- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Do I need multiple clearers? This is a key question for many buy side firms when commencing or expanding usage of centrally cleared OTC derivatives.

- Mon 11 October 2021

- 5 MIN READ

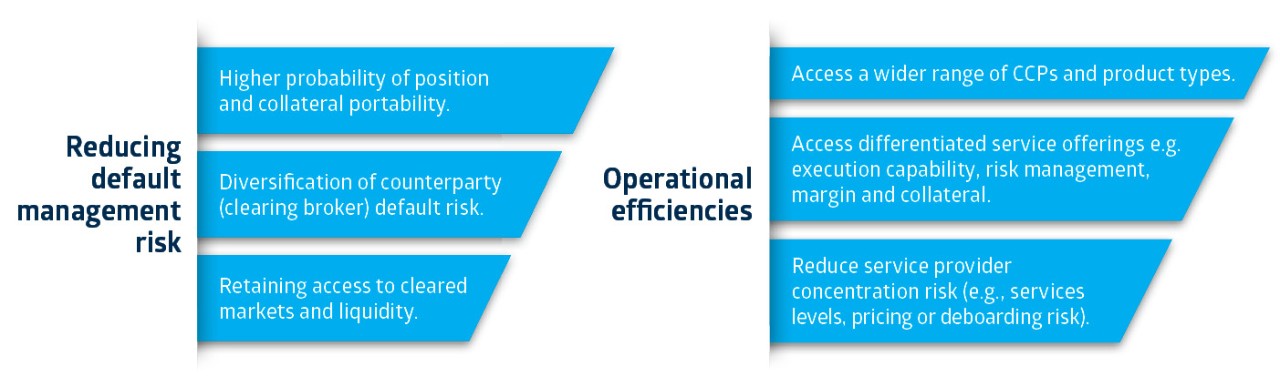

As buy side firms access central clearing services through clearing brokers, it’s important to consider the benefits of using multiple clearing brokers. Appointment of a clearing broker will determine access to various CCPs, cleared product types, client protection models, account structures, and ultimately the risks faced in the rare but very significant event of a clearing broker default.

Central clearing reduces the web of exposures that exist within bilateral markets and provides additional protection to market participants in the event of default. Some of the risk mitigation layers that provide protection include:

- multilateral netting,

- collection of margins,

- operational efficiency,

- transparency (regulators, rules and volumes), and

- default management resources and protocols.

Improving the probability that a CCP is able to successfully port (transfer) a firm’s positions and collateral - should the clearing broker go into default - is the most obvious reason to have more than one clearing broker. As a first step, a client requires the clearing broker to offer them an individual client account (with segregated positions and margin), to avail themselves of the potential to achieve portability under the CCP’s client protection model (if applicable). However, without an alternative clearing broker to accept positions and collateral, the CCP default management process will liquidate positions and collateral before returning remaining margins back to the clearing broker’s external administrator and its client. The risks of potential losses from this liquidation process, removal of access to market liquidity and cost of position resets are just some of the unattractive outcomes of a clearing broker default.

The benefits of accessing multiple clearing brokers

Multiple clearing broker implementation considerations

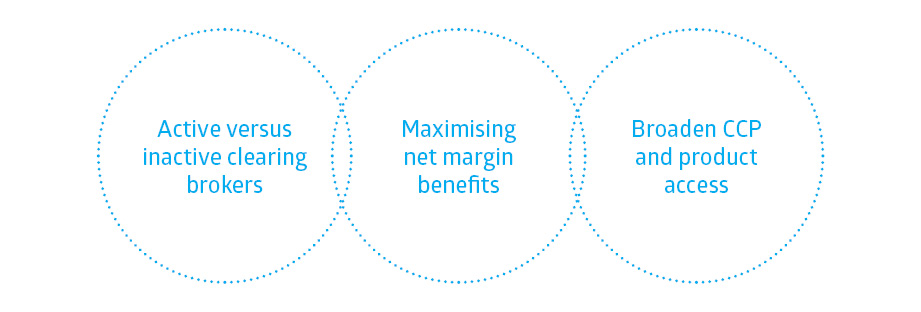

Active vs inactive clearing brokers

The use of an inactive or back-up clearing broker to protect against an active clearing broker default is generally seen as unrealistic in practice. Clearing brokers will expect to generate revenue for their services and any inactive service arrangement will incur an ongoing cost. It is equally unrealistic to activate a clearing broker relationship from scratch with any speed and certainty. This limits the confidence that an inactive clearing broker relationship or timely activation of a new clearing broker arrangement could provide support in the tight timeframes required under a default management process.

Ross Gulliford, Head of Investment Operations, Challenger Financial Services Group, comments:

“At Challenger, the use of multiple clearing brokers is important for risk mitigation and commercial flexibility. Should an issue occur with a single clearing broker, we maintain resilient access to market liquidity and put ourselves in the best possible position to achieve portability of our positions and collateral if required – both extremely important in volatile markets. Commercially we take advantage of the flexibility achieved through greater product coverage, wider CCP access and competitive service offerings that we obtain through our multiple clearing relationships.”

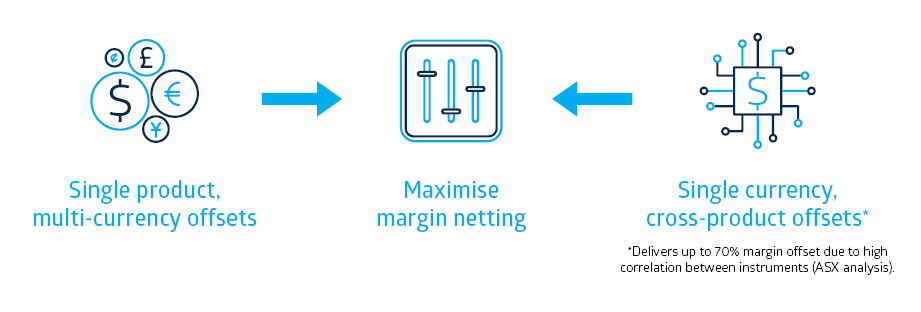

Maximising netting benefits

An obvious objective is to maximise net margin benefits to reduce the funding costs associated with meeting centrally cleared margins. Using multiple clearing brokers can make it difficult to determine how to best maximise the netting of margins. Understanding the firm’s cleared product universe, trading strategy, and optimal account structures will highlight where netting benefits are most significant. For example, the maximum netting benefit may be achieved through a CCP providing access to multi-currency netting benefits within a single product type, or alternatively a CCP providing cross product margining (such as cleared OTC interest rates with cleared exchange traded interest rates), or a combination of both. Clearing brokers also differentiate their offering through the provision of a range of margin netting and collateral services directly to customers if the CCP does not offer a particular service, for certain clients, this may become both an important clearing broker selection criteria; and also a driver for accessing multiple clearing brokers.

Once it is clear how net margin benefits can be optimised, it will be possible to identify how multiple clearing brokers can be accessed without significant impact to those benefits.

Broaden CCP and product access

It’s also important to consider that the development of services and products within the CCP space is always evolving. As outlined in the recent article on improving counterparty access and liquidity through OTC clearing, different asset classes and products shift with varying momentum between trading on a bilateral and cleared basis. Firms should remain aware that the offering across clearing brokers will vary across CCPs, products and regions. Diversification of clearing brokers can help to retain flexibility as the cleared market evolves.

Balancing the benefits and flexibility of multiple clearing brokers with cost

Cost is a consideration that may discourage the use of multiple clearing brokers. Clearing services are charged based on position size and transaction volume. There is often a scale attributed to these costs, or a floor cost to access clearing broker services. If position size and transaction volumes do not meet the floor service cost level, then using additional clearing brokers will increase costs. For these firms a decision to add multiple clearing brokers is generally based around whether the “insurance” cost is worth the risks and benefits it is designed to cover.

Making choices on key service relationships is never an easy process or decision to make. Some may feel that a single clearing broker appointment is their best (or only) option, at least initially. However, with a clear understanding of the benefits and specific needs, firms should be able to build a roadmap to multiple clearers.

For more information, contact:

Allan McGregor

allan.mcgregor@asx.com.au

www2.asx.com.au/OTC