- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Improving counterparty access and liquidity through OTC Clearing

- Wed 18 August 2021

Counterparty access and market liquidity go hand in hand when trading OTC derivatives. With trading continuing to shift from a non-cleared to cleared basis, access to central clearing will play an important role in ensuring firms can improve or even retain desired levels of access to counterparties and liquidity.

During our recent article on strategies to manage the implementation of uncleared margin rules in Australia, we highlighted how central clearing can help reduce firms’ AANA and remain under counterparty IM exchange threshold levels. We also highlighted ways firms are looking to optimise their trading book and access to liquidity. In this article, we continue our analysis of how counterparty access and liquidity can be improved through OTC clearing.

Regulatory reform has increased costs for trading on a bilateral basis

There are fundamental reasons for firms to look at central clearing of OTC derivatives as “best practice”. Principally the 2007-08 financial crisis corralled commitment by G20 leaders to increase the resilience and transparency of the OTC derivatives markets, declaring that all standardised OTC derivative contracts should be cleared through central counterparties. Regulators globally have supported this goal through various means; mandating central clearing for certain firm types and size, capital charges for uncleared counterparty credit risk (counterparty valuation adjustment, “CVA”), capital and liquidity frameworks for banks to better absorb future shocks and of course the uncleared margin rules (“UMR”) for non-cleared OTC derivatives. These combined approaches have had the effect of allocating higher costs to OTC derivatives trades that remain bilateral. Banks have, in response, limited the types of services offered to clients, the type or breadth of client coverage and appetite for certain types of assets, and these measures ultimately restrict trading capacity available to bilateral counterparties.

Growth of trading on a cleared basis

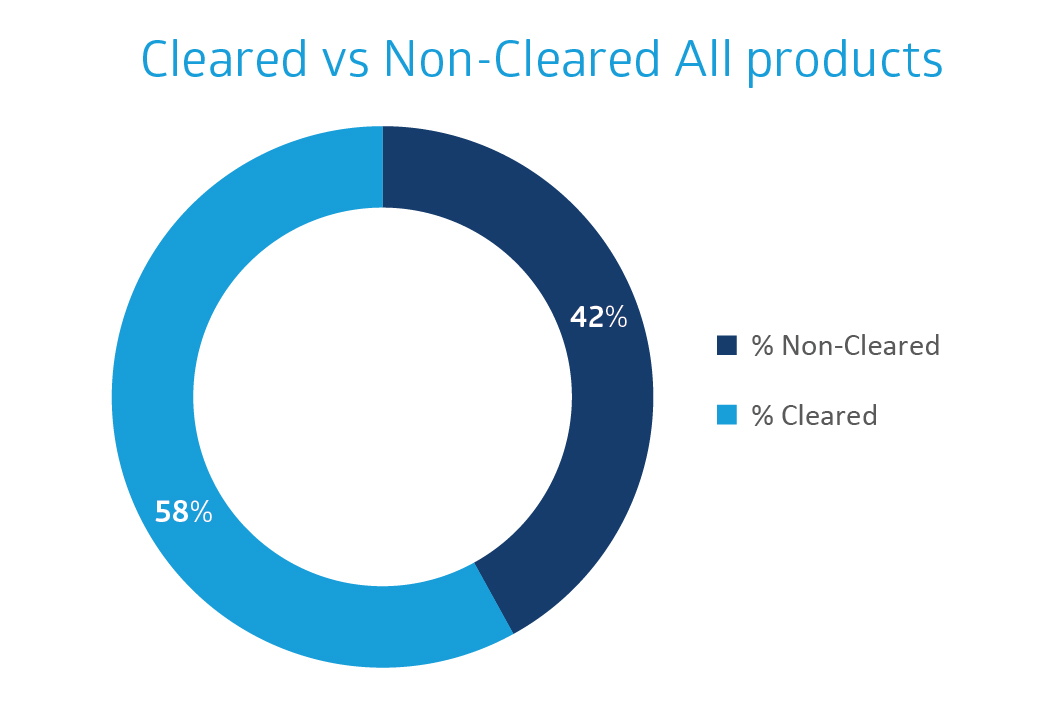

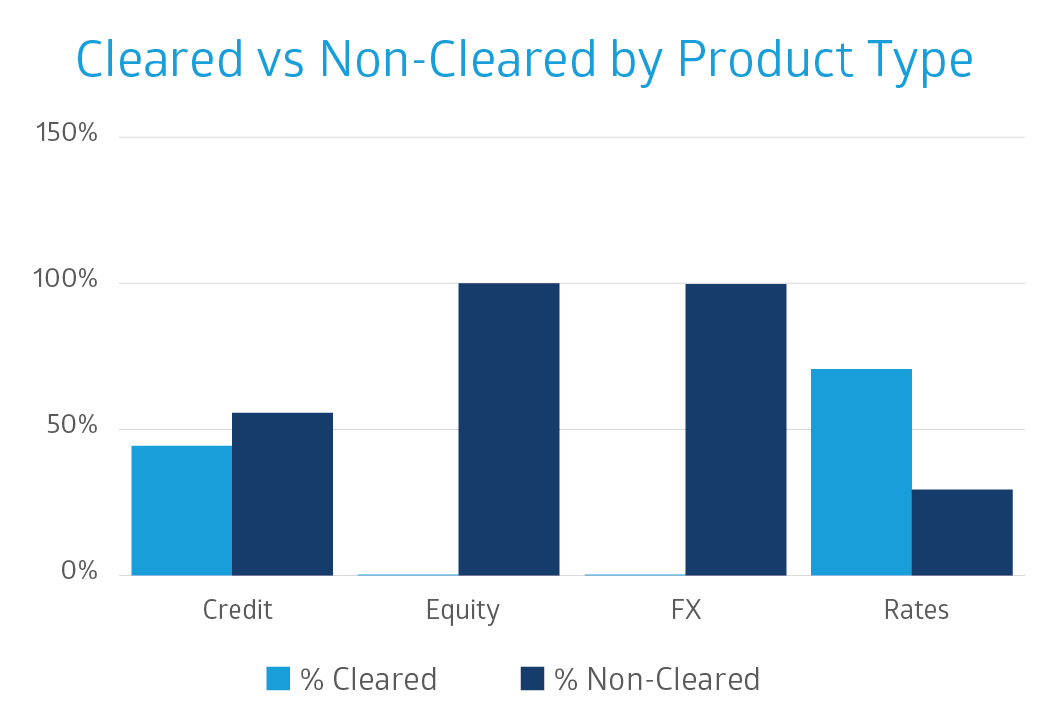

Whether directly through regulation or other efficiency factors, the market has also supported this goal evidenced through the ever-growing market share of OTC derivatives being traded on a cleared versus a non-cleared basis. Multiple clearing houses that focus on different service areas, from global markets to regional markets, and product-specific offerings provide firms with optionality to best fit their clearing needs. The below graph provides some insight into the percentage of cleared vs non-cleared positions.

Sourced from DTCC Australian Trade Repository - Gross Notional Outstanding by Cleared Status (Millions of AUD) as at 12 July 2021 https://www.dtcc.com/repository-otc-data/asic-reports.aspx

Clearing supports access to liquidity and competitive pricing in all market conditions

The ability to access liquidity and competitive pricing is tested most during stressed market conditions when risk appetite and access to a counterparty’s balance sheet retract. The very nature of trading OTC derivatives, unlike traditional exchange-traded products, means a firm’s access to liquidity is based on bilateral counterparty trading relationships. For buy-side firms, bilateral access represents a smaller component of overall market liquidity across some vanilla OTC derivatives. Unlike the US, UK, and European markets, central clearing for the buy-side in Australia remains voluntary. Drivers for voluntarily adopting central clearing are specific to each firm. However, they can broadly be categorised as being associated within the following areas, which interplay with each other.

Market access, credit appetite, legal, and operational requirements often drive decisions that impact the number of available counterparties. Establishing bilateral relationships, especially with the additional UMR documentation and operating requirements, is an extensive process and can reduce the incentive to broaden the number of counterparties firms engage with. Counterparty concentration risk is commonly associated with credit risk, however, it can also result in reduced access to liquidity and limit the ability to achieve best execution.

Michael Reddick, Head of Derivatives Trading and Analytics, NSW Treasury Corporation comments;

“The most important issue to consider when looking at why we should access central clearing of OTC Derivatives is ensuring that we can retain suitable access to market liquidity and competitive pricing. As OTC derivative liquidity bifurcates between cleared and non-cleared markets, we are mindful that without having access to both liquidity pools, our trading risks increase. With the upcoming UMR implementation for phase 5 and 6 firms impacting a broader group of market participants, we see this risk as being more imminent.”

OTC Clearing enables improved access to counterparties and liquidity and further delivers:

- reduced counterparty credit risk;

- process efficiencies through reduced legal and ongoing operational burden when broadening trading counterparties access the same OTC clearing house;

- multilateral netting of exposures, reducing the total exposure of the entire system and facilitating efficient collateralisation of exposures;

- access to the significant OTC derivatives marketshare, already centrally cleared, especially within the Rates and Credit product types; and

- lower overall cost to trade, due to capital benefits from trading on a cleared versus non-cleared basis passed on by dealers via pricing.

This becomes more evident as OTC derivative market activity moves between being traded on a cleared and non-cleared basis. Many firms consider OTC derivatives clearing as an efficient and practical way to increase their access to counterparties and greater market liquidity.

Clear OTC with ASX

ASX operates one of the world’s largest (top 5) interest rate futures exchanges, with customers from across the globe accessing ASX’s deep liquid markets in AUD and NZD rates products alongside a suite of equity, grain and energy derivatives. Our interest rate futures market forms the foundation for the complementary Over the Counter (OTC) interest rate swap market while our AUD equities and exchange-traded options underpin the OTC equity options clearing service.

ASX delivers OTC clearing as a fully integrated offering, providing significant margin, capital, trade, and operational efficiency for customers, including:

- 24hr clearing for AUD and NZD interest rate swaps, enabling global trading and access to clear risk across time zones and key periods of market activity;

- cross-product margining between Futures and OTC swaps, and ETO’s and OTC equity options, delivering significant margin reduction to diversified portfolios; and

- local market expertise and strong domestic relationships allowing us to take action where required.

In the financial year ending 30 June 2021, ASX cleared over AUD 50 trillion notional value in AUD interest rate derivatives and over AUD2.4 trillion in equity derivatives, across its exchanged traded futures, options products, and OTC products.

About the author

Market insights , ASX

Disclaimer

Independent advice from an Australian financial services licensee is needed before making financial decisions. This is not intended to be financial product advice. To the extent permitted by law, ASX Limited ABN 98 008 624 691 and its related bodies corporate excludes all liability for any loss or damage arising in any way including by way of negligence.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2021.