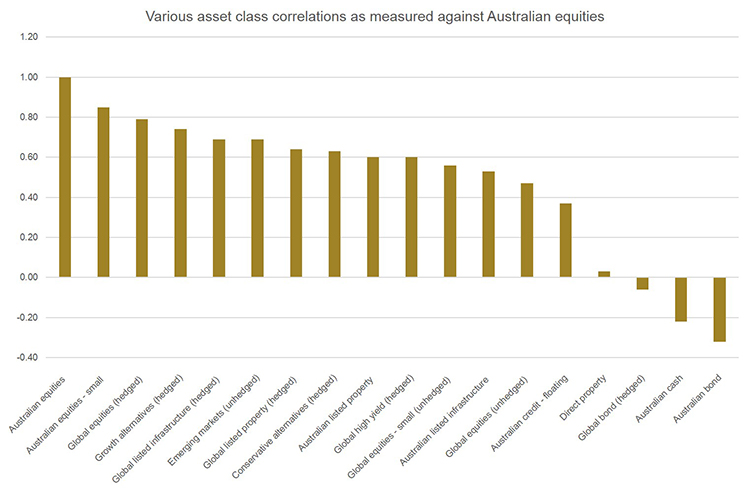

The way to measure the reduction in volatility is via the correlation coefficient.

It gives an indication of how each asset class peaks and troughs relative to another asset class. A correlation coefficient of 1.0 means the two asset classes move up and down in lockstep while a correlation coefficient of -1.0 would indicate the opposite.

A mix of Australian and global shares can reduce a portfolio’s levels of volatility. However, the introduction of other asset classes (such as property, infrastructure, and other alternative assets) can lower volatility even more.

Source: Lonsec (as at June 2014)

Unlisted growth assets such as direct property, which has a correlation coefficient of 0.03 compared to Australian equities, can significantly lower volatility. A number of large industry super funds have allocated significant amounts of their portfolio to direct property and unlisted infrastructure assets, which provide steady, inflation-linked cash flows over decades.

The diversification journey also includes a range of other asset classes such as emerging market equities and small-cap shares.

The mFund Settlement Service was launched in the first half of 2014 and allows investors to buy and sell unlisted managed funds via an ASX broker. It removes the paperwork associated with investing in managed funds replacing it with a fully automated electronic service, offering access to a wide range of professionally-managed asset classes.

1. Morningstar Australasia 2014. Past performance is not a reliable indicator of future performance. This report was prepared by Morningstar Inc. ASX did not prepare any part of the report and has not contributed in any way to its content. ASX does not provide financial product advice. The views expressed in this research report may not necessarily reflect the views of ASX. To the maximum extent permitted by law, no representation, warranty or undertaking, express or implied, is made and no responsibility or liability is accepted by ASX as to the adequacy, accuracy, completeness or reasonableness of the report.

2. Australian Taxation Office and Australian Prudential Regulation Authority data quoted by Rice Warner Actuaries in its Ageing and Capital Flows submission to the Financial System Inquiry. May 2014.

3. Analysis prepared by Milliman Australia. September 2014.

4. Analysis prepared by Milliman Australia. September 2014.

5. Lonsec Research. Data prepared June 2014.Past performance is not a reliable indicator of future performance.