References and notes

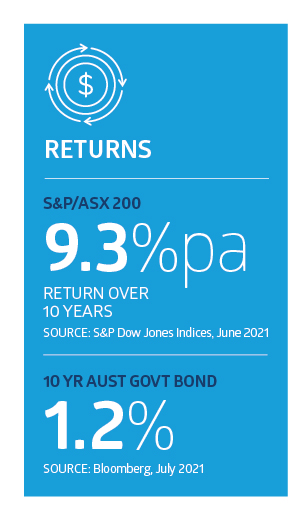

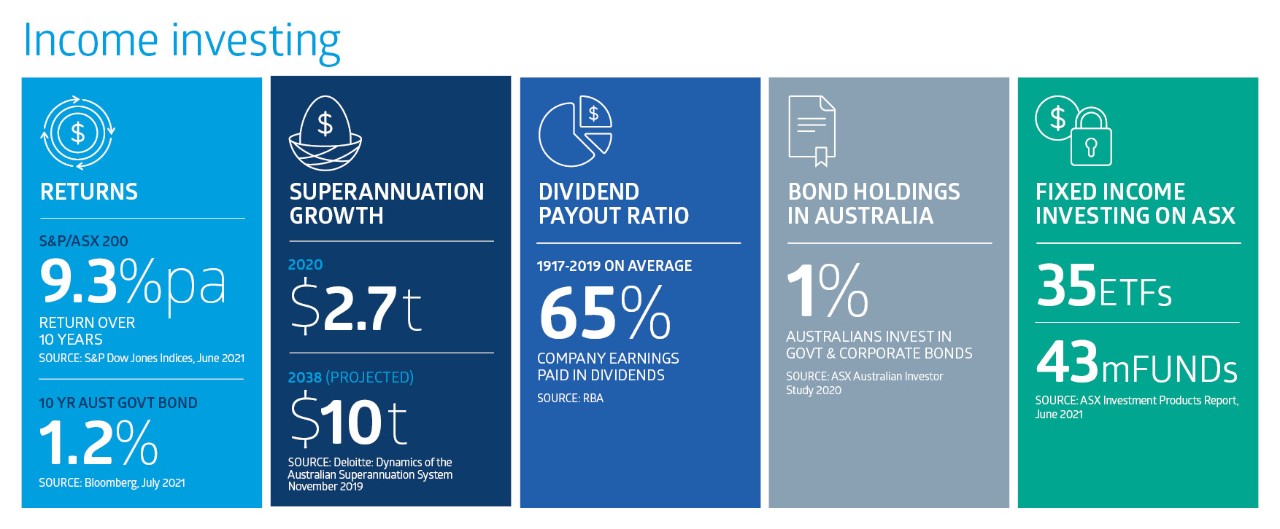

[1] S&P Dow Jones Indices, 2021, “S&P/ASX 200 Fact Sheet,” June 30. 2021.

[2] Reserve Bank (2021), “Retail Deposit and Investment Rates,” June 2021. Based on $100,000 invested for one year in a term deposit.

[3] S&P Dow Jones Indices, 2021, “S&P/ASX 200 Fact Sheet,” June 30. 2021. The total return was 9.26% over 10 years to end-June 2021. The price return was 4.73% in this period.

[4] The RBA cash target rate was 10 basis points at July 2021.

[5] Inflation was 1.1 per cent in the March 2021 quarter. The average annual interest rate on a 1-year, $100,000 term deposit was 25 basis points at June 2021. Source: RBA.

[6] Bloomberg (2021). Government Bond Yields. Australian Bond 10-year Yield. July 20, 2021.

[7] Reserve Bank (2021), “Retail Deposit and Investment Rates,” June 2021. Based on 6.45% interest rate for one-year term deposit, at December 2017.

[8] Assuming a 0.25 return on a one-year term deposit. Reserve Bank (2021), “Retail Deposit and Investment Rates,” June 2021.

[9] Compared to holding risk-free cash.

[10] ASX demutualised on October 13, 1998. It listed on ASX on October 14, 1998. It was known as the Australian Stock Exchange at the time.

[11] Willis Towers Watson Global Pension Assets Study 2020.

[12] Deloitte: Dynamics of the Australian Superannuation System: November 2019.

[13] Australian Prudential Regulation Authority (March 2021), “APRA Release Superannuation Statistics for March 2021.”

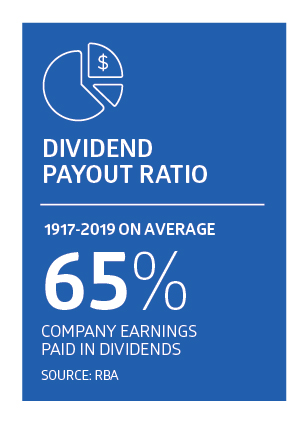

[14] Bergmann, M (2016), “The Rise in Dividend Payments,” Reserve Bank of Australia, March Bulletin 2016.

[15] Matthews, T. (2019), “Australian Equity Markets Facts: 1917-2019,” Reserve Bank of Australia, June 2019.

[16] Bergmann, M (2016), “The Rise in Dividend Payments,” Reserve Bank of Australia, March Bulletin 2016.

[17] ibid

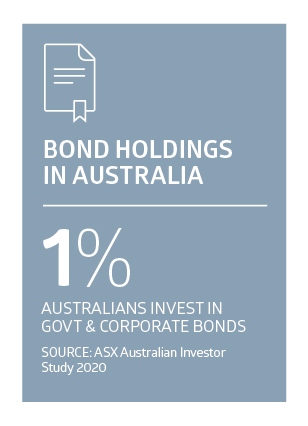

[18] ASX (2020), “ASX Australian Investor Study,”.

[19] ibid

[20] At end-June 2021. Standard & Poor’s, (2021), “S&P/ASX 200 Index: Fact Sheet,”.

[21] Bergmann, M (2016), “The Rise in Dividend Payments,” Reserve Bank of Australia, March Bulletin 2016.

[22] ibid

[23] Do not read that as a stock recommendation. Do further research of your own or talk to your financial advisers before acting on themes in this article.

[24] Morningstar. At July 20, 2021. Based on trailing (historic) dividend yield. BHP Group yield 6.1 per cent, Rio Tinto yield 10 per cent the Fortescue Metals Group yielded 11.3 per cent. The big-four bank trailing yields ranged were around 3 per cent.

[25] At end-June 2021. Standard & Poor’s, (2021), “S&P/ASX 200 Index: Fact Sheet,”.

[26] ibid

[27] ASX Investment Products Report. “Investment Product Summary: A-REITs,” June 2021.

[28] ASX (2020), “ASX Australian Investor Study,”.

[29] ASX Russell Investment Study 2018. Australian shares on average returned 8.8 per cent annually over 20 years to December 2017. Australian fixed income returned 5.9 per cent in that period.

[30] XTB corporate website. “About Us”. July 21, 2021.

[31] ASX, “ASX Hybrid Market Report,” June 2021.

[32] ASX, “ASX Investment Products Report”. June 2021

[33] ASX, “ASX Investment Products Report”, June 2021.

[34] ASX Investment Products Report. “Investment Product Summary: A-REITs,” June 2021.

[35] mFund website. July 21, 2021.

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.