- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Navigating ASX escrow (or lock-up) for beginners: the basics

- Thu 06 May 2021

Restrictions placed on a company’s shares on day one of trading can be a daunting thought for any founder or budding IPO prospect, but it doesn’t have to be an unnerving exercise once you wrap your head around a few key concepts.

Why escrow?

ASX is unique in the sense that it allows the listing of early stage companies without a track record of profitability or revenue, including companies whose assets are largely speculative or intangible, such as junior resources, early stage life science and technology companies.

In such cases, ASX applies escrow to protect the integrity of the market. Restricting the trading of securities of related parties, vendors or promoters for a period after listing serves to align their risks with those of incoming public shareholders.

Risk alignment is achieved by prescribing an escrow period that allows for the value of the company’s business, or services provided, or the asset vended in to become apparent and, in turn, reflected in the market price of the company’s securities.

Profit test or Assets test?

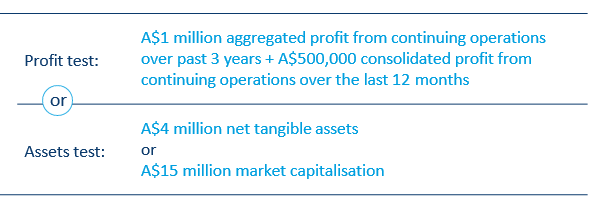

Companies seeking listing are required to satisfy either the Profit test or the Assets test, being the financial thresholds for admission reflected below:

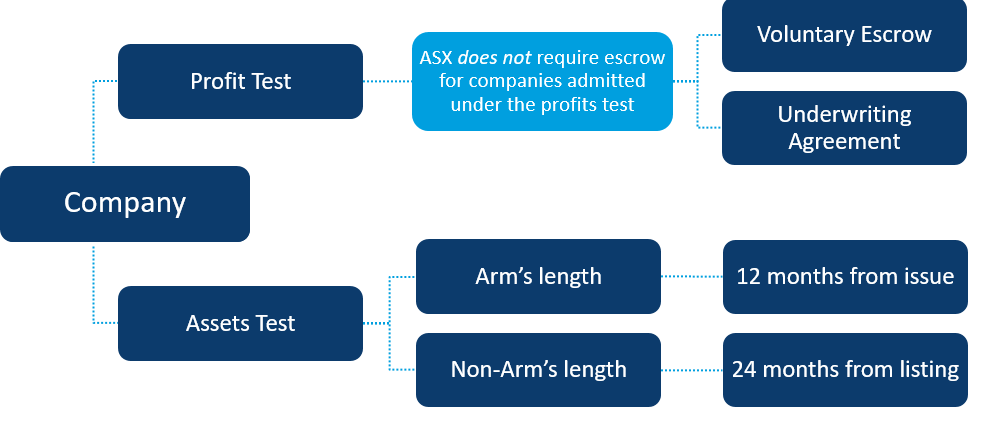

When a company is admitted under the Profit test, no escrow is applied by ASX. A company may however choose to impose some lock-up or escrow of existing securities usually through voluntary agreement (discussed further below).

ASX escrow under the Assets test

A company admitted under the Assets test is usually subject to ASX escrow. This regime is enforced by ASX, and shareholders subject to escrow are not permitted to dispose, trade or transfer their securities during the lock-up period, which can be up to 2 years from the first day of public trading.

The restriction is administered by restriction notices for all ASX-imposed escrowed holders (ASX Appendix 9C) to streamline the administrative task of notifying and enforcing ASX-imposed escrow on securityholders.

Exceptions to ASX escrow under the Assets test

The listing rules allow ASX to exercise its discretion not to apply escrow to companies admitted under the Assets test in defined circumstances including where the company has:

- a track record of revenue acceptable to ASX; or

- a substantial proportion of its assets as tangible assets or assets with readily ascertainable value.

This means that escrow will not ordinarily apply to listings of “investment entities” or other entities that have mostly tangible assets (such as developed land) or other assets (such as marketable securities) that have a readily ascertainable value.

What is an acceptable track record of revenue?

ASX provides guidance that it may not apply escrow if a company meets certain requirements at the time of its application. These include that the company must:

- be a going concern or the successor of a going concern that has had continuing operations for at least 3 full financial years;

- have conducted the same main business activity during the last 3 full financial years and through to the date it is admitted;

- have aggregated revenue from continuing operations for the last 3 full financial years of at least $20 million;

- have consolidated revenue from continuing operations for the 12 months to a date no more than 2 months before the date it applied for admission of at least $15 million;

- be raising at least $20 million in its IPO; and

- have a market capitalisation at the date of listing of at least $100 million.

This policy accommodates high growth companies that have already demonstrated successful commercialisation despite not meeting the Profit test.

Voluntary escrow vs. ASX escrow - the difference

The application of ASX escrow is rule-based. The terms and period of escrow are prescribed in the listing rules and are not able to be modified to suit the parties. Once in place, ASX escrow cannot be varied or terminated except with a consent or waiver from ASX, which is rarely given.

In contrast, the application of voluntary escrow is contract-based. Any decision to apply voluntary escrow, and the terms and period of escrow, are a matter for negotiation between the company, the shareholder and often an underwriter, lead manager or cornerstone investor. The terms of a voluntary escrow contract can generally be varied or terminated by mutual agreement.

How are shareholders treated under the escrow regime?

Also considered on a case-by-case basis, different parties are treated in accordance with ASX Chapter 9, Appendix 9B and Guidance Note 11 – all worth a read if you have the time. As this article is for beginners, here’s the 10,000 foot view:

Where to now?

For any questions, please feel free to get in touch with the ASX Listings team

Read our latest edition of Listed@

Your go-to source for ASX IPO and listed company news, insights and analysis - straight to your inbox three time a year.

About the author

Belinda Chiu, ASX

Belinda Chiu is a Principal Adviser within the Listings Compliance team at ASX whose primary responsibility is to maintain the integrity and reputation of an efficient, fair, orderly and transparent market.