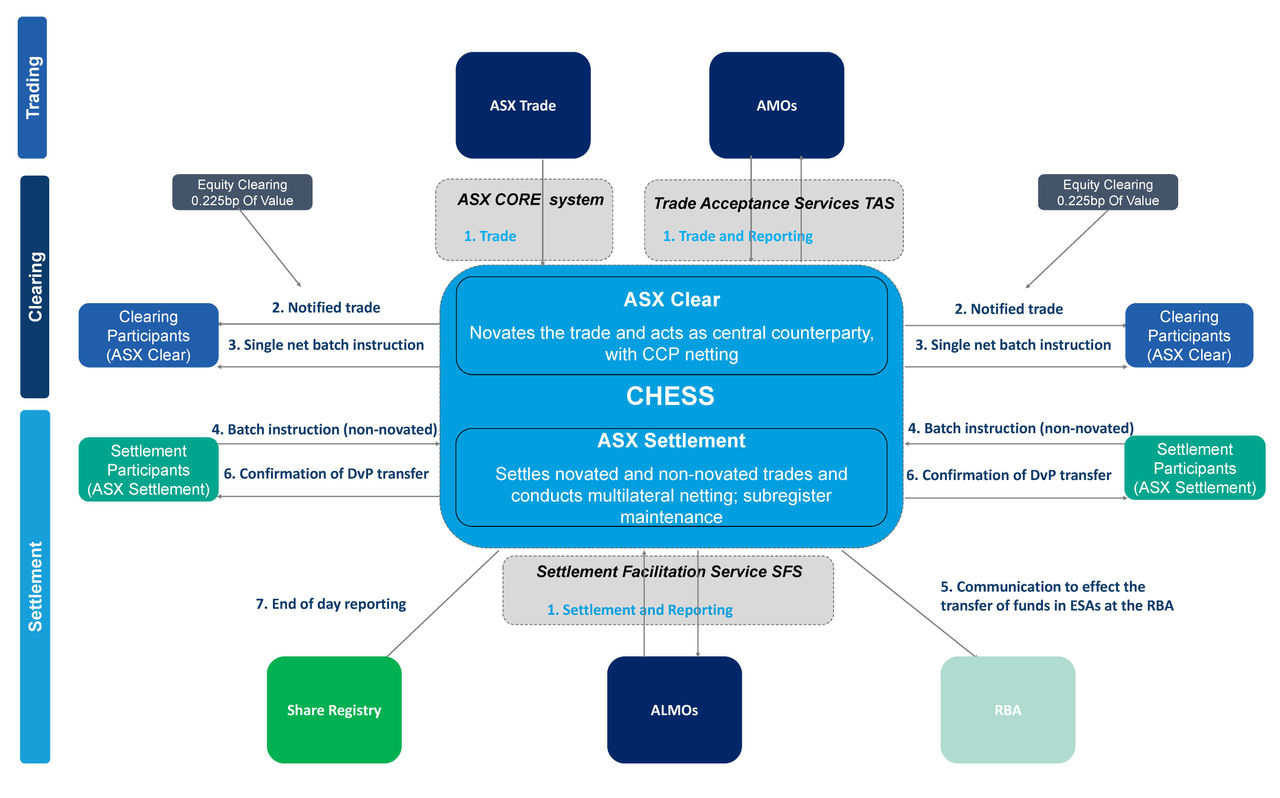

Settlement is effected through CHESS, Clearing House Electronic Sub-register System. Usually, two business days after a buyer and seller agree to a trade, the settlement of that trade is effected through CHESS. This involves the transfer of title or legal ownership of the cash market products and the simultaneous transfer of money for those cash market products between participants via their respective banks. This type of settlement is called Delivery versus Payment (DvP). It is irrevocable.

CHESS achieves DvP settlement through a Model 3 multilateral net batch settlement mechanism (for an explanation of Model 3 settlement and how it differs from other models please see Section 5.1 of the RBA's 'Review of Settlement Practices for Australian Equities').

This settlement of all transactions due for settlement on a given business day occurs in a single 'batch' settlement which completes at around 12:30pm. Batch settlement involves the determination of each participant’s net funds and security delivery obligations and the net funds obligations of all participants’ financial institutions (payment providers). This maximises the efficiency of settlement by:

- netting settlement obligations (buys and sells) in each individual cash market product into one net buy or sell obligation per settlement participant

- netting all payment obligations (pays and collects) into one net pay or collect per settlement participant.

Funds settlement (the transfer of money) occurs across the Exchange Settlement Accounts of those payment providers in the Reserve Bank of Australia’s Information and Transfer System (RITS). Once completed, this triggers the movement of securities from delivering to receiving settlement participants within CHESS. These multilateral payment netting arrangements, which are key to the settlement efficiency of the system, are approved under the Payment Systems and Netting Act.

The CHESS sub-register

To facilitate settlement between participants on a delivery versus payment basis (DvP), CHESS electronically registers the title (ownership) of cash market products on its sub-register. Investors can choose to have their holdings registered in one of two ways:

- on an Issuer Sponsored Sub-register or

- on the CHESS Sub-register.

The two types of sub-register provide alternative forms of registration for investors and the cash market products they own. Every company admitted to the official list of an Approved Market Operator (AMO), or issuer of investment products that are quoted on the market of an AMO, manages its own Issuer Sponsored Sub-register for the registration of cash market products in their company or fund. This form of registration is also referred to as being ‘Issuer Sponsored’.

Alternatively, cash market products in any listed company or investment product issuer can be registered in the CHESS Sub-register. This form of registration is held within the CHESS system and allows brokers to manage their sponsored clients' shareholdings, while the client retains legal title to those holdings. This form of registration is also referred as being 'Broker Sponsored'.

An investor who is Broker Sponsored can include a variety of different cash market products in a single registration held in CHESS under that investor's name. This has the advantage of simplifying the administration of a portfolio by consolidating all cash market products into a single account. It also provides investors with comfort and confidence that their holdings are registered in their name. CHESS Holding Statements are also generated directly from the sub-register and sent to investors to provide a form of independent validation of their share purchases, sales, transfers and holdings.

For brokers, maintaining their investor clients' holdings on the sub-register also has the advantage of reducing their risk in facilitating settlement of market and client transactions through expediting both the movement of securities in preparation for settlement and the timely allocation of shares to client accounts post settlement. Finally, for issuers, the CHESS sub-register provides both a cost effective manner to maintain a register of investors and an efficient and accurate mechanism to process corporate actions.