- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Getting started in property investing through ETFs

- Fri 04 June 2021

Raf Choudhury of State Street Global Advisors considers how Exchange Traded Funds can provide exposure to international and Australian property. Vanguard’s Robin Bowerman outlines how ETFs can be used for diversified exposure to the property sector.

Property has been a cornerstone investment for many Australians. According to the Australian Bureau of Statistics, 66% of Australian households own their own home. [1]

Over recent years, low interest rates, multiple home-buyer incentives, and economic and jobs recovery have made investing in property attractive. In addition to having a place to call your own, home ownership has the potential for income and capital gains.

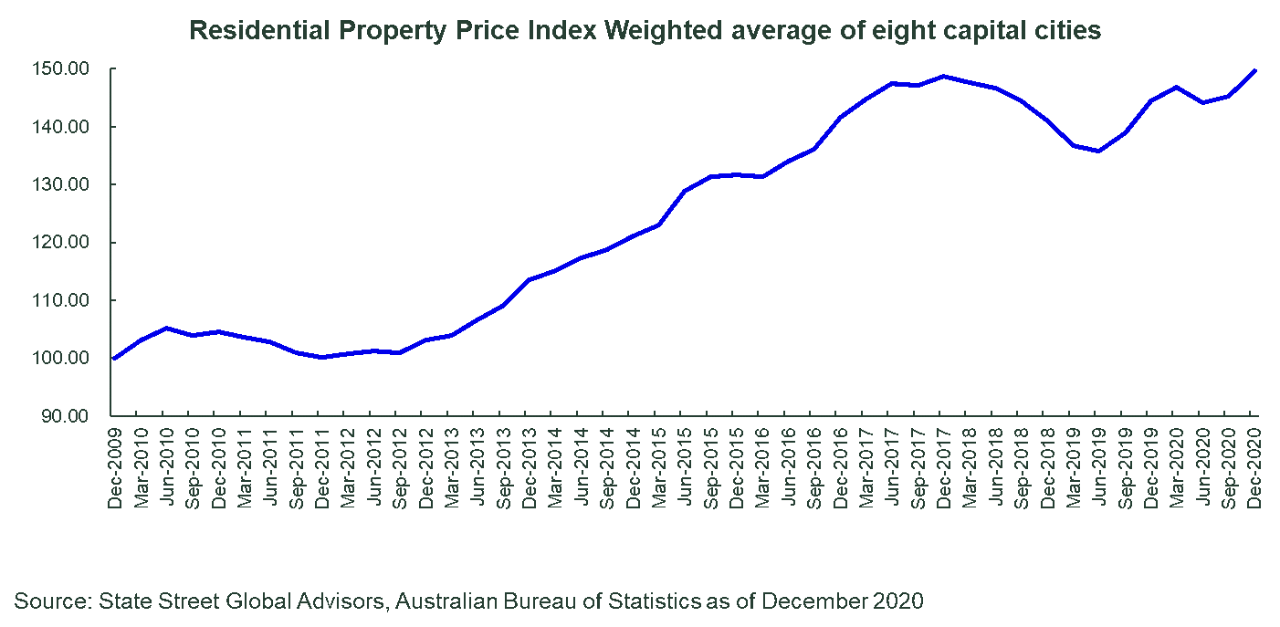

However, the continued rise in house prices has increased the hurdle for potential investors and homeowners.

Raf Choudhury, State Street Global Advisors

In fact, double-digit house-price growth is widely expected across the main cities in 2021. ANZ upgraded its to 9% housing price growth nationally, while for Sydney and Perth the bank forecasts 19% and 16% for Melbourne and Brisbane. [2]

Booming global market

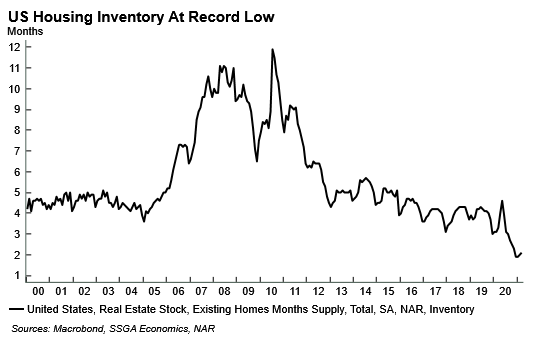

Australia is not the only country where property is in hot demand and proving to be frustrating for buyers. In the United States, with near record-low inventories, record-high price increases and record speed for sales, it’s difficult for potential homeowners to get onto the ladder. This was a problem even before COVID-19 and it’s got far worse over the last year.

Broad exposure

When we think about investing in property, the first thing that may come to mind is saving money to buy a house. But you don’t have to own a mortgage or be a landlord to build a property portfolio. Australian Real Estate Investment Trusts (A-REITs) offer access to a pool of investments whose objective is to invest in income-producing property or property-related assets.

One simple way to access A-REITs is through investment vehicles like Exchange Traded Funds (ETFs). ETFs can provide broad exposure to a range of global real estate assets while bringing the benefits of being cost efficient and transparent.

Going global

As Australia represents only 4.5% of the global REIT [3] market, there are many diversifying REIT sectors that are underrepresented in the local market.

A-REITs (Australian Real Estate Investment Trusts), for example, are heavily weighted towards retail and industrial, which combined account for over 50% [4] of the index compared to global REITs, which provide greater diversification and hold around 17% of their holdings in retail, 17% in industrial, 15% in residential and 7% in healthcare. [5]

For example, the SPDR Dow Jones Real Estate Fund (ASX: DJRE) seeks to provide investment returns, before fees and other costs, that closely correspond to and track the performance of the Dow Jones Global Select Real Estate Securities index.

This index measures the performance of publicly traded REITs and real estate operating companies traded globally. Based on dividends over the last 12 months, it had a yield of 6%. [6]

Through a global REIT ETF like DJRE, investors can gain access to securities underrepresented in the local market, including casinos, hotels and healthcare infrastructure (hospitals). And, most importantly, the cost of an ETF like DJRE is a more affordable approach to investing in property. Of course, that depends on the size of your investment.

Robin Bowerman, Vanguard

Using property ETFs for diversification, liquidity

Investing in property – whether it is owning one’s home as part of the Great Australian Dream, or buying an investment property as part of a portfolio – has been a well-trodden path for Australians.

And as the economy re-opens and recovers from the impact of COVID-19, our love affair with property has never been stronger. It’s been hard to ignore not just the number of “For Sale” signs erected outside homes in my suburb but the speed at which the “Sold” stickers are slapped on – an unscientific but probably accurate reflection of the booming property market, fuelled by low interest rates.

But for investors not keen on being lumbered with a mortgage and other costs involved in maintaining a physical property, or who would like to invest smaller amounts in this asset class, there is always the alternative of A-REIT Exchange Traded Funds.

Bought or sold on the ASX, these ETFs are often viewed as a low-cost way of investing in property securities listed on ASX.

Before you dive head-first into purchasing an A-REIT ETF, though, here are a few things you should know:

Commercial versus residential

Investors in A-REIT ETFs should be aware of the type of property securities invested in when purchasing a “property ETF”.

For instance, the Vanguard Australian Property Securities index ETF (ASX: VAP) seeks to track the return of the S&P/ASX 300 A-REIT index, and invests in property sectors that include retail, industrial and office space. In other words, this ETF invests in commercial property and not residential property.

This has historically been one of the diversification benefits of REITs. While many Australians can afford a residential property, few can aspire to owning a CBD office block or shopping centre.

Liquidity

A-REIT ETFs, like most other ETFs, are highly liquid in comparison to residential property. The process of selling a residential property is often a long one and it is hard to fathom the quickest of property sales beating the two-day turnaround for liquidating an ETF.

Liquidity is less of an issue if you have invested in listed property via shares or a property ETF, as you can quite easily sell your ETF(s) back on the stock exchange if the need arises.

Further, one could imagine the difficulty a retiree in need of cash would have in trying to sell just a bathroom or a kitchen in comparison to a percentage of an ETF portfolio.

That liquidity clearly has value but from a diversification viewpoint it is important to be aware that while REIT ETFs give you exposure to the commercial property market, their behaviour can track the broader sharemarket during moments of market stress.

Short-term volatility and returns

Equally, you should be aware that especially in the short-term, the sharemarket is subject to volatility, possibly more so than the property market.

This was best illustrated during the COVID-19-induced market dip early last year, when the ASX 300 A-REIT index fell almost 50% shortly after it reached its all-time high of 1712 points just a few weeks prior. At time of writing, the index is sitting in the mid-1400s.

But over the long term, whether in direct shares or ETFs, the volatility smooths out – the Vanguard Index Chart shows that $10,000 invested in listed property since 1990 would have delivered annual returns averaging 7.8%.

You should also be aware that the expected returns of an A-REIT ETF could be quite different to that of owning a physical residential property.

Property markets are not all the same and there are different economic drivers for residential property versus a High Street retail shop versus a CBD office tower. Again, diversification within the broader property market can help spread the investment risk.

Diversification

The diversification benefits of investing in an A-REIT ETF are compelling. For instance, VAP is invested in 32 property securities listed on ASX, across several property sectors, as previously mentioned.

Short of purchasing 30-odd separate properties in the retail, commercial and industry sectors, it is impossible to beat the diversification benefit gained through investing in VAP or other broad A-REIT ETFs.

More broadly, having a guiding principle of diversification in your investment portfolio – that is, diversification across and within asset classes that balances the investor’s risk profile, goals and time horizon, and is tax efficient – will serve most investors well.

Vanguard does not recommend being overweight in any asset class, whether it is in direct shares (or ETFs) on the end of one spectrum or property on the other.

As such, the value of a well-diversified portfolio across asset classes – for instance, a mix of residential property, direct shares or a broad-based ETF and bonds – cannot be overstated.

About the author

Multiple authors, State Street Global Advisors, Vanguard

Raf Choudhury is Head of Investment Strategy & Research, Australia at State Street Global Advisors. State Street Global Advisors is Australia’s first ETF issuer. The SPDR® Dow Jones Global Real Estate Fund and SPDR S&P/ASX 200 Listed Property Fund are available via ETFs

Robin Bowerman is head of corporate affairs at Vanguard Australia.

[1] https://www.abs.gov.au/statistics/people/housing/housing-occupancy-and-costs/2017-18

[3] Source: Weight of Australia in the Dow Jones Global Select Real Estate Securities Index was 4.5% as of 18 May 2021.

[4] Source: Weight of retail and industrial in the S&P/ASX 200 A-REIT Index was 50.96% as of 18 May 2021.

[5] Source: Dow Jones Global Select Real Estate Securities Index as of 18 May 2021

[6] Source: Bloomberg Finance, L.P., SPDR Dow Jones Global Real Estate Fund as of 18 May 2021

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.