[Editor’s Note: Do not read the following analysis as a recommendation to invest in emerging market shares or funds that invest in companies in these markets. On average, emerging markets equities historically have been more volatile than those in developed markets. Emerging market equities may not suit conservative investors or those with low risk tolerance. For most investors, emerging markets equities are typically only a small part of a balanced portfolio. The nature of emerging economies means there may be more political, economic and market risks to consider, compared to investing in developed economies. Do further research of your own or talk to a licensed financial adviser before acting on themes in this article].

The term “emerging markets” was coined in 1981 by Antoine van Agtmael while working at the World Bank, to create a more aspirational description of approximately 80% of the world’s population previously referred to as the “third world”.

There’s no precise definition of what constitutes an emerging market (EM), but they’re generally categorised as economies with low to middle income per capita, that are in the transitional phase towards becoming developed economies that generally have a higher per capita income and are well integrated into the global economic system.

The countries that constitute “emerging” are not uniform in nature and exhibit different levels of economic and social development. They also exhibit different growth and risk profiles and exposure to different market sectors.

As investors and consumers, we all have direct or indirect exposure to investments or products and services from emerging markets.

Many large companies from the developed world derive significant portions of their revenues from emerging markets. BHP Group (ASX: BHP) for example, generates over half of its revenue from sales to China.

In terms of trade, some of Australia’s most significant partners hail from emerging markets most notably China, our largest trading partner, and South Korea, our fourth largest.

Brands such as Samsung and Hyundai are household names and most of us would be using products that contain microchips manufactured by Taiwanese company TMSC - Taiwan Semiconductor Manufacturing Company Limited, which dominates the production of semi-conductors used by brands such as Apple.

In addition to these global EM players, there are many domestic companies seeking to grow as emerging economies evolve and per capita income increases, leading to a rise in consumer demand for a range of goods and services.

Why invest in emerging markets

From an investment perspective, one of the primary reasons for considering investing in emerging markets is gaining exposure to the strong economic growth they’ve historically generated and could generate into the future, in Fidelity’s opinion.

For the past 20 years, the GDP of emerging market economies has grown by 5.3% compared to developed markets which have grown by 1.7%, according to Fidelity analysis. GDP growth for emerging markets for the coming five years is expected to be 4% compared to 1.6% for developed markets, according to Fidelity analysis.

As part of this growth, the world has seen household income transition from low income to lower/middle income, upper/middle income through to high income (households earning more than $40,0000 per annum).

If Fidelity looks at India as an example, this transition from the lower income bracket is expected to gain momentum over the coming years with the lower income brackets declining and most noticeably the upper/middle income bracket rising strongly by 2030.

This effective growth of the “middle class” is expected to see an increase in the market penetration of certain goods and services as households have more money to spend.

As an example, the number of vehicles per thousand people is 59 in India compared to 890 in the USA. Likewise, 3% of Indians have credit cards versus, China at 22% and the USA at 69%, according to Fidelity analysis. As income levels grow, demand for goods and services is anticipated to increase, providing significant opportunities for companies within these sectors.

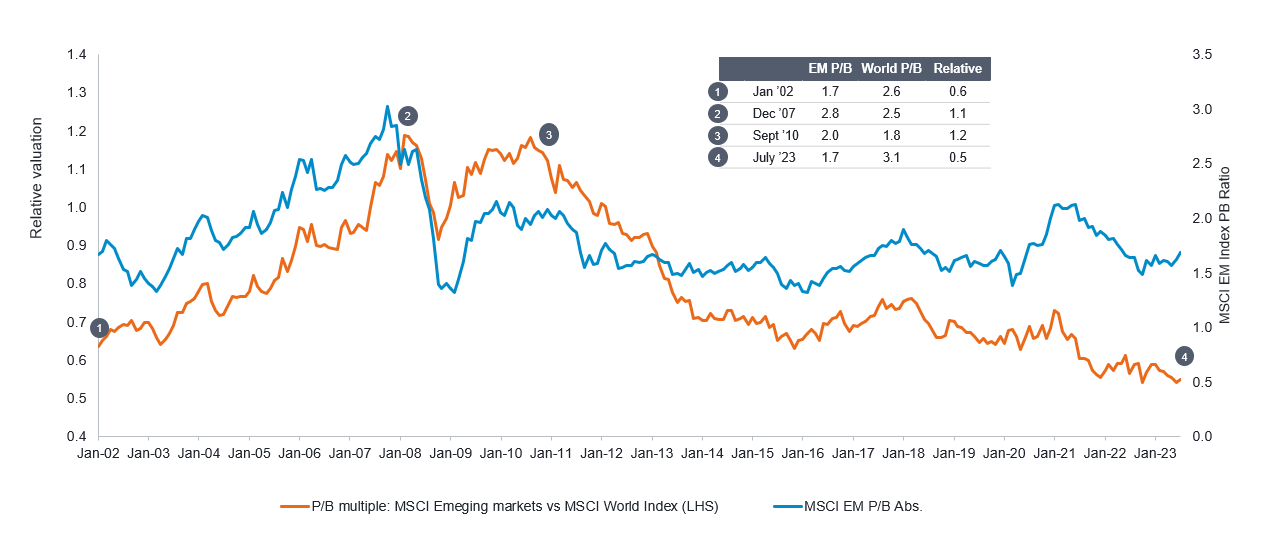

Aside from the opportunity to access growth, emerging markets are currently trading at a valuation discount to developed markets, as the chart below shows.

When Fidelity considers financial metrics such as price-to-book ratio, for example [which compares a company’s market value to its book value], emerging markets have been trading at a significant discount.

EM index trades at deep discount relative to history

Source: Fidelity International, Refinitiv DataStream, 31 July 2023. P/B = Price to Book ratio

Generally, investing in assets when they’re trading at a discount is positive for long-term returns, in Fidelity’s opinion.

[Editors’ note: Buying assets at a valuation discount is no guarantee of investment success. Some companies trade at a large discount to their historical average because of market concerns about their prospects or the market’s assessment of potential risks in that investment].

Risks of emerging markets

Assets also generally trade at a discount for specific reasons. In the case of emerging markets, the lower relative prices may reflect the additional risks associated with investing in these regions such as geopolitical risk, poor governance, liquidity risk, or that economic performance in certain countries is below expectations.

Each country will be exposed to their own specific risks. In the current market, for example, there are geopolitical concerns regarding tension between China and the US over Taiwan.

Conversely, if we look at the Indian market, many companies are tightly held by the founding families of the business, and issues relating to governance may need to be considered.

As part of the investment research process, analysts will generally factor in risk considerations in their return assumptions. The return an analyst will expect for taking on a higher level of risk will be incorporated into the price they’re willing to pay for investing in a company exposed to certain risks. This means the hurdle for investing in a higher-risk investment will be higher than that of a lower-risk investment.

Historically, emerging markets have exhibited greater volatility than developed markets, hence the trade-off with potentially higher returns. This is an important point when considering an allocation. EM equities have a longer-term investment horizon and for investors concerned about short-term fluctuations, this may not be appropriate.

On the other hand, for investors with a longer-term view, seeking a higher level of growth, emerging markets could be an addition for a diversified portfolio of growth assets.

To conclude, emerging markets provide exposure to a diverse range of countries, sectors and companies that can complement other equity exposures within a portfolio. The sector provides exposure to a range of economies that are rapidly evolving, expanding their GDPs and have burgeoning middle classes who will demand access to goods and services, providing opportunities for companies to tap into this changing dynamic.

DISCLAIMER

This document is issued by FIL Responsible Entity (Australia) Limited ABN 33 148 059 009, AFSL No. 409340 (‘Fidelity Australia’). Fidelity Australia is a member of the FIL Limited group of companies commonly known as Fidelity International. Prior to making any investment decision, investors should consider seeking independent legal, taxation, financial or other relevant professional advice. This document is intended as general information only and has been prepared without taking into account any person’s objectives, financial situation or needs. You should also consider the relevant Product Disclosure Statements (‘PDS’) for any Fidelity Australia product mentioned in this document before making any decision about whether to acquire the product. The PDS can be obtained by contacting Fidelity Australia on 1800 044 922 or by downloading it from our website at www.fidelity.com.au. The relevant Target Market Determination (TMD) is available via www.fidelity.com.au. This document may include general commentary on market activity, sector trends or other broad-based economic or political conditions that should not be taken as investment advice. Information stated about specific securities may change. Any reference to specific securities should not be taken as a recommendation to buy, sell or hold these securities. You should consider these matters and seeking professional advice before acting on any information. Any forward-looking statements, opinions, projections and estimates in this document may be based on market conditions, beliefs, expectations, assumptions, interpretations, circumstances and contingencies which can change without notice, and may not be correct. Any forward-looking statements are provided as a general guide only and there can be no assurance that actual results or outcomes will not be unfavourable, worse than or materially different to those indicated by these forward-looking statements. Any graphs, examples or case studies included are for illustrative purposes only and may be specific to the context and circumstances and based on specific factual and other assumptions. They are not and do not represent forecasts or guides regarding future returns or any other future matters and are not intended to be considered in a broader context. While the information contained in this document has been prepared with reasonable care, to the maximum extent permitted by law, no responsibility or liability is accepted for any errors or omissions or misstatements however caused. Past performance information provided in this document is not a reliable indicator of future performance. The document may not be reproduced, transmitted or otherwise made available without the prior written permission of Fidelity Australia. The issuer of Fidelity’s managed investment schemes is Fidelity Australia.

© 2023 FIL Responsible Entity (Australia) Limited. Fidelity, Fidelity International and the Fidelity International logo and F symbol are trademarks of FIL Limited.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.