Investing can be a great way to build wealth but can often be unpredictable due to factors that we cannot control.

When constructing a portfolio, you can incorporate several key investment principles that focus on a number of factors that are within your control to give yourself the best chance of long-term investment success.

Here are four issues to consider:

1. Create clear and appropriate investment goals

The first key investment principle when constructing a portfolio is to create clear and appropriate investment goals.

Investment goals can be broken down into return and risk objectives. The return objective involves determining how much your investments need to grow to meet your investment goals. The risk objective involves assessing your willingness to take on risk.

Your ability to take on risk can be influenced by a number of factors such as your time horizon, your current financial situation and the size of expenses relative to your portfolio.

When coming up with your investment goals, it is often helpful to incorporate this into an investment plan, such as the example below.

| Example of a basic investment plan | |

| Investment objective |

|

| Constraints |

|

| Contributions |

|

| Asset allocation target |

|

| Rebalancing frequency |

|

| Monitoring and evaluation |

|

Source: ASX

2. Create an asset allocation that is consistent with your investment goals

The second key investment principle is to create an asset allocation that reflects your investment goals and risk tolerance.

Asset allocation refers to a process of dividing your investments across different asset classes, such as equities, property, fixed interest securities and cash, in a way that reflects your investment goals and risk tolerance.

Each asset class will have its own risk and return profile and it is important to understand this relationship when constructing your asset allocation.

Source: ASX

The right asset allocation will depend on your individual investment goals and risk tolerance.

Below are three broad asset allocations that may suit the needs of a range of investors along the risk spectrum from conservative to growth.

Source: ASX

| Investor Profile | Conservative | Balanced | Growth |

| Time horizon | Short | Medium | Long |

| Risk tolerance | Low | Medium | High |

| Investment goal | Capital protection | Balance between capital protection and growth | Capital growth |

Source: ASX

Asset allocation is not a set-and-forget strategy. You should regularly rebalance your portfolio, because the performance of assets will change over time which will cause you to move away from your target asset allocation.

Rebalancing a portfolio involves selling a proportion of your assets that have risen in value and using those proceeds to buy assets that have fallen in value.

Source: ASX

In the above diagram, the investor has determined that their target asset allocation comprises an even split between stocks and bonds.

Over time, the stock market has performed better than the bond market and the investor’s asset allocation now comprises a significantly higher allocation to stocks than bonds. As consequence, the investor’s portfolio now contains a higher level of risk than their target asset allocation.

To rebalance their portfolio, this investor would sell a proportion of their shares and use those proceeds to buy more bonds until they have a portfolio that comprises an even split between stocks and bonds.

By regularly rebalancing your portfolio, this ensures your asset allocation continually reflects your investment goals and risk tolerance.

3. Minimise cost

It is important to minimise costs where you can because even small differences in terms of fees can have a substantial impact on the returns on your investments, in particular over the long-time horizon.

In the below example, you can see that the total annual cost of 2% on a $100,000 investment rather than 1%, assuming this investment grows by 5% per annum, would reduce your final return by more than $80,000 over a 30-year period.

Source: Managed funds fee calculator - Moneysmart.gov.au

4. Maintain perspective and long-term discipline

Having investment perspective and discipline will provide you with the time for your investment to grow through a powerful investing concept called compounding.

Compounding is an investing concept that involves earning returns on both your original investment and on the return you previously received.

The impact of compounding can be illustrated by using basic maths. Assume you have $10,000 and it grows 5% in the first year. At the end of the first year, this investment will grow to $10,500. Assume in the second year, this same investment grows 5%. At end of the second year, this investment will grow to $11,525.

Instead of your investment growing by $500 like it did in the first year, your investment has grown $525 because you are earning a return on the $10,500 that you had at the end of the first year and not on the original investment. That is essentially what compounding is.

If you extrapolate this same example over a 30-year period, your $10,000 investment will have grown exponentially to more than $43,000.

Source: Compound Interest Calculator - Moneysmart.gov.au

Disclaimer: note the graph provided is not a prediction and does not represent any particular investment. The can examples are not intended to be your sole source of information when making financial decisions and you should consider getting advice from a licensed financial advicer if you need advice.

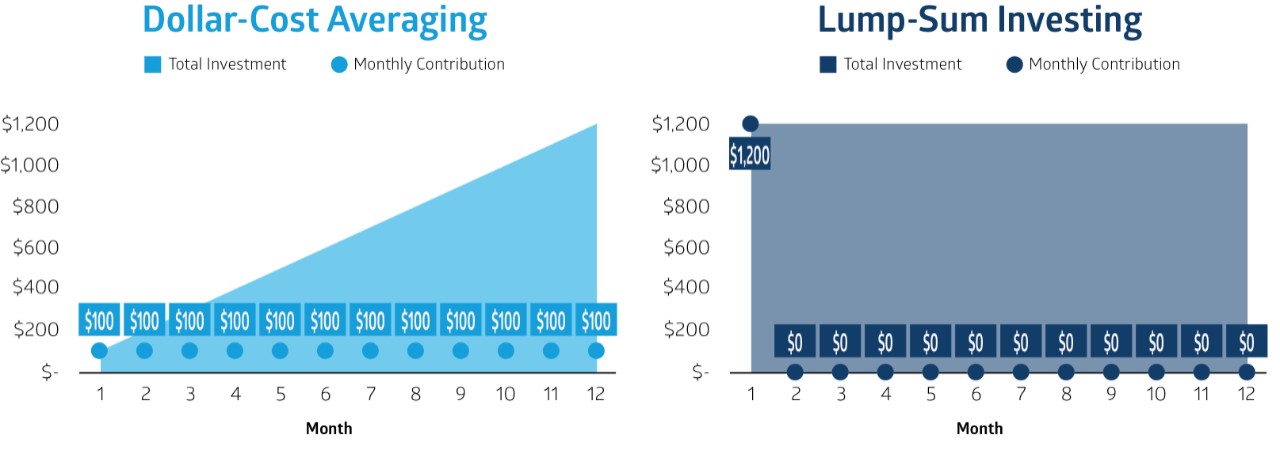

When maintaining perspective and long-term discipline, you could consider taking a “dollar-cost average” approach as opposed to a lump-sum approach.

A dollar-cost average approach refers to the process of making small regular contributions regardless of the share price whereas a lump-sum approach refers to investing all at once in an investment. The diagram below compares dollar-cost averaging to investing a lump sum.

Source: eToro

A dollar cost-average approach can help remove emotion from investing because you are buying shares on a regular basis regardless of market conditions. This will smooth out the purchase price because there will be times where you are buying the shares at a more expensive price but also other times where you will buying the shares at a cheaper price.

Making small regular contributions can also be a great way for you to reach your investment goals because the impacts of compounding are even more profound. This is because you are earning an annual compound return on both your original investment as well as all the contributions that you make over the entire period.

Using the same example that we provided above, let us now assume this investor now makes regular $100 contributions a month for the entire period.

You can see from the below graph that this $10,000 investment has now grown to over $122,000, which is more than three times higher than the investor’s portfolio that did not make any regular contributions.

Source: Compound Interest Calculator - Moneysmart.gov.au

Disclaimer: note the graph provided is not a prediction and does not represent any particular investment. The can examples are not intended to be your sole source of information when making financial decisions and you should consider getting advice from a licensed financial advicer if you need advice.

More Investor Update articles

Don’t miss the latest insights from ASX Investor Update on LinkedIn

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way due to or in connection with the publication of this article, including by way of negligence.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People