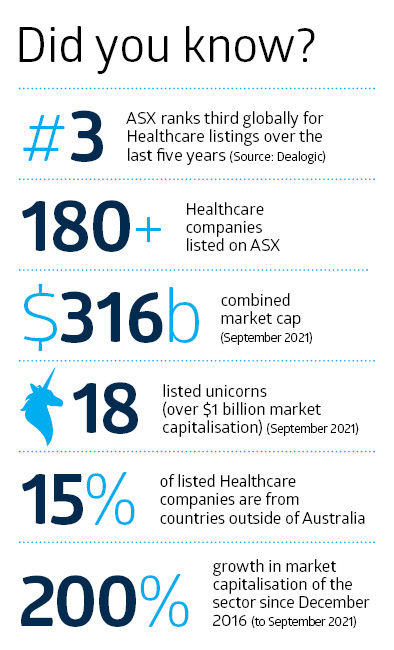

The healthcare sector plays an important role in the Australian equity market, and makes up approximately 10 per cent, by both number of companies and market capitalisation, of the listed company population. The development of the sector is exemplified by the established position of CSL within the top three companies on the board, breaking up the historical dominance of the miners and banks in the top five.

In the 2020/21 financial year, there were 15 new listings in the healthcare sector on the ASX, the highest number since FY2017. The largest listing was Australian Clinical Labs (ASX: ACL), a private hospital pathology business that raised more than $400 million. As the largest healthcare capital raising on the ASX in more than six years, the Australian Clinical Labs initial public offering (IPO) reinforced the strong investor interest in ASX-listed life sciences and healthcare companies.

The new financial year has begun with similarly strong momentum for the sector, with four listings in the first quarter, including ASX’s largest-ever biotech IPO by capital raise. Clarity Pharmaceuticals Limited (ASX: CU6), a clinical-stage radiopharmaceutical company, raised $92 million and listed with a market capitalisation of more than $360 million at the end of August. The use of these funds will be to advance and finance the clinical trials of the company’s three lead products in Australia and the United States.

Despite international border closures, the ASX has continued to attract overseas companies looking to capitalise on the investor appetite, attractive valuations, and deep superannuation pool available for growth companies (Australia boasts the world’s fifth-largest pool of pension fund assets). The healthcare sector has been no different, with significant listings from New Zealand, the United Kingdom, and the United States in FY2021, including Aroa Biosurgery (ASX: ARX) (New Zealand), Doctor Care Anywhere (ASX: DOC) (United Kingdom) and Lumos Diagnostics (ASX: LDX) (United States). These international companies help to attract global attention to the ASX market, strengthen the listed peer groups and broaden investor understanding for local businesses developing in similar verticals.

Aroa Biosurgery, an Auckland-based soft tissue regeneration company, was one of the first listings after the IPO window reopened following extreme levels of market volatility caused by the COVID-19 outbreak. The company raised $45 million and listed with a market capitalisation of $225 million. Brian Ward, Founder and CEO of Aroa Biosurgery, recently spoke to the ASX’s On the Board series and described the company’s reasoning for listing in Australia as twofold:

‘We were pleased by the strong interest from Australian institutional investors towards healthcare companies,’ and ‘getting quality research coverage from biotechnology analysts was an important factor in Aroa’s decision to list on the ASX.’ Aroa Biosurgery also returned to market in July this year, raising an additional $47 million to underpin growth efforts in the United States, and broaden and accelerate its research and development (R&D) pipeline.

Power to raise capital

This ability to quickly raise capital is a significant advantage of being a listed entity, and became a key factor at the start of the COVID-19 pandemic – when markets crashed and volatility was high. ASX-listed companies were able to quickly and efficiently raise additional capital. In 2020, the ASX ranked first across global exchanges by number of secondary offerings, and ASX-listed healthcare companies raised $4.6 billion in total in this period, according to Dealogic. This capital was used to strengthen balance sheets; to take advantage of growth opportunities through mergers and acquisitions (M&A); and to accelerate R&D, regulatory and commercialisation activities.

Another New Zealand–based ASX-listing, Volpara Health Technologies (ASX: VHT), raised $28 million through an institutional placement and an additional $9 million through a share purchase plan in April 2020 to pursue M&A opportunities and strengthen its balance sheet. According to Volpara Founder and CEO Ralph Highnam, ‘Having access to capital via the ASX at the levels we’ve managed to access it is simply staggering for a New Zealand company. I’m very grateful we’re here [in New Zealand] and I’m very grateful we listed on the ASX.’

Launching the S&P/ASX All Technology Index

There are more than 180 healthcare companies listed on the ASX, of which more than a quarter are part of the S&P/ASX 300 Index. The latest addition is Telix Pharmaceuticals (ASX: TLX), which was added as part of the March 2021 rebalance. Index inclusion is an important part of life as a listed company, as it cements institutional investment from both passive and active investment management and fuels liquidity.

Passive investment is driven by index-tracking funds, and the attention of active investors stems from becoming part of their investable universe. Active managers will take high-conviction positions in companies they find attractive through overweight bets relative to the benchmark. Index inclusion also provides scope for international institutional investment, with 45 per cent of the institutional investment in the S&P/ASX 300 Index coming from overseas investors, the largest cohort of which is the United States (25 per cent).

The ASX launched the S&P/ASX All Technology Index in February 2020. The primary aim of this index was to reach beyond the GICS Information Technology sector and include other innovative technology-related industries, such as healthcare technology. Five healthcare technology companies currently form part of the index (as of the June 2021 rebalance), these are Pro Medicus (ASX: PME), Alcidion (ASX: ALC), 4D Medical (ASX: 4DX), Volpara (ASX: VHT) and Mach7 (ASX: M7T). BetaShares launched an exchange traded fund to track this index, which currently has a market capitalisation of more than $200 million.

The cumulative value of healthcare companies on the ASX has grown by 200 per cent since December 2016. Momentum is strong, and the population of both pre-IPO and listed equity investors deepens, as does the pool of investible assets. Australia is in an enviable position as the fifth-largest superannuation pool globally, and with an active retail and institutional investor base with a level of risk tolerance that is well-suited to investing in growth companies. For a company at the right point in its life cycle, the public markets can help to support the journey through regulatory approval, commercialisation and further growth.

Learn from your peers – tips for a successful IPO

Brian Ward, Founder and CEO, Aroa Biosurgery

- We’ve taken a lot of uncertainty out of the business, and we have a good, strong portfolio of commercial products that we’re selling.

- Bring in good advisers: we had very good advisers, and we appointed a new director who had considerable experience in listing companies.

- Take some time to work your way through the process of becoming public. I was surprised by the length of those time frames, such as getting your financials in order, writing the prospectus, et cetera. It is a journey. There’s quite a lot of detail that needs to be sorted out.

- There’s a strong peer group of life sciences companies on the ASX. So, we felt that not only would we have that peer group, but there are also analysts that follow that peer group, and that is important in the aftermarket.

John Kelly, Founder and CEO, Atomo Diagnostics

- During certain periods throughout the process, the requirements of the executive team are overwhelming.

- You need people attached to the IPO and other people focused on running the day-to-day business, because you can’t do both – it just isn’t feasible, and one of them will suffer.

- Due diligence committee meetings [were] very good for project management. If they’re run well, it really helps to drive the time line.

- Make sure the fundamentals of the business are set up in advance of running the listing – all of the accounts, the corporate structure, tidying up any outstanding options… all of those types of things can become very problematic in the end. I am really glad that we took the first two or three months sorting that out before we really started implementing the process.

- We got in specialist support via company secretarial and finance experts to help with prospectus drafting so that our internal finance team was not overwhelmed. Some things related to IPOs are quite specialist, so having that expertise available really helped to troubleshoot some of the areas that companies could potentially get into trouble or experience delays with.

Where to now?

For more information contact ASX Listings Business Development