- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Top 5 remuneration planning considerations for pre-IPO companies

- Wed 10 February 2021

The initial public offering (IPO) of a company’s shares on the Australian Securities Exchange (ASX) is a momentous occasion for its founders, employees and shareholders. An IPO generates a transparent market value for the company’s shares and creates a reference point for any future issuances of equity securities to employees and investors. It also brings obligations for the company to structure its executive remuneration arrangements to comply with Australian legal and regulatory provisions, the ASX Listing Rules, address ASX Corporate Governance Council’s Principles and Recommendations (among other governance guidelines for best practice); including disclosure requirements subjecting it to shareholder and proxy advisor scrutiny.

In this article, we start with framing the differences in approach to remuneration between the private and listed spaces and then examine specific factors a company will want to consider in preparation for an IPO event.

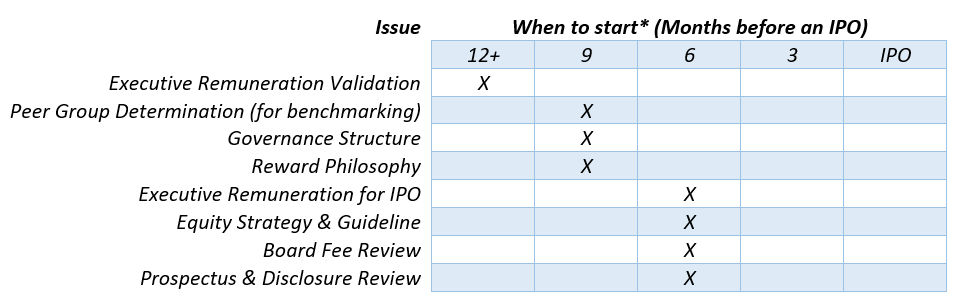

This article primarily focuses on considerations for growth-stage companies, though many factors are applicable for mature businesses exiting private equity ownership as well. In any case, all companies looking to list should not underestimate the time involved in reviewing their remuneration framework and governance structures and start this process at least 12 months prior to a planned IPO event to ensure a seamless transition and avoid knee-jerk reactions.

IPO Remuneration Checklist

Moving towards a more structured approach: transitioning equity grants from a % of ownership basis to target $.

STIs, LTIs, hybrid schemes, malus provisions, balanced scorecards, performance hurdles, cliff vs pro-rata vesting…trying to understand the complexity of remuneration structures at listed companies is not for the faint of heart. It is miles away from the simple approach to remuneration at many start-ups: a modest cash salary coupled with a grant of equity (frequently options), typically benchmarked as an ownership percentage in the business. The latter approach is frequently born out of necessity: many start-ups need to conserve cash, and the granting of equity gives employees a strong incentive to grow the value of the company. Importantly, the lack of a public valuation of the company’s equity means that there is substantial uncertainty in the value of equity grants to employees (secondary private markets that deal in employee shares notwithstanding). This uncertainty pushes up the percentage of equity required to be granted to employees as compensation for the risk they take relative to working for a listed company.

Once a company lists, the value of equity grants is quantifiable, allowing the company to approach equity grants (and remuneration packages more generally) in terms of target value, rather than on an ownership percentage basis. This distinction is particularly important given the potential diversification of the company’s share register post-IPO, with the company likely gaining shareholders (investors) who do not wish their ownership percentages to be unduly diluted by generous equity grants to employees.

However, the prevalence of target values, combined with the remuneration disclosure requirements for ASX-listed companies, result in significantly more scrutiny by shareholders who want to ensure that their capital is being wisely spent. Listed companies typically respond to this scrutiny by adding remuneration features to placate investors, which frequently results in additional complexity in plan design.

Specific considerations for pre-IPO companies

1. Governance

Perhaps the most important consideration for pre-IPO companies is the establishment of formal governance structures and processes for reviewing remuneration matters, regulatory requirements and investor sentiment. Companies will want to formalise the structure of the remuneration committee on the board (preferably composed of a majority of independent directors and an independent chair) and retain external advisors to assist with plan design and execution. In the absence of formal governance structures, remuneration matters are subject to ad hoc negotiations which will likely lead to pay inequities (see below) and undermine investor and proxy advisor support.

2.- Executive Remuneration Validation (pay mix and benchmarking)

Many growth-stage companies will likely find following comparative benchmarking against listed peers, their executives’ cash salary and cash bonus /short-term incentives are below the market average. Consistent with this, the typical pay mix for executives at pre-IPO growth-stage companies is skewed in favour of equity over cash. This dynamic will put upward pressure on cash-based remuneration following the IPO, especially as listed companies become more disciplined in their equity usage. Companies seeking to list will want to review their pay mix prior to listing and develop a plan prior to manage any rebalancing in pay mix.

3.- Pay inequities

Remuneration packages for executives at most pre-IPO companies are generally private and not disclosed publicly. By contrast, the Australian Corporations Act 2001 requires listed companies to disclose the remuneration details of the key management personnel (“KMP”) of the company. This public disclosure may expose any internal pay inequities among the KMP.

Companies nearing an IPO will want to review internal relativities and address any material inequities prior. Failure to do so may result in more costly and visible adjustments, or retention issues.

4.- IPO awards

There are multiple reasons to consider making equity grants to KMP in advance of an IPO. These include:

- addressing any pay inequities (see above);

- ensuring retention, in which case vesting should occur well after the IPO (e.g. three years); and;

- incentivising achievement of the pro forma forecasts as shareholders in listed companies are generally not enthusiastic about equity grants that are made solely to reward executives for a “successful” IPO, as liquidity and clear market value to equity should be incentive enough.

5.- Post-IPO LTI plan design

Companies should prepare to introduce equity plans that are fit for purpose in the listed environment and undertake a review of its intended “burn rate” (dilution) to ensure it meets the regulatory requirements (i.e. ASIC Class Order 14/1000).

Companies should look to retain specialist advice to help them design plans that are consistent with the strategic drivers of their business to ensure they meet shareholder expectations and support from proxy advisors.

In this article, we have reviewed just a few of the factors companies may want to consider in preparation for the transition of its remuneration framework and governance structures for a successful IPO event. And in closing, again, highlight not underestimating the time involved.

About the author

Kirsten Ross CFA, Aon Advisory Australia

Kirsten leads the Corporate Governance and Private Markets (Pre-IPO) practices in Australia. She is an experienced Human Capital consultant with global expertise in reward best practice gained from roles held in Human Capital, Finance, Corporate Governance, Audit, Risk and Compliance, in both a corporate and advisory capacity over the past twenty years. Kirsten helps clients in high-growth industries navigate executive remuneration matters and governance issues that arise during the transition from IPO to public company.

Prior to joining Aon, Kirsten held roles with Hastings Funds Management, Westpac and Egan Associates. Kirsten is a CFA charter holder, member of the Institute of Chartered Accountants Australia and New Zealand and holds a Bachelor of Business (Accounting, Economics and Chinese) from the University of Technology, Sydney.