- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Listed investment companies appeal for income investors

- Fri 04 December 2020

Sector shows its worth for investors in times of sharemarket volatility.

It has been a challenging year on many fronts, not least of all for investors, particularly those relying on income generated from investment portfolios or Self-Managed Superannuation Funds (SMSF).

With the Listed Investment Company (LIC) and Listed Investment Trust (LIT) sector containing some of the largest, most cost-efficient and longest-standing actively managed investment entities that can be accessed by retail investors in Australia, it might be of interest to see how they have continued to adapt and fare over the year and what may lie ahead in 2021.

Much market attention and commentary has recently centred on the rebound and ensuing growth in the sharemarket. However, the All Ordinaries index is still down 9% over the 12 months to end-October.

In contrast, the market capitalisation of the almost 100-year-old LIC/LIT sector remained steady over the same period; down just 2% to end-October 2020 (as shown in the table below).

Further, income investors will be aware that dividends and distributions received from their investment portfolios and SMSFs are also down, possibly by 30%, according to some commentators.

The strength in the LIC/LIT sector capitalisation relative to the sharemarket reflects a combination of underlying LIC/LIT performance, movements in trading ranges relative to asset backing and net issuance of LIC/LIT securities during this period.

LIC and LIT market capitalisation comparisons year to end-October 2020*

| LIC & LIT Sector | Oct20 Mkt Cap $M | Oct19 Mkt Cap $M | Change on Y/a $M/pts | Change on Y/a % |

| TOTAL Mkt Cap | 48, 132 | 49, 364 | -1, 232 | -2.5% |

| Equity Aus. | 29, 519 | 31, 2855 | -1, 766 | -5.6% |

| Equity global | 13, 740 | 13, 837 | -97 | -0.7% |

| All Ords | 6, 133.20 | 6, 772.90 | -640 pts | -9.4% |

| S&P/ASX200 (XJO) | 5, 927.60 | 6, 663.4 | -736 pts | -11.0% |

| S&P/ASX200 accum (XJOA) | 65, 856.0 | 71, 699.30 | -5, 843 pts | -8.1% |

Source: LICAT & ASX

*November 2020 data was not yet available at time of publication.

LIC/LITs also provide investors with structural benefits; their closed-end structure and active management allow managers to choose where and when to invest capital.

This closed-end structural trait may be of particular benefit in times of volatility, such as those seen over the pandemic-affected months of 2020, when LIC/LIT managers have been free to make investment decisions purely on their merit.

In contrast, open-ended funds such as managed funds or ETFs have had to be buyers and/or sellers during this period to accommodate investor applications and redemptions, with actions such as fund withdrawals occurring during periods of market weakness or large deposits being made into rapidly rising markets, potentially contributing to market volatility.

Additionally, the closed-end company structure of an LIC can allow it to retain profits after tax and, where desirable, to smooth the flow of dividends to shareholders.

This has enabled some LICs to maintain a far steadier payment of income to their investors over a period when dividend income from the broad market has fallen significantly. This consistency of income flow can be important for people, such as retirees, who must live off their investment income.

LICs and LITs offer more than Australian Equities

LICs have long been associated with actively managed portfolios of Australian shares.

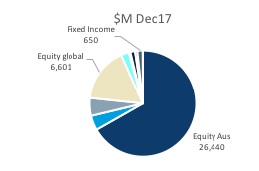

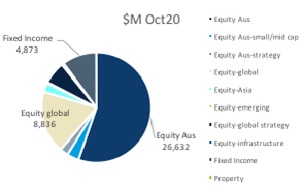

However, as shown in the LICAT charts below, the nature of the underlying assets held in a LIC or LIT structure has evolved.

Although the value of assets held [in LICs and LITs] as Australian shares remains constant at around $26 billion, other asset classes such as global equities and fixed income have contributed significantly to the growth of the overall sector. (Based on LICAT/ASX data).

At end-October 2020, the shift to these asset classes saw:

- Australian equities accounting for 61% of the LIC/LIT sector value, from 77% at December 2017;

- Global equities now 28%, up from 21%;

- Fixed income now 10%, up from 2% over the same period.

LIC and LIT split by asset class December17 to October20

Source: LICAT & ASX

This changing dynamic can now provide investors with access to the closed-end structure of LIC/LITs over a broader range of asset classes, assisting with their asset-allocation and diversification strategies while delivering on the many benefits these structures offer.

Another interesting development within the sector is the growth of LITs, which utilise a closed-end trust structure. The value of LITs is now around $10.5 billion, accounting for 22% of the $48 billion sector at end-October 2020, according to LICAT.

Like other trust structures such as ETFs and managed funds, LITs pass through income to investors untaxed. Because of their closed-end structure, unlike open-ended ETF or managed funds, LITs have a fixed capital base and are not forced to sell assets to meet withdrawal requests or to make income payments.

Investors in a LIT, on the other hand, wishing to sell or buy more do so at a price determined between them and other investors by trading on ASX.

Due to a secure capital base, LITs can hold regular income-producing assets such bonds or corporate loans, where income is received by the fund; coupon payments for bonds and interest on loans and passed through to investors without the need to sell bonds or call in loans.

Premiums and discounts – myths busted

Over recent times, the premium or discount at which an LIC/LIT trades to its intrinsic value has been a topic of much debate.

Although some commentators suggest the purchase or sale of a LIC/LIT at anything other than net asset backing is inappropriate, this view is flawed in many respects.

All listed shares of whatever kind, whether a LIC, LIT, bank, healthcare stock, industrial stock or property trust, trade at prices above and below a perceived intrinsic value all the time.

Indeed, it is the ability for those investors to buy and sell at prices that don’t exactly match intrinsic value that makes listed markets attractive – as it is this dynamic that creates the potential to earn a higher investment return.

This is the very nature of sharemarkets. The price determined by the market takes account of many factors investors consider relevant: differing views of intrinsic value, the value of franking credits, potential for outperformance and risks.

It may be argued that this market price determined by investors is a more fair, equitable and comprehensive representation of value than merely asset backing alone.

In addition to these considerations, the market price is also the mechanism that matches up the volume of buyers and sellers, in turn providing immediate liquidity for those wishing to sell.

What’s in store for 2021

There were 110 LICs and LITs listed on ASX at October 2020, according to the ASX Investment Products Monthly Update.

The longest-running LIC, Whitefield (ASX:WHF) will enter its 98th year of continuous trading in 2021. This bears testament to the ability of LICs and LITs to adapt and continue to provide benefits to investors.

There may well be a change in the number of LICs and LITs listed. There have been announcements regarding change in structure, possible merging of entities and acquisitions. These types of changes are not unique to LICs and LITs and are particularly evident in the wealth and investment industry at large and also in other listed companies at present.

What the LIC/LIT changes do show is that managers are seeking to accommodate the needs of investors.

Similarly, when there is investor demand for particular investment strategies that suit a closed-end fund structure, LIC/LITs issue capital to meet that demand.

Most recently, investors have sought to increase exposures in private equity, infrastructure and small-cap equities, and we have seen capital raisings by LIC/LITs in these asset classes to accommodate this.

Summary

In a period when income is hard to find, the relative stability of many LIC dividends has been viewed as an attractive trait by some investors.

The ability for a LIC to retain profits and smooth its dividend payments allows many LICs to absorb market volatility, while delivering consistency of income for their investors. For investors in the wealth-accumulation phase, steadily building exposure to a preferred asset class by regularly buying shares/units on market is one means of building an investment portfolio.

Careful buyers may also be able to use points where LIC/LITs are trading at attractive levels to asset backing as a means of enhancing their long-term returns. Closed-end fund, such as LICs and LITs, will continue to provide unique advantages to investors, the broader economy and the financial-markets system.

LICs and LITs have been assisting investors in growing their wealth for nearly 100 years. Today, over 700,000 Australians invest in the LIC/LIT sector, according to LICAT.

The efficiency and stability of their closed-end structure, coupled with the corporate governance disciplines of ASX listing, have proven far more durable than many other investment structures.

Related links

READ MORE

View featured articles from ASX publications On the Board and Listed@ASX.

About the author

Ian Irvine, Listed Investment Companies & Trusts Association

Ian Irvine is CEO, of the Listed Investment Companies & Trusts Association (LICAT). Ian has over 40 years’ experience in sales, marketing and business development and has worked in the financial services arena since 1986, including time at Westpac, AMP and 14 years at ASX to December 2017.

His role at ASX included developing and delivering educational sessions for investors, self-managed super fund trustees and financial advisers. He is well acquainted with the listed investment companies and trusts sector, having worked with many of its member entities over his time at ASX.

Ian has been CEO of the Listed Investment Companies and Trusts Association since January 2018. He holds a Bachelor of Commerce (UNSW) and has been a member and trustee of a self-managed super funds since 1996.

About LICAT

The Listed Investment Companies and Trusts Association (LICAT) represents the interests of Listed Investment Companies (LICs), Listed Investment Trusts (LITs) and investors holding over 700,000 interests in one or more LIC or LIT. LICAT represents the LICs and LITs accounting for approximately 75% of the current Australian capital invested in the sector.