Types of risk

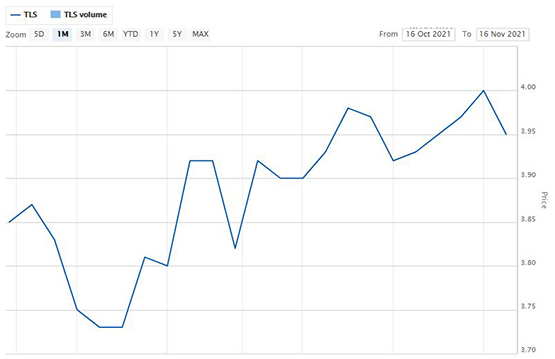

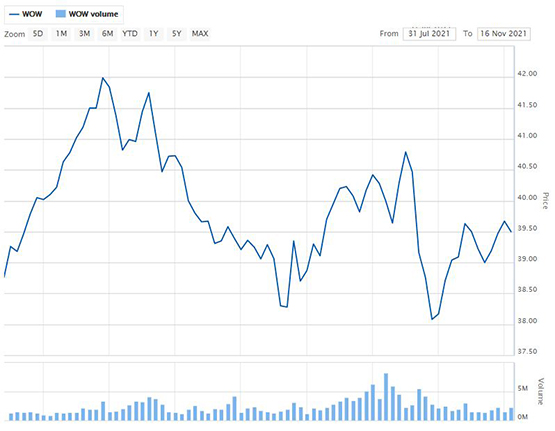

In investing, today's outperformer could be tomorrow’s loser. Social or political events, a natural disaster, rising or falling interest rates, unfavourable exchange rates, industry disruption or changes to commodity prices: all of these factors can impact a company’s share price – as can unfavourable media attention, supply and demand issues or governance problems.

As an investor, you may also be impacted by concentration risk – where you’ve focused too heavily on a small number of companies or sectors. And timing risk comes into play if you need to sell your investment earlier than planned – or you may not be able to sell them at all.

So what can you do to mitigate risk?

Protect your capital

It’s vital to protect your capital – your initial investment. (In the Sharemarket Game, your capital is the $50,000 that you started with.) If you don’t, you could lose all your hard-earned money – and also, without those funds, you could also miss out on the chance to build more wealth.

In real life, if you have a long investment timeframe (five years or more), you can take a few more chances, since you have time to rebuild your capital if there’s a market downturn or you make an unsuccessful investment. But in the Sharemarket Game, you won’t have the time to rebuild if you do suffer major losses.

Diversify your investments

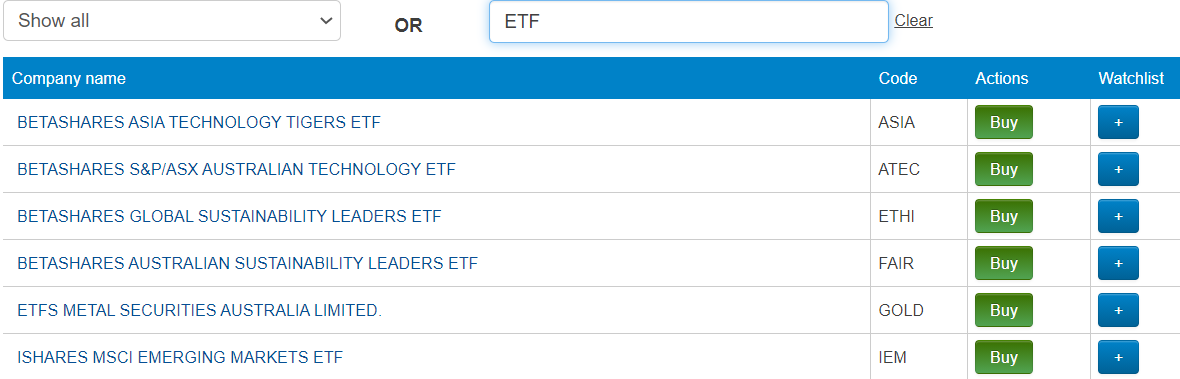

Diversification – spreading your money across companies, sectors, markets and asset classes – is a key way to preserve your capital and protect any returns you make. That’s because if some of your investments perform poorly, others are likely to do well – or at least won’t be so seriously impacted.

For example, if you were invested in travel or tourism stocks at the beginning of the pandemic, your portfolio would have suffered a loss. But you may have been able to compensate for this if you’d also invested in a sector or stocks that outperformed at that time, like videoconferencing companies or certain healthcare stocks.

In real life, you can also diversify your portfolio by investing in other assets too. This could include cash, fixed interest investments like bonds, commodities, foreign currencies or real estate investment stocks (REITs). Many of these investments aren’t correlated with shares. In other words, they’re not tied to the ups and downs of the market.