- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Behind the rise of niche A-REITs

- Fri 04 June 2021

A new breed of specialist Australian Real Estate Investment Trusts are an option to go beyond traditional property sectors.

In recent years, we have observed the rise of niche and alternative real estate within the A-REIT sector. This has occurred through sector-specific A-REITs as well as niche property investments through diversified A-REITs.

Niche A-REITs are those groups that have property holdings in sectors beyond the traditional food groups of office, retail and industrial property. There are also several diversified A-REITs that provide exposure to niche sectors.

Within Australia, niche sectors could include:

- Land Lease – Manufactured Homes

- Healthcare

- Hotels

- Rural

- Petrol Stations

- Childcare

- Medical

- Storage

- Build-to-Rent

- Data Centres

- Cold Stores

- Retirement

Why this form of A-REIT is growing on ASX

To understand the growth of this form of exposure on the ASX, it is important to understand the attraction of niche sectors in the first place and observe global themes.

Niche property sub-sectors can be an opportunity for diversification, a source of yield and potential re-rating as the sector becomes institutionalised (when fund managers invest more in the sector).

Many institutional investors already have high exposure to the traditional property sub-sectors of office, retail and industrial. There is a view that retail is challenged and disrupted given the growth of ecommerce, and office property has challenges through flexible work arrangements, primarily the increased adoption of working from home.

While industrial property has a lower weighting (in fund manager portfolios), it is popular and now keenly priced. This all leads to increasing the focus towards other property sectors.

The missing piece is how many of these changes are cyclical, brought about by the pandemic, and how many will be enduring and, most importantly, what is embedded in the pricing.

Niche A-REITs small, but growing

Currently, niche property sectors within the ASX universe have a relatively small weight at around 7% of the S&P/ASX 300 A-REIT sector.

Globally, there has been significant growth in niche property sectors and increased investor interest that has been more apparent in public rather than private markets.

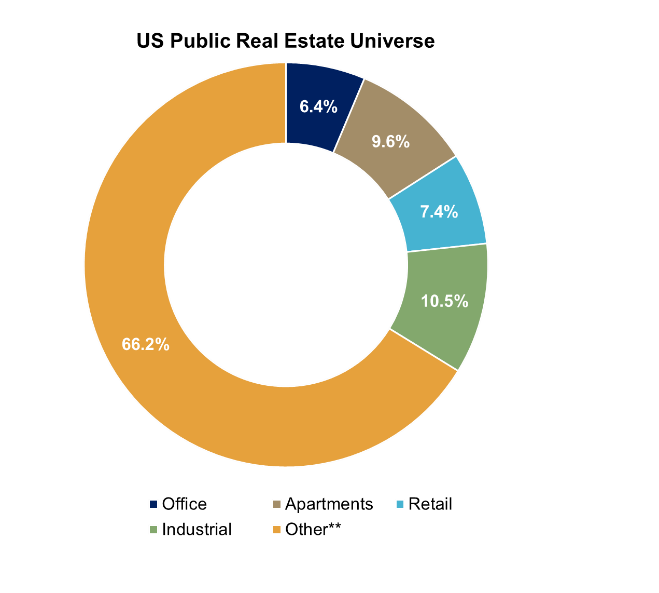

The chart below highlights the significant growth in niche property sub-sectors in the US public real estate market, such that niche real estate has a higher weighting in the US than traditional core real estate. Niche real estate opportunities are also diverse.

While the focus of this article is the A-REIT sector, the significance of niche sectors in offshore markets is an attraction for investing in global REITs as well.

**Other in the US REIT Universe includes Cell Tower, Data Centres, Health Care, Triple Net Lease, Specialty, Self-Storage, Lodging & Resorts, Timber, Manufactured Homes, Single Family Homes, Life Sciences, Student Housing

Source: LaSalle Investment Management

Global REITs provide a wider opportunity set, while the A-REIT sector via ASX has the potential for strong growth towards niche sectors.

How niche A-REITs differ from larger/traditional A-REITs

This varies across sectors. Generally, the market capitalisation of niche REITs tends to be lower, less than $2 billion, with the exception of National Storage REIT (ASX: NSR). Asset sizes (in niche A-REITs) tend to be smaller, which has traditionally seen them less likely to be owned by institutions. A-REITs have the advantage of assembling portfolios of scale.

Lease terms can be longer in the case of hotels, data centres, childcare and healthcare properties, with the tenants being responsible for maintenance capital expenditure.

With storage, rental agreements are short term and the landlord is responsible for maintenance capital expenditure. Tenant incentives in niche sectors are also less prevalent than in office and retail property.

However, because they often own smaller assets, many niche A-REIT sub-sectors are the domain of private investors. As a result, pricing (for their assets) may already be highly competitive. Barriers to entry may also be lower in building assets (given the size of the assets, planning and build time) than some of the traditional core real estate – in particular, large-scale retail centres.

Who niche A-REITs suit

Niche sectors may suit investors looking to diversify their property exposure and increase lease tenure. In many cases, niche property sectors have the attraction of being less economically sensitive. The A-REIT sector is an efficient way to access niche sectors given liquidity and low transaction costs.

There may also be the opportunity to re-rate (increase in price), as these sectors become more mainstream and attract more investment from fund managers. Several niche sectors will have tailwinds, in SG Hiscock’s view. For example:

- Data centres – growth of data

- Childcare – increased workforce participation rate

- Health and age care – ageing demographics

- Retirement – ageing demographics

However, tailwinds do not always correlate to superior investment returns as tailwinds are well identified and can be imbedded in pricing, with a high propensity for competition, particularly if the barriers to entry are low.

Pricing of niche sectors compared to traditional core sectors

GPT Group (ASX: GPT) is the oldest A-REIT, having a diversified portfolio of the traditional subsectors with approximately 40% office, 40% retail and 20% industrial property. GPT, being a stapled security, has the advantage of operating a funds-management business as well.

(Editor’s note: Do not read the following commentary as a recommendation on GPT or niche A-REITs. Do further research of your own or talk to your advisor before acting on themes in this article).

The table below provides comparison between the niche sectors within the S&P/ASX 300 A-REIT sector to GPT. Key terms in the table include:

- Forecast distribution yield

- Valuer capitalisation rate (market yield on property valuations)

- Implied capitalisation rate (representative of the implied pricing on ASX)

- Pricing to the physical market (is the public market trading at a premium to or at a discount to the private market?)

- Price to Net Tangible Assets (is the security price at a premium to or at a discount to book value?)

The aggregate niche sectors are trading at higher capitalisation rates in the private market versus traditional core real estate, which suggests scope for re-rating as the sectors attract more funds from institutional investors.

However, the table highlights that the benefits of the niche sectors in aggregate are well recognised in the A-REIT sector, with the group trading at a considerable valuation premium to the traditional core property on all metrics (noting that pricing does vary across the niche sectors).

GPT is trading at a discount to the private market and, consequently, it is currently buying back its own securities, taking advantage of that discount.

| Distribution Yield* | Valuer Cap Rate | Implied Cap Rate | Pricing to Physical Market | Price to NTA | |

|---|---|---|---|---|---|

| Niche Sectors ARF, CQE, HPI, INA, NSR, RFF, WPR | 4.4% | 6.3% | 5.3% | 18.9% | 29.1% |

| GPT Group | 5.4% | 4.9% | 5.8% | -15.5% | -16.8% |

Source: SG Hiscock and Company. Estimates at 7.5.21. *GPT is 2021 Calendar year. Niche Sectors are Financial 2021 year.

As niche sectors in aggregate are trading at a valuation premium compared to the direct property market, this provides the potential to raise capital and buy assets from the private market.

The pricing disparity is likely to further assist the growth of niche sectors at the expense of the traditional core A-REIT sectors. The global experience for niche REITs indicates good scope for niche A-REITs in Australia to also grow over time.

Conclusion

Niche property sectors will continue to evolve and provide opportunities for A-REIT investors. However, it is also important to closely monitor A-REITs in the traditional core property sectors and their pricing as they are:

- highly transparent

- in many cases have superior Environmental, Social and Governance (ESG) factors

- are currently trading at a discount to private market pricing

- provide a higher yield in the public markets

A diversified portfolio of A-REITs provides the ability to be exposed to emerging niche sectors and traditional core real estate, with the benefit of liquidity and low transaction costs.

About the author

Grant Berry, SG Hiscock & Company

Grant Berry is a Director and Portfolio Manager at SG Hiscock & Company. SG Hiscock property funds are available via mFund.

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.