- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Six trends to drive A-REIT opportunities

- Fri 04 June 2021

Recovery from the effects of COVID-19 provides a long-term investment option in real estate sector.

Fifty years ago this year, GPT Group (ASX: GPT) listed on ASX. In so doing, GPT changed the lives of proprety income investors for good.

Since then, Australia has become a global leader in listed commercial property. Local and offshore investors have been attracted to the relatively high income of Australian Real Estate Investment Trusts (A-REITs) and their competitive, risk-adjusted returns.

Then came COVID-19 last year and an altogether different environment tailor-made to disrupt the sector.

The mighty Westfield had put Australia on the map as a global retail real estate leader but also gave us one of the highest exposures to retail real estate in the world. Within a few days of lockdown, shopping centres were empty, with the enforced switch to online seeing several years of growth compressed into a few weeks.

In offices across the country, a similar shift was taking place. Having prevaricated for years over the pros and cons of working from home, managers and their staff were surprised at how smoothly and quickly the transition occurred.

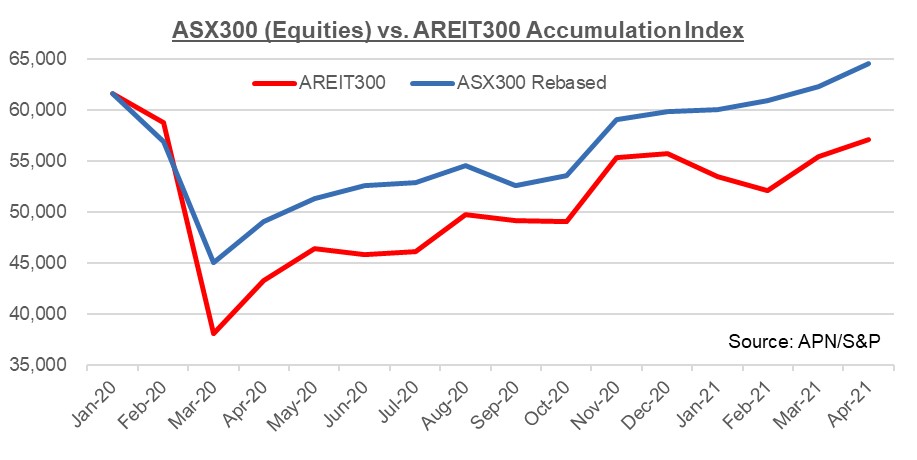

These factors were the writing on the wall for the A-REIT sector. Having reached a high over 64,000 in late February 2020, the ASX300 A-REIT index fell 37% in March 2020 as investors tried to comprehend the implications of the pandemic.

Shopping-centre stocks were among the hardest hit, notably the large mall landlords Scentre Group (ASX: SCG) (down 55%) and Vicinity Centres (ASX: VCX) (down 52%), as investors panicked over whether their shopping centres would ever re-open.

The forlorn outlook many experts predicted then hasn’t eventuated, with Australia’s largely successful control of the pandemic getting much of the credit. Those offshore investors that ran for the hills last March have since turned tail, realising Australia was a better place to invest in a pandemic.

A-REITs have since recovered significant ground with the vaccine announcement delivering a further boost. Still, the sector continues to trail the broader Australian equity market recovery (see above chart), which is an opportunity for investors focussing on the long term, in APN’s view.

The structural concerns that first surfaced as the pandemic took hold, along with the absence of international tourists and immigration, explain much of the performance gap. The Government-mandated Leasing Code of Conduct was also a significant burden (not placed on most businesses) for landlords.

The code removed a tenant’s obligation to meet contracted rental payments under the lease contract, meaning landlords were having to support their business partner (tenants), which created great uncertainty for investors. As some support is still being provided, this continues to weigh on the sector’s recovery.

Thus far, A-REIT landlords have provided more than $1 billion in support under the code, with more than 90% delivered by owners of retail properties (notably large shopping malls).

The unintended consequence is that those businesses most affected by the pandemic – namely large mall landlords Scentre and Vicinity – have provided the highest levels of tenant support. The impact on their bottom line has been pronounced and prolonged.

Six trends will drive opportunities

Although all A-REITs have recovered significantly from their March 2020 lows, it is in the dispersion of that performance where opportunities lie.

Those A-REITs currently trading well below their pre-pandemic 2020 highs include Vicinity (down 40%), Scentre Group (down 34%) and GPT (down 27%), all of which were burdened with additional COVID-19 impacts (lockdowns and the leasing code).

However, as always, there’s a caveat. A-REIT performance is inextricably linked to the Australian economy. On that score, the ongoing recovery will be boosted by six factors:

- A return to the office will assist struggling CBD retail as foot traffic rises.

- Price growth in residential property and ongoing construction will boost retail, especially do-it-yourself and homeware categories. Consumers’ willingness to spend, a key plank in the path for a return to pre-COVID life, should gather pace.

- The vaccine rollout will further lift business and consumer confidence.

- The return of international tourism, potentially exceeding prior levels (revenge travel as consumers look to catch-up), should have a similar impact.

- The return of international students will also boost confidence, with residential and retail property benefiting. Overseas students can also help Australia address current labour shortages.

- The return of immigration will be a major economic driver. As with foreign students, residential real estate will be a major beneficiary, with flow-on benefits for office/retail and other real estate sectors.

These factors point to A-REITs performing well over coming years, in APN’s view.

(Editor’s note: Do not read the following commentary as a recommendation on A-REITs. Do further research of your own or talk to your advisor before acting on themes in this article).

Between 2010 and 2019, A-REITs returned 11.6% each year. (mainly from income). According to UBS data, over the past 20 years A-REITs have delivered an average return of 9.6% a year, including an average distribution yield of 6.9% each year. The income that investors received is almost 50% higher than equities over this period.

This is a key takeaway for income investors – it is the income component of A-REIT returns that is the most predictable.

Risks

The major risks to the A-REIT sector concern all those factors that may apprehend the economic recovery. Inflationary pressures that may result in higher interest rates, damaging the wealth effect (as asset prices rise), the continued slow pace of vaccine rollout and more damaging mutations of COVID should all be considered.

While inflation has become a growing concern across financial markets, it could see more investors turn to commercial real estate, which has leases that have inflation-linked or fixed rental escalations, providing a level of protection other asset classes cannot provide.

And there remain unknowns in the office and retail sectors, although in our view these are diminishing each day. In sticking to high-quality, well-located properties with premium tenants, as APN Property Group likes to do, these risks can generally be offset.

Three major trends

Here are three further trends to consider:

1. Benefits of funds management earnings to A-REIT growth

In recent years, Charter Hall Group (ASX: CHC) and Goodman Group (ASX: GMG) have grown their funds-management operations. Their moves proved prescient. COVID-19 highlighted the reliability of their earnings under significant market stress. As recognised leaders in real estate asset management, the growth in funds-management earnings by A-REITs is set to continue.

2. Not all retail is created equal

Large malls with heavy exposure to discretionary retail suffered from lockdowns and reduced foot traffic while non-discretionary convenience centres, underpinned by supermarkets, thrived. Large-format retail (LFR) centres, meanwhile, fed our demand for homewares, electrical, furniture and everyday needs.

A recent LFR transaction occurred at a 50% premium to the December 2020 valuation. Post-COVID, most assets will continue to deliver healthy income but investors should remember not all retail is created equal.

3. Say hello to new commercial property asset classes

Already, there are two listed childcare (or social infrastructure) A-REITs, with more likely to come. Hotels (pubs) and primary produce is another sector getting attention from commercial property investors, with FY21 seeing a record year of transactions.

Service-station assets also deliver bond-like returns but with growing income, underpinned by high-quality tenant covenants and strong investor demand (2020 saw a record level of transactions). An added benefit is alternative-use potential (when electric vehicles dominate our roads).

The future A-REIT index may look more like its US counterpart, where commercial property investors can add healthcare properties, life sciences and government buildings, and even mobile phone towers to their portfolios.

About the author

Pete Morrissey, APN Property Group

Pete Morrissey is Head of Funds Management and Portfolio Manager, APN Property Group, a leading property manager that has several A-REITs on ASX (ASX: APD).

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.