The Global Financial Crisis (GFC), between mid-2007 and early-2009, proved to be an exceptionally powerful macroeconomic headwind for stocks, resulting in a significant fall in sharemarkets. The past six months reflect the looming presence of a similar macroeconomic headwind.

The drivers of this macroeconomic environment should be no secret: tightening monetary policy and supply-chain issues. The choice of investment to weather this macroeconomic environment should also be no secret: quality companies with secular uptrends (in their industry) and strong balance sheets.

Since the GFC, interest rates have been consistently and anomalously low by historical standards. Meanwhile, loose monetary policy during COVID-19 has been pushing inflation higher since early 2021. US inflation has accelerated from around 2.6% in March of that year to 8.5% in March 2022*.

The US Fed’s subsequent moves to raise interest rates should be regarded as nothing other than expected (although the extent to which rates will increase remains unknown).

Additionally, supply-chain disruptions abound with China’s patchwork process of reopening after COVID-19 lockdowns causing major, global supply chain pain.

Geopolitically, Russia’s invasion of Ukraine and subsequent trade sanctions placed on Russia have put a premium on prices for raw materials such as oil, gas, grain and fertiliser as exports from Eastern Europe are cut off.

Russia’s war and the pandemic have created some speculative bubbles, in Loftus Peak’s opinion. This is shown in the meteoric rise and fall of “lockdown darlings” – companies whose stock prices soared and dropped with the imposition and lifting of COVID-19 restrictions.

Focus on quality

In today’s macroeconomic environment, company quality is key. Companies with strong balance sheets, good cashflows and current earnings are poised to best tolerate the high interest-rate environment.

Quality in tech companies also distinguishes today's market from that of 2000 during the dot-com bubble.

Capitalisation-weighted Price Earnings (P/E) ratios for US tech stocks in November 2021 were high, with prices cresting at 38 times greater than earnings, according to Loftus Peak analysis. But this does not go close to the cap-weighted P/E ratio of 94.2 in March 2000 for tech stocks.

Another great divide exists between November 2021’s price-to-cash flow (P/CF) ratio of 40.4 in tech stocks and the P/CF ratio of 113.1 during March 2000, Loftus Peak analysis shows.

[Editor’s note: price-to-cash-flow compares a company’s share price to its operating free cash flow per share, and is a common metric that analysts use to assess tech-company valuations. A low multiple can signal better value].

As monetary policy tightens and interest rates rise, economic growth will temper while the cost of capital for companies increases. This can be a lethal combination for smaller tech companies that have yet to establish their business models or a path to profitability, because plugging the funding gap with fresh debt and equity will become much more costly.

A similar story applies to supply-chain disruption. Quality companies will more easily pass on to consumers the cost increases caused by inflation and supply-chain disruption.

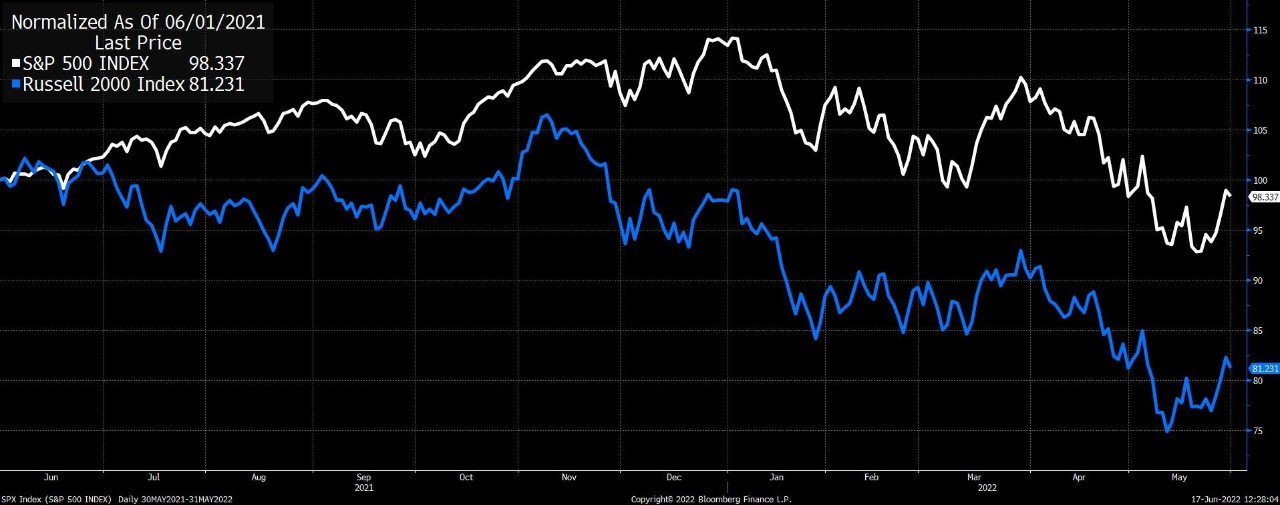

The chart below shows -17.8% underperformance of the Russell 2000 against the S&P500 over the past year. The Russell 2000 is an index of small to mid-cap US companies that generally exhibit much less financial strength than the larger companies that dominate the S&P500 in the US.

Source: Bloomberg

Where quality mitigates the effect of the inflation and supply-chain disruption, positive secular industry trends provide a path onwards and upwards.

During the GFC, a number of key disruptive trends were working their way through the economy. Smartphones were becoming ubiquitous, the fledgling e-commerce sector was growing strongly, online advertising was taking shape and TV, movie and music streaming began to benefit from faster download speeds.

In the end, the disruptive secular trends benefiting these companies outstripped the macroeconomic headwinds. This resulted in stock outperformance.

The chart below shows performance of Apple, Alphabet (owner of Google) and Amazon against the S&P500 Index from September 2007 to now.

Source: Bloomberg

The secular trend in technology today is towards increased computational power - that is to say, semiconductor devices, solid-state storage and networking products.

This need stems not only from growth in traditional end-markets like consumer electronics and enterprise information technology, but also from emerging end markets such as: cloud-enabled data centres, automobiles, 5G and edge computing [edge computing is a distributed computing architecture that bring computation and data storage closer to the data source].

In Loftus Peak’s view, semiconductor companies like Nvidia, AMD and the Taiwan Semiconductor Manufacturing Company, which form part of the Loftus Peak Global Disruption Fund (ASX: LPGD), are balance sheet and cash-flow strong, do not require additional financing and are buying back their stock. This view is of course subject to change over time and based on our own professional analysis.

Conclusion

The end result of tightening monetary policy and supply-chain issues remains uncertain. However, the promising outlook of quality global technology companies benefitting from secular trends remains a hard act to follow.

[Editor’s note: Do not read the ideas in this story as recommendations. Do further research of your own or talk to a licensed financial adviser before acting on themes in this article. It is important to understand the features, benefits and risks of investing in global technology companies. Growth stocks, such as some technology companies, can be volatile during periods of rising interest rates. Industry disruption can have uncertain outcomes because it is hard to determine how innovation will transform existing sectors or create new ones. Currency movements are another consideration with global investing.]

*(source: Bureau of Labour Statistics).

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People