What is the Futures roll?

In general, most activity in futures markets is confined to the ‘spot’ contract, that is, the contract which is going to expire first, known as the nearest expiry date. This is because market participants want to trade where the majority of the liquidity and open interest in the product is focused.

Whilst a participant may have traded into the spot contract, they may wish to maintain their exposure beyond the expiry date of the current contract. If this is the case, they will need to ‘roll’ their position to the next expiring contract.

How does this work in practice?

There are a couple of ways to transfer exposure from the spot to the next contract:

It is possible to execute the migration of the open interest (the outstanding futures position) from the spot contract to the next contract by unwinding the spot position in one transaction and simultaneously opening a new position in the next contract. Each of these transactions are known as ‘legs’. This method of execution exposes the participant to ‘legging risk’, meaning the adverse movement in market price or liquidity during the time that it takes to complete one, or both of the legs.

A more efficient and less risky option is to trade calendar spreads. Calendar spreads, also known as intra-commodity spreads, are the simultaneous sale and purchase of contracts with different expiry dates. For the purposes of the Bond Futures Roll, a sale would be transacted in the current December (spot) contract whilst simultaneously purchasing an offsetting contract delivering in March (the ‘next’ contract). Using the 3 Year Treasury Bond Futures (commodity code YT) as an example, the December 2023 (Z3) contract can be offset against the March 2024 (H4) contract. This is displayed as YTZ3H4 in trading platforms. In executing a calendar spread, the participant can trade at a net price (that is, the difference between the sale and purchase price) and avoids legging risk.

When does the Futures Roll take place?

The exercise of rolling exposure from the spot to the next contract can happen at any time whilst both the spot and next contracts are listed. In practice, most roll activity takes place 5 business days before expiry. The brevity of this period is influenced by the fact that the contracts are cash settled, as opposed to deliverable. In addition, for the Treasury Bond Roll there is a 5-day period during which the minimum price increment (the bid-offer tick, expressed in basis points) is narrowed to make the roll process more economic for the market (see example in the next section). The period when the ticks are narrowed is defined as the 8th day of the expiry month (Trade Date 9th) to the 15th of the expiry month, or next business day, if the 15th is not a business day. For more volatile contracts like SPI the tick does not change during the roll period.

Treasury Bond Futures Roll and the Outright market

As mentioned above, for 5 days prior to expiry of the Treasury Bond futures contracts, the minimum price increment (tick) is lowered. The 3 Year Treasury Bond tick size is adjusted from 1 basis point to 0.2 basis points during the roll period (as an example, the cost of crossing the spread during the roll is reduced from $29 to $5.80 as a result of the reduced tick) and the 10 Year is adjusted from 0.5 basis points to 0.1 basis point. It is notable that during this period trading in the outright market (trading of the regular spot and next contracts) decreases. ASX is aware that liquidity in the outright contracts is challenged during the roll period and is currently analysing the opportunity to maintain the outright contracts at their regular tick increments during the bond roll period.

Pace of Roll

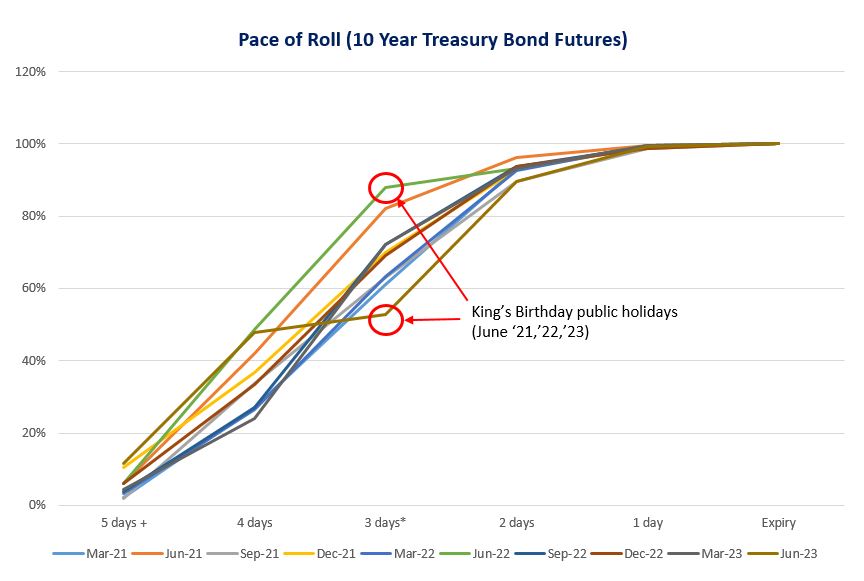

The bond futures roll follows a fairly regular pattern over the course of the roll period. Chart 1 shows the cumulative roll volume (known as the pace of the roll) for the YT contract over the last 2 years for each quarterly expiry. From 5 days prior to expiry, driven by the reduced tick sizes, these contracts see a high volume of activity. Volumes tend to peak 3 days before expiry, remain elevated 2 days before expiry before tailing off the day before expiry. By the expiry date, the level of calendar-spread trading is very low with the market preferring to make use of the elevated levels of liquidity during the previous days. Additionally, in order to mitigate position concentration risk and the market disruption that this may cause during expiry, the ASX imposes Expiry Position Limits on the number of derivatives market contracts which may held in the lead up to expiry of the contract.

Data Source: ASX

What influences the pace of the roll?

Several factors influence when traders decide to roll their positions. In Chart 1, we can see how the pace of the roll in June 2023 was impacted by the King’s Birthday public holiday (which is the second Monday in June). In 2023, the King’s Birthday fell on the 3rd day of the roll. The public holiday has the impact of shortening the number of highly liquid roll days from 3 down to 2. When the King’s Birthday public holiday falls closer to the expiry date (for example 13th or 14th June) participants will choose to execute their roll trades prior to the public holiday which can be observed in the chart as a steepening of the curve earlier in the roll period (see Jun-21 and Jun-22).

Economic data prints or major global economic news can also influence the pace of the roll with participants generally opting to execute prior to potential volatility events.

Determining the fair value of the Futures Roll

To understand the value of the Treasury Bond Futures roll we first need to understand the construct of a Treasury Bond Futures contract. A Treasury Bond Futures contract is underpinned by a basket of liquid Australian Government Securities (Treasury Bonds) with the Australian Office of Financial Management (AOFM) as the benchmark issuer. Liquidity of the underlying Treasury Bonds is important as this provides transparency of pricing into the futures contract as well as ensuring accurate pricing of the futures contract Expiry Settlement Price (see Contract Expiry below).

Bond Basket Construction

The 3, 5, 10 and 20 Year ASX Treasury Bond Futures baskets are determined and announced prior to the contract month being listed on ASX 24 for trading. There are always two tradable contracts listed (spot and next). Each basket is made up of a minimum of three Treasury Bond lines per basket. To determine the Treasury Bond lines that make up the basket, a number of criteria are considered including the:

- outstanding volume on issue for each bond; liquidity of the bond

- average maturity of each bond on issue; duration of the bond

- average maturity of the bond basket; duration of the basket.

Several options are presented using the above criteria to an external panel comprising active Australian Government Securities market makers and investors in Treasury Bonds. Each panel member will vote on their preferred option. In the event that a consensus cannot be reached, ASX as the Market Operator will make a final decision, incorporating feedback received from panel members, on the lines to be included in the bond basket.

Chart 2 shows the construct of the bond baskets for the March 2024 expiring futures contracts.

Data Source: AOFM

Contract Expiry

On expiry date (15th day of the settlement month or the following business day if the 15th is not a business day)* the ASX 3, 5, 10 and 20 year Treasury Bond Futures are cash settled against the average price of the basket of bonds for each contract. The expiry price is calculated using live executable bid and offer quotes for the Treasury Bonds in the underlying bonds on the expiry date.

The ASX Treasury Bond Futures Expiry Settlement Price has been declared by ASIC as one of five significant financial benchmarks in Australia.

The Value of the Bond Roll

The market determines the value of the roll (calendar spread price) based upon its expectation of the value of the spot contract’s underlying basket of bonds at expiry versus the current value of the next contract. Orders in the calendar spread are quoted as a net price of the two contracts in the trading platform (ASX24).

Various trading strategies can be deployed depending upon the relative value of the calendar spread to the futures contracts as well as the value of the underlying bonds and this will be explored further in an upcoming paper on Relative Value and Arbitrage.

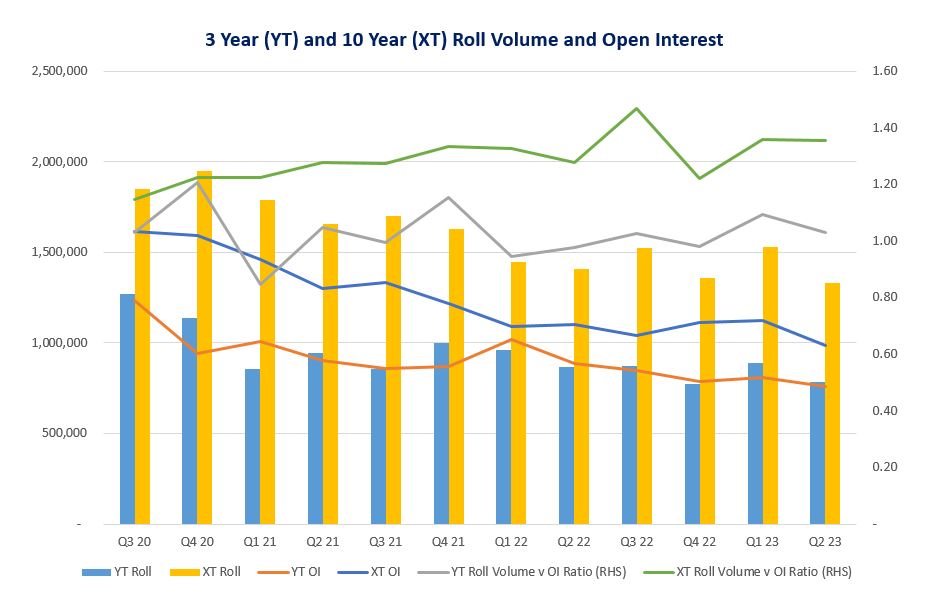

Roll Volume and Open Interest

Open interest in a futures product is the outstanding number of contracts at the end of a trading day. Open interest drives the volume in the futures roll; it provides an indication of the number of contracts that will need to be extended to the next contract. Chart 3 shows the relationship between the roll volume and open interest, along with the Roll volume and Open Interest ratio. The Roll volume versus Open Interest ratio divides the total Roll volume by the prior end of month Open Interest. This measure is an indicator of the amount of trading taking place in the Roll beyond those users who are transferring their positions from one expiry to the next. The Open Interest ratio of >1 indicates a roll volume higher than the amount of open interest.

Data Source: ASX

Conclusion

The quarterly futures roll is an important part of the futures contract lifecycle providing a pool of deep liquidity in which to execute the transfer of open interest to the next contract. It allows the market to mitigate legging risk in an efficient and economic manner.

More Insights

The next article in our series will focus on relative value and arbitrage. This will be followed by ‘exchange of futures for physicals (EFPs)’ and how to incorporate EFPs in trading strategies. To receive these insights via email, please subscribe to the ASX Rates Highlights quarterly newsletter.

Disclaimer

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2023.