Demographic analysis is the study of historical and projected changes in population over time that have the power to significantly impact society and economies. These trends can create opportunities for the active stock-picking investor.

Importantly, demographic forecasts can be made with a relatively high degree of certainty. For example, we can confidently predict the working-age populations of most countries in ten years’ time – excluding unpredictable events such as wars, epidemics, or catastrophes – with greater certainty than the GDP forecasts of those same countries.

Unlike macroeconomic cycles and investor sentiment, demographic trends are slow-moving, so their cumulative effects are not properly valued by myopic markets.

This creates an opportunity for investment strategies like the Fidelity Global Demographics Fund (Managed Fund) (ASX: FDEM) that focuses on companies benefiting from these long-term structural changes.

In Fidelity’s view, three mega-trends shaping global growth, on which long-term investors can potentially capitalise are:

1. We are living longer lives

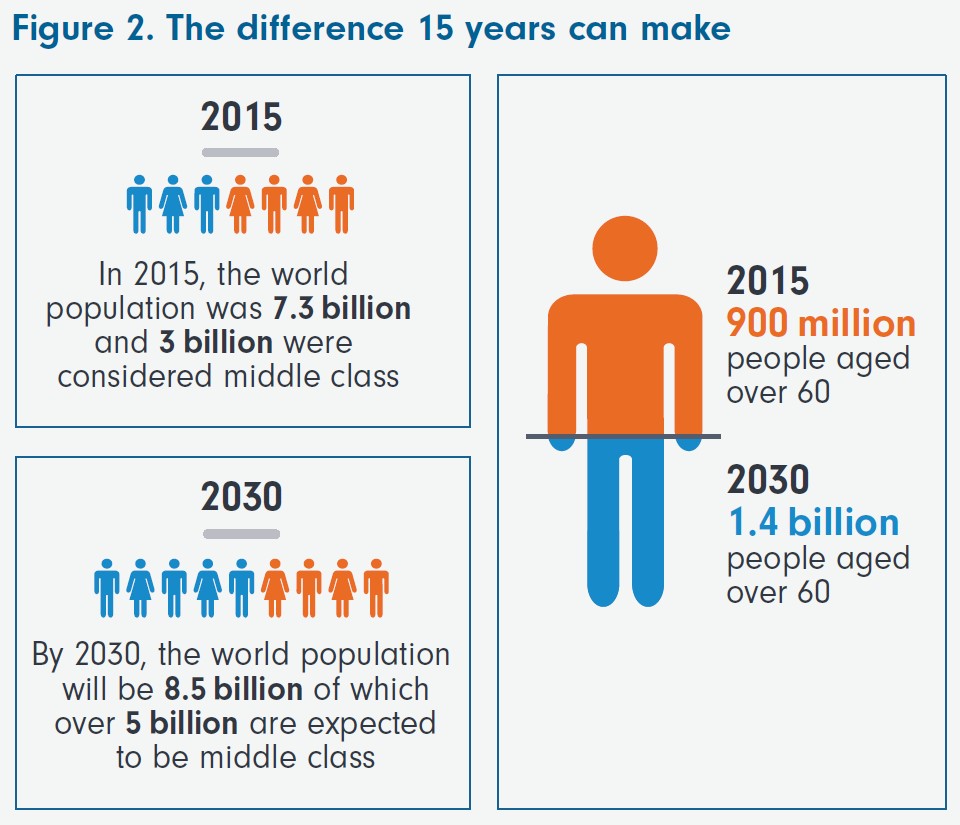

This process is a result of the combined effects of declining mortality rates, increased longevity, and lower fertility rates. Older persons aged 60 and over, today comprise the world’s fastest growing age group and in 2045, this group is expected to exceed the number of children (aged under 15) for the first time, according to UN data (refer to diagram) .

While ageing populations are more prominent in developed countries, it is a global phenomenon. By 2050, one in three people in developed countries is expected to be aged 60 and over compared with one in five today.

Ageing of the world’s population has massive investment implications and opportunities in industries such as healthcare, robotics, aged services and finance.

Source: Fidelity International, HSBC, UN Population Database, Feb 2021

As a population ages, the size of their workforce also declines, creating opportunities for companies in robotics and automation. Japan and Germany have some of the oldest workforces in the world and have some of the highest density of robots and automation.

In its most basic form, automation is the replacement of a human worker with a machine. These machines reduce costs, free up worker capacity for other tasks – and they never sleep. We see a long runway for growth in automation, with low density rates in other parts of the world.

Ageing is naturally linked to rising health expenditures, but urbanisation is also important as people move to cities, incomes rise and diets change. That raises not only the propensity to spend more on healthcare, but the necessity to do so as people consume more processed food, meat, sugar, diary, and alcohol. In turn, this raises the risks of obesity rates in Asia with consequence of a rise in chronic diseases, which in turn create a demand for a wider range of healthcare products and services.

Private hospitals, care services and drug manufacturers are positioned to see rising demand. As people live longer, there will also be increasing demand for discretionary treatments for eye and hearing products to improve their quality of life.

2. Better lives via expanding middle class

Over recent decades, the middle class has grown exponentially. Of the 7.6 billion citizens in the world, 3.6 billion now belong to the middle class [1], according to the United Nations. This is staggering considering that just 10 years earlier, the size of the middle class was only half as much.

The middle-class speed of growth is also accelerating. After reaching the first billion at the end of the 1980s, it took more than 20 years to add another billion to the middle class, but only around eight years to add the next 1.6 billion. Latest estimates place the middle-class population at around 5.2 billion in 2030, representing two thirds of the world’s population, United Nations data shows.

Most of the growth will come from the developing world, particularly Asia, which McKinsey estimates will represent more than US$10 trillion worth of consumption over the next 10 years. [2]

The growth in the emerging middle class provides support for a wide range of discretionary products from phones to fashion and electronics to automobiles, boosted by the trend of “premiumisation”, where consumers trade up for superior products as incomes rise.

As more people join the middle class, the challenge for businesses will be to meet this demand while protecting the long-term sustainability of people and the planet. Over the past 50 years, global consumption has been exerting increasing stress on the Earth’s ecosystems.

In general, consumers are growing more aware of sustainability issues and making more conscious purchasing decisions, with most younger people willing to use their consumption power to affect change. These new consumption patterns will both benefit and disrupt several sectors, crystallising the need for an ongoing focus on sustainability.

Source: United Nations Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2015 Revision Produced by: United Nations Department of Public Information. Middle Class definition is that of households spending $11–110 per day per person in 2011 PPP, building on the definition outlined in Homi Kharas (2010), White Paper No. 285 for the OECD Development Center.

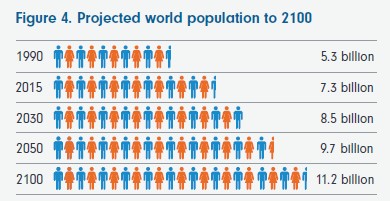

3. More lives

By 2100, the global population could be more than double the 5.3 billion in 1990 [3]. The overwhelming drivers of growth are developing countries. This is a result of the combined effects of declining mortality rates, increased longevity, and lower fertility rates.

Older persons aged 60 and over today comprise the world’s fastest growing age group and in 2045 this group is expected to exceed the number of children (aged under 15) for the first time, UN data shows.

The projected population will boost global demand and underpin economic growth. But a growing population also raises demand for resources, such as food, water, arable land and energy, contributing to climate change.

The World Bank estimates that demand for food will rise by 70% by 2050. This poses a serious challenge for food production, particularly given that the amount of arable land in the world is falling due to industrialisation and urbanisation. To help meet this demand, companies are producing sustainable fertilisers and pesticides and developing precision farming techniques to increase crop yields.

Likewise, to meet increasing water and energy demands, we expect to see investment in sustainable water solutions across the supply and distribution of water, as well as into renewable energy sources, with wind and solar set to be the largest beneficiaries.

Source: United Nations Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2015 Revision Produced by: United Nations Department of Public Information.

Megatrend investing through ASX-quoted funds

The Fidelity Global Demographics Fund (Managed Fund) is available as an Active ETF (ASX: FDEM) or as a Managed Fund. You have the choice to invest directly, via an investment platform, financial planner or broker. To find out more, visit fidelity.com.au or speak to your financial planner or broker.

[1] Middle class is defined in line with Homi Kharas (https://www.oecd.org/dev/44457738.pdf) as households spending $11–110 per day per person in 2011 purchasing power parity, or PPP

[2] McKinsey, Global Institute Analysis, August 2021 (https://www.mckinsey.com/featured-insights/asia-pacific/beyond-income-redrawing-asias-consumer-map)

[3] All numerical estimates are made using the methodology developed by Homi Kharas. See H. Kharas (2010), ‘The emerging middle class in developing countries’, OECD Working Paper; H. Kharas (2017), ‘The unprecedented expansion of the global middle class: An update’, Brookings, and data from the Word Data Lab.

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People