[Editor’s Note: Do not read the following commentary as a recommendation to invest in US or Australian tech stocks or tech Exchanged Traded Funds (ETFs). Like all investments, tech stocks and tech ETFs have risks. The sector can be volatile and prone to market sentiment about latest tech trends. Also, there can be many more tech losers than winners as new technologies emerge. Valuations in the largest tech stocks can be substantially higher than average market valuations, due to expectations of faster earnings growth from technology. Tech ETFs aim to provide a tech index return, meaning investors can potentially suffer losses when tech stocks fall. Talk to a licensed financial adviser or do further research or your own before acting on themes in this article].

To put it bluntly, 2023 has been a confusing year for investors.

The major stories that have filled our headlines have mostly revolved around an impending recession, painful inflation, high interest rates, and the Nasdaq-100 index closing out its best first-half performance yet with a 40% rally, according to Betashares analysis.

With many economists still predicting a US recession, investors are justified in asking: “Why has US tech been soaring?”

Technology traditionally has been seen as a high-risk high-reward sector, suitable for investors with a long-time horizon and the ability to withstand at least a few years of losses on the way. Anyone who was investing before the turn of the century will be acutely aware of the 15 years it took for the Nasdaq-100 to recover from the dot-com crash.

That’s not the kind of exposure investors would intuitively rush to buy in the face of an imminent recession. However, the companies in the technology sector have changed a lot in the last 20 years, and a closer look at US tech leaders reveals some important characteristics that may explain its current popularity.

What is driving tech’s performance

The Nasdaq-100’s current rally has been driven almost entirely by the largest seven stocks: Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta. While their average total weight of 50% in the index is high, they have contributed 75% of returns in the Nasdaq-100 index in the first half of 2023, according to Betashares analysis.

A major factor is the natural advantage the large tech companies have in the skillset as well as access to computing power and financial resources required to develop and monetise increasingly sophisticated AI models.

Another underappreciated reason is that these tech companies are some of the largest, most established businesses in the world.

In Betashares’ opinion, the largest tech companies tend to have strong fundamentals, hold significant cash reserves, and historically have generated relatively steady revenues over the business cycle.

For example, over the last 20 years, Microsoft generally has exhibited steady revenue growth – even through the Global Financial Crisis, the downturn in 2015/16 and Covid, as the chart below shows.

Source: Bloomberg. As at 30/06/23. Past performance is not indicative of future performance.

In contrast, BHP Group’s (ASX: BHP) revenue has swung up and down more significantly with the business cycle [as would be expected of a mining company exposed to cyclical commodity prices]. The largest tech companies offer products and services that nearly all of us use every day, and their ubiquity could give them strength, which is currently reflected in their fundamentals.

Tech company fundamentals

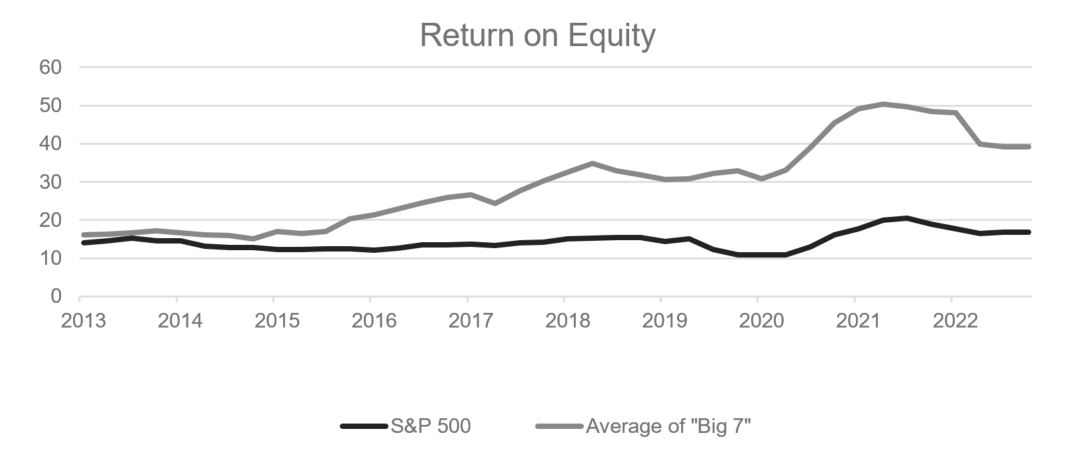

Over the last 10 years, the seven tech giants have displayed an attractive growth in return on equity (ROE), leaving behind the rest of the S&P 500, as the chart below shows. As well as driving technological innovation, the firms’ digital nature and relatively low capital requirements have allowed them to develop scalable business models across multiple market sectors.

Source: Bloomberg. "Average of Big 7" is the simple average of ROE of Alphabet, Apple, Microsoft, Tesla, Meta, Nvidia & Amazon. Tesla data only available from 31/12/2020, average of the other 6 companies has been used prior to that date.

An example of this trend is Amazon Web Services (AWS), Amazon’s cloud computing platform. While many people would still think of Amazon as an online shopping company, AWS is now its most successful business unit.

The segment generated almost US$23 billion in profit on US$80 billion of revenue in 2022, bringing Amazon’s operating income to US$12.25 billion for the year, from what would have been a US$10.59 billion loss without AWS [1].

What about Aussie tech?

The US tech giants aren’t the only investable tech companies. While the US traditionally has been the go-to place for tech investors, there’s been increasing interest in our domestic tech sector.

Australian technology offers qualities as a diversifier for investors with an existing US tech exposure. The most obvious of these is size. While the US tech giants dwarf Australian tech names on an absolute basis, they are also much larger compared to the rest of their market.

The weighted average market capitalisation of the Information Technology (IT) sector within the S&P 500 is 2.8 times that of the S&P 500 index. In Australia, the trend is reversed, with the S&P/ASX 200 index having a weighted average market cap 5 times higher than its technology component.

The Australian tech industry is still in its nascency compared to the US tech sector. But Australia has a highly educated and tech-savvy population and is seen as a desirable destination within the Asia Pacific for skilled migrants to work and study.

The S&P/ ASX All Technology Index has enjoyed a 21% gain for the six months to 30 June this year. While well below the 45% gain in the S&P 500 tech sector, this was significantly higher than any other S&P/ASX 200 sector.

Over the five-year period to 30 June 2023, the ASX All Technology Index has returned 10.44% per annum, according to S&P data.

The Australian tech sector is far more B2B software-focused and has likely missed out on some of the excitement around AI and semi-conductors that has driven gains in the US, in Betashares’ view. The smaller size of Australian tech companies also means Australian investors may be less likely to turn to them in the face of a recession.

Ultimately, the recent gains in the US tech sector suggest that some investors may view some of the larger, more established companies in that sector as having potential “defensive” characteristics.

Their established market presence, potentially more economically-resilient revenue streams and access to resources to invest in new business lines could make them a consideration for investors expecting challenging times ahead, in Betashares’ opinion.

On the other hand, Australian technology potentially offers a longer-term prospect, according to Betashares. Supportive demographics and room for growth presents opportunities for investors looking to capitalise on a developing tech market.

How can Australian investors gain technology exposure?

Index-tracking ETFs are an increasingly popular way for Australian investors to gain exposure to domestic and international equities. They offer intra-day liquidity as they are able to be bought and sold on the ASX like a share.

Their holdings are generally published daily, allowing investors to know exactly what they are investing in. They offer diversified exposure to the sector, as opposed to the high-risk approach of trying to pick the next star tech stocks.

Finally, thanks to their passive, rules-based methodology, ETFs generally enjoy lower management fees than their active fund peers.

[Editor’s note: As index-tracking investments, tech ETFs can also include many tech stocks that underperform their index, as well as those that outperform. Thematic or sector-based ETFs can be more concentrated due to fewer stocks included in the underlying index, compared to broadbased ETFs. Moreover, some technology companies can have a large weighting in tech indices, meaning investors can have high exposure to a small group of stocks. The free ASX online ETF course can help you understand the features, benefits and risks of ETFs before investing in them.]

-----------------------

[1] Amazon Financial Reports

DISCLAIMER

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) is the issuer of the Betashares Funds. This information is general in nature and doesn’t take into account any person’s financial objectives, situation or needs. You should consider its appropriateness taking into account such factors and seek professional financial advice. It is not a recommendation to invest or adopt any investment strategy. Read the Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au, and consider with your financial adviser whether the relevant product is appropriate for your circumstances.

The S&P/ASX All Technology Index (Index) is a product of S&P Dow Jones Indices LLC or its affiliates (SPDJI) and ASX Operations Pty Ltd (ASX) and has been licensed for use by Betashares. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC (S&P); ASX® is a registered trademark of ASX and these trademarks have been licensed for use by SPDJI and sublicensed for certain purposes by Betashares. ATEC is not sponsored, endorsed, sold or promoted by SPDJI, S&P, their respective affiliates, or ASX, and none of such parties makes any representation regarding the advisability of investing in ATEC nor do they have any liability for any errors, omissions or interruptions of the Index.

Nasdaq®, Nasdaq-100®, Nasdaq-100 Index® and Nasdaq-100 Currency Hedged AUD Index® are registered trademarks of Nasdaq Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Betashares. Neither NDQ nor HNDQ have been passed on by the Corporations as to its legality or suitability. NDQ and HNDQ are not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to NDQ or HNDQ.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.