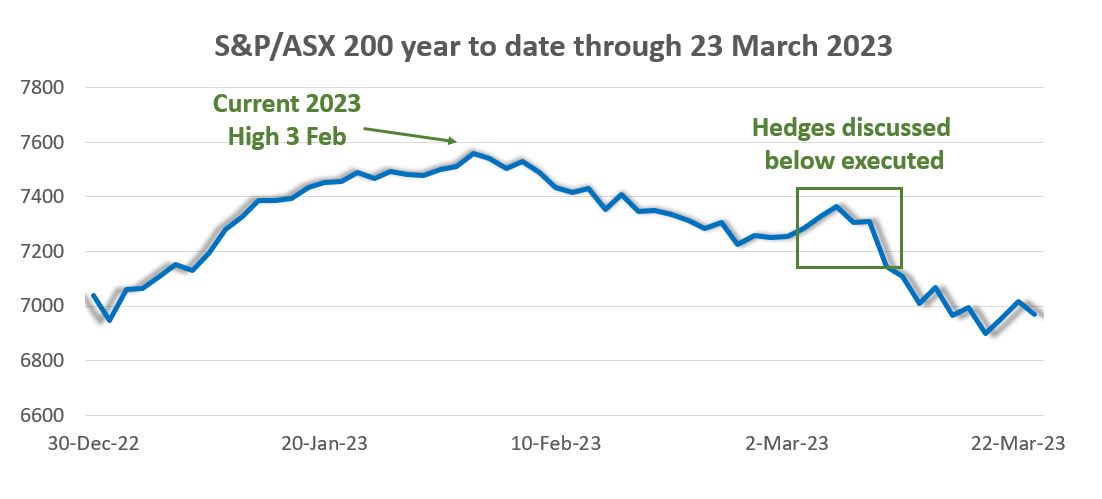

After moving higher by over 7% in the first few weeks of 2023, the S&P/ASX 200 index retreated in February and March returning to the same level it started the year. The strong trend from the first few weeks of 2023 lost some steam and started to turn lower in early February. As this downtrend continued to develop, we noticed a few large index put option purchases that cushioned the bearish moves in early March.

Data Source: Bloomberg

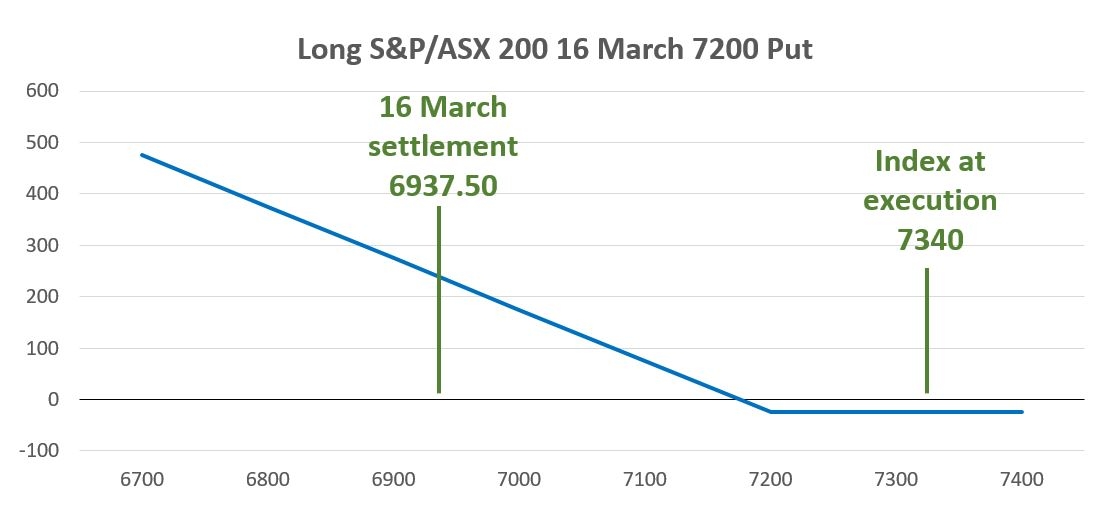

A well-timed trade occurred mid-day on Monday, 6 March with the S&P/ASX 200 around 7340. A trader entered the market buying 125 S&P/ASX 200 on 16 March with 7200 Puts for 25.00 each. The payoff on 16 March index option settlement shows up below.

Data Source: Bloomberg

At settlement these options were valued at 262.50, a nice return relative to the cost of 25.00. This combined with a portfolio tied to index performance could lock in some of the gains from 2023.

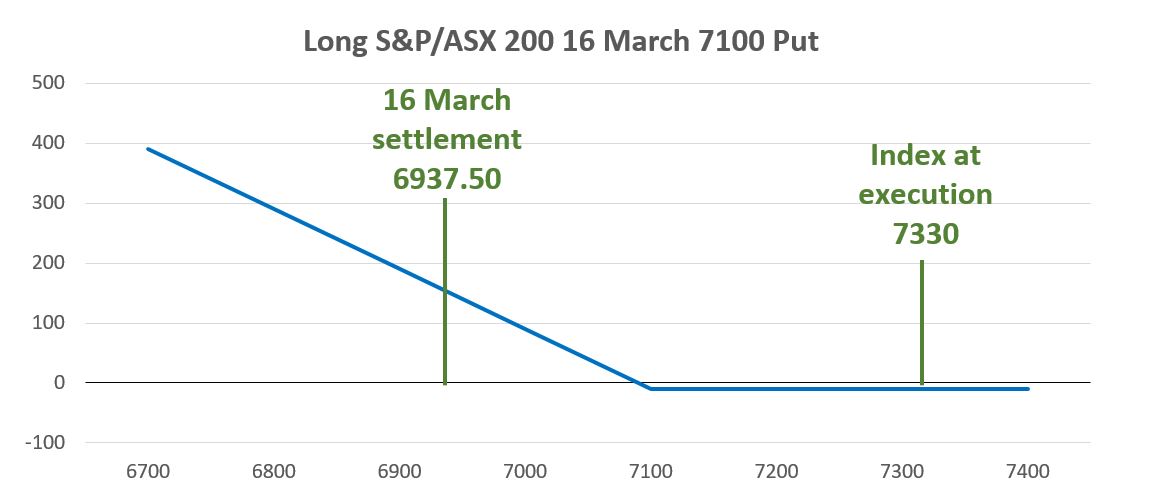

Possibly the best timed put purchase of size in March occurred on 7 March as the S&P/ASX 200 was around 7325. An institutional size trade buying over 1800 S&P/ASX 200, 16 March 7100 Puts for 8.925 a contract. The outcome, just a few days later, came at expiration with a settlement price of 6937.50 for the 16 March option contracts. The payout for this trade, held through settlement, sums to 162.50.

Data Source: Bloomberg

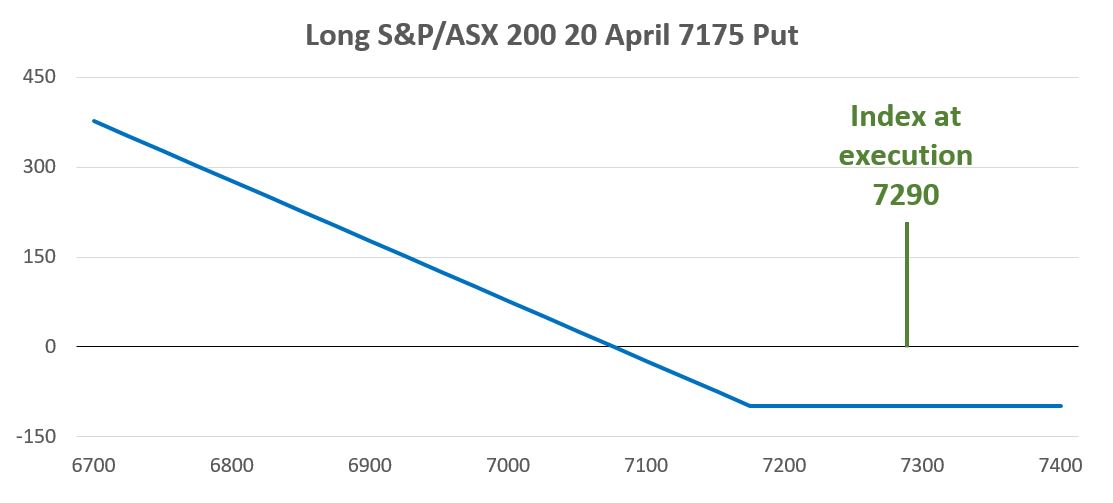

Some institutions are also looking for protection beyond March and there have been some hedging transactions using April options. On 3 March, with S&P/ASX 200 at 7290, there was a large trade in the S&P/ASX 200 April 7175 Put, with the firm paying 99.00 per contract. The payout at April expiration shows up below.

Data Source: Bloomberg

This blog is written before this option expires, but based on the 23 March, 2023 market close of 6955.20 this trade is doing well. Specifically, the unrealized profit sums to 122.80 based on the option closing price of 221.80.

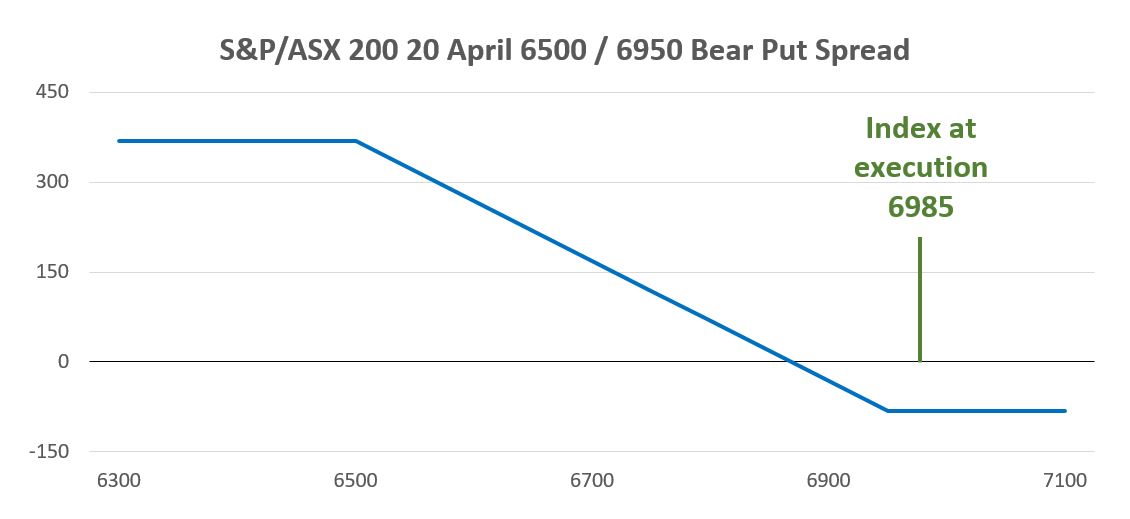

Finally, a trade using April options that is based on a farther drop in stock prices over the next few weeks. On 21 March, S&P/ASX 200 was at 6985 and a firm initiated a bear put spread which is a combination of owning a put with a higher strike price and selling a put with a lower strike price. The specific trade purchased the S&P/ASX 200, 20 April 6950 Put for 110 and sold the 20 April 6500 Put for 28. The net result is a cost of 82.00 per put spread and a payoff at expiration that appears below.

Data Source: Bloomberg

A bear put spread is a method of lowering the cost of protection through generating some income to offset the price of the long put option. Also, if a specific price level is expected to be close to the short strike at expiration. The best-case scenario for this put spread is April index settlement at 6500 or lower which results in a profit of 368.00, while at 6950 or higher the trade loss is equal to the 82.00 cost of the spread.

These are examples of a few trades from the past couple of weeks that appear to be offsetting a drawdown in the performance of portfolios tied to the S&P/ASX 200. The trades expiring on 16 March worked well, realising a big profit relative to the cost of those trades. The long April put discussed above has a solid unrealised profit, while the April put spread is set to benefit if the index drops to 6500 over the next few weeks.

For more information, contact

Receive the Equity Derivatives newsletter with monthly data and insights

Disclaimer

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and examples used detail the performance of historic trading strategies, and as such past performance is no guarantee of future performance. The content does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.