- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

ASX in New Zealand: 2020, the year the tyranny of distance became our “liberty of distance”

- Wed 10 February 2021

Resilience

Throughout history, New Zealand has led the world with innovation and resourcefulness carved out of the challenges and opportunity presented to us here in our little land of plenty located in our distant corner of the world. More often than not, New Zealand has shined on the world stage, conquering the tyranny of distance and combining kiwi ingenuity with a little help from some offshore funding.

The New Zealand invention of refrigerated shipping in the late nineteenth century – funded by Scottish company Australian and New Zealand Land Co. – paved the way for the export of frozen meat and dairy products from New Zealand that became the cornerstone of New Zealand’s modern economy.

Much later, Sir Edmund Hillary, an apiarist, whose mountaineering skills were forged on the slopes of New Zealand’s rugged, untamed and unexplored Southern Alps famously applied his know-how to climb Mount Everest in 1953 in an expedition organised and financed by the Joint Himalayan Committee. The quintessential kiwi bloke, he described himself in typical understated kiwi fashion as a “reasonably good climber” and that he and Tensing Norgay did a “pretty good job” when conquering the world’s tallest peak.

Sir Edmond Hillary’s comments spring to mind when reflecting on Aroa Biosurgery founder and CEO Brian Ward who – when speaking to a packed room of trans-Tasman attendees of the BioShares Summit in Queenstown in 2019 – introduced himself as the founder of a company that “upgrades sheep stomachs”.

Aroa Biosurgery is of course much more than that – it is a soft-tissue regeneration company that develops, manufactures, sells and distributes medical and surgical products to improve healing in complex wounds and soft tissue reconstruction. Aroa is now a circa $350 million market cap company that listed on ASX on 24 July 2020; its share-price almost doubling on debut.

What also makes the Aroa Biosurgery listing interesting is that it was the first IPO on ASX from New Zealand to have taken place whilst international borders were closed. Similar to Sir Peter Jackson bringing Hollywood and US capital to New Zealand, Aroa Biosurgery was able to attract global investors to invest in its New Zealand-based business to support the export of its product globally – but this time it was carried out almost entirely virtually – through virtual roadshows, conferences and meetings.

When speaking with Brian about this process, he described how it was much more efficient to no longer have to fly to Australia or the US to meet in person, which would take him and key members of his staff out of the company for extended periods of time.

The tyranny of distance had prepared us well – we were already adept at running global businesses from afar – but as the world locked down, our geographical remoteness became somewhat moot and the rest of the world began operating almost as remotely as those of us in New Zealand.

It is, after all, what we do and what we do exceptionally well when we get it right. New Zealanders have been able to build incredibly successful global businesses and brands from New Zealand, using our “number eight wire” creative mindset whilst leveraging global pools of capital – Xero, Fisher & Paykel Healthcare, Kathmandu, and Bloomberg’s top global stock of the decade A2 Milk to name just a few.

The New Zealand All-Blacks, helped with the sponsorship from Adidas and AIG, have created a globally recognised brand that remains quintessentially New Zealand in its origin and all that it stands for. Perhaps nothing better symbolizes New Zealand internationally than the All-Black haka which is not diluted in any way by their sponsor’s three letter acronym adorning the All-Black’s chests.

As I write, Emirates Team New Zealand are warming up in Auckland’s Hauraki Gulf preparing to defend the Americas Cup later this year. Team New Zealand has taken New Zealand sailing technology know-how and the New Zealand sailing technology industry to the world and, albeit virtually this year, brought the world back to New Zealand to witness a summer sailing spectacle right here in Auckland.

2020

Consistent with that theme, the first New Zealand company to list on ASX in 2020 was Happy Valley Nutrition. Happy Valley Nutrition listed on 23 January 2020 raising capital to develop a milk processing, blending, and packaging facility in Ōtorohanga to produce infant milk formula and other nutritional products for global export markets.

There was a pause on 25 March 2020 when New Zealand moved into nationwide lockdown where we remained until 27 April 2020. Restrictions were gradually relaxed and then on 8 June 2020, all restrictions except international border controls were removed.

Leading the charge after New Zealand emerged from lockdown, Aroa Biosurgery completed their listing on 24 July 2020 and were followed by buy-now pay-later platform Laybuy which listed on the ASX on 7 September 2020.

Founded just four years prior out of Auckland’s beautiful North Shore, but focused on markets in UK and Europe, Laybuy has grown in to a $200 million technology company in that time. In December 2020, Laybuy entered the S&P ASX All Technology index joining fellow kiwi companies Xero, Pushpay and Volpara.

New Zealand Oil & Gas rounded out an active month completing their ASX listing on 25 September 2020, citing the ASX as a market where interest in upstream oil and gas is stronger and one which “tends to value exploration and production realistically”.

New Zealand peer-to-peer lending platform, Harmoney, listed on ASX on 19 November 2020 (with a secondary listing on NZX) to accelerate their trans-Tasman growth. Harmoney’s listing was co-led by now trans-Tasman New Zealand Investment Bank, Jarden. Jarden had recently expanded into Australia which also followed a rebranding that paid homage to their founder, All-Black Ron Jarden, reinforcing their kiwi roots and identity.

It is of no surprise that technology company listings from New Zealand are trending upwards. By their very nature, as easily globally distributable non-physical platforms or services, they can be developed here in New Zealand – sometimes in quite remote parts of the country – but can still attract global demand, are therefore subject to high growth and require access to capital.

The ASX, just across the Tasman with similar rules and regulations to New Zealand, a highly correlated currency to our own, a global investor base, and a vibrant, growing technology sector of over 250 technology companies, provides that access to capital and has become the natural home for technology companies in this region.

Joining Laybuy were New Zealand technology companies EROAD and Plexure which listed on ASX on 18 September 2020 and 27 November 2020, respectively. Plexure was the seventh New Zealand company to list on the ASX during 2020.

2021 is here

It is hard to predict just what 2021 will bring, but one thing is for certain – New Zealand companies with global aspirations will continue to emerge, and in most cases prosper, leveraging global pools of capital to do so.

In fact, we have already had our first ASX listing in 2021, and proudly, it has come from New Zealand. Cervical cancer screening company Truscreen listed on 6 January 2021 trading up strongly on debut and bringing the total community of New Zealand companies listed on the ASX to 62.

I look forward to watching our ASX-listed New Zealand companies leverage their listing to expand, grow, and succeed internationally. I also look forward to welcoming many more New Zealand companies to the ASX this year to support their own growth plans through access to global pools of capital.

I say to them kia kaha, kia māia, kia manawanui! (be strong, be steadfast, be willing!) and, in the words of the late Sir Edmond Hillary, “Life’s a bit like mountaineering – never look down”.

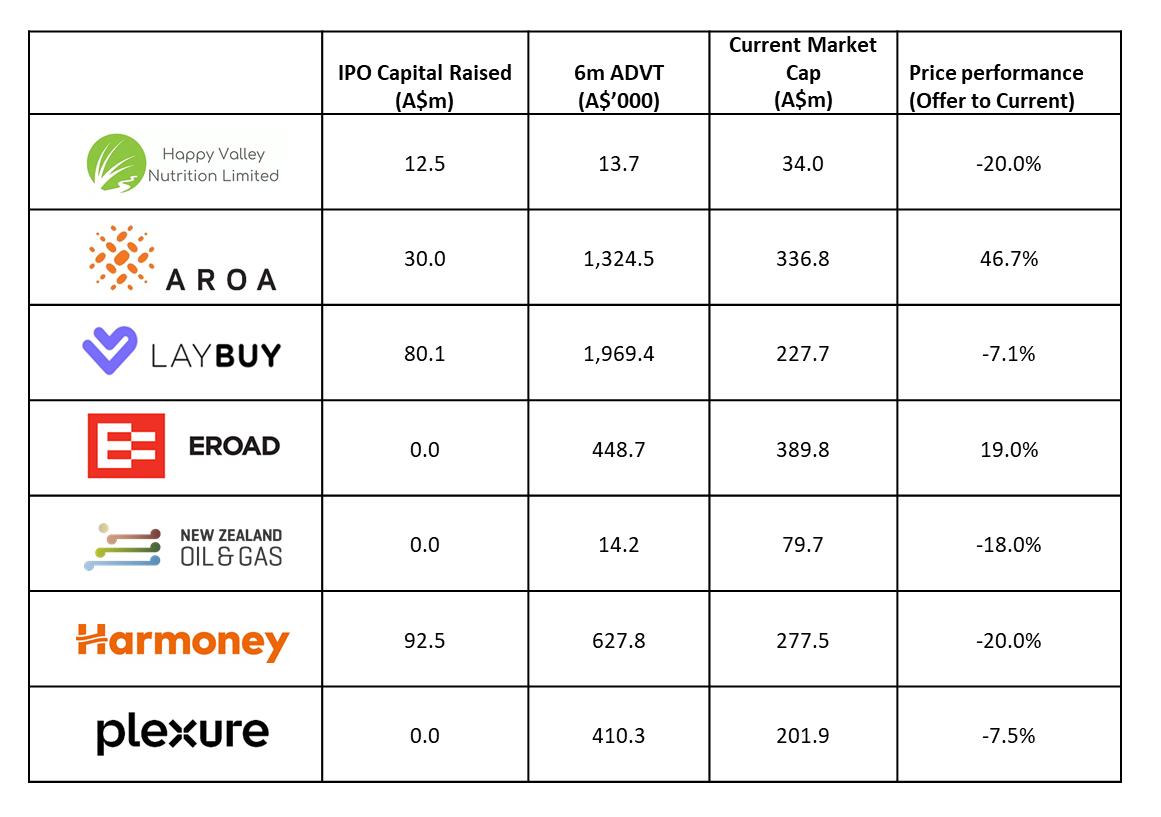

2020 ASX NZ Listings

Current figures as of 6 Januaty 2021; All figures in AUD. NCR: No Capital Raised; ADVT: Average Daily Value Traded.

Source: Bloomberg ASX Internal.

About the author

Blair Harrison, ASX

Blair Harrison is a Senior Manager within the Listings & Issuer Services team at ASX based in Auckland, New Zealand at the Australian Securities Exchange (ASX) and heads the ASX New Zealand office, based in Auckland. He has over 20 years’ experience in financial markets internationally across New Zealand, UK, Japan and Sydney.

Blair joined ASX in 2013 and was in the in the Derivatives and OTC Markets team before relocating home to New Zealand in June 2019 to open the ASX, New Zealand office in Auckland.