Founders and owners going through that phase often weigh up whether to seek private funding or take the company to a public listing. They also usually consider which exchange to list on.

We explore why it makes sense for New Zealand technology companies to list on ASX and explore how it can help take them to the next level.

The pros and cons of private funding

Some companies choose to expand using private capital, even once they’ve been established for some time. Sometimes that’s because the founders feel that their companies are not yet big enough to list. Sometimes, it’s because they fear diluting ownership. And sometimes it’s simply because they’ve already gone through prior rounds of funding and it’s just what they’re used to.

Staying private can bring some benefits, especially when it comes to keeping the investor pool tight. However, virtually all of the world’s leading tech companies are publicly listed. Many, including Apple, AfterPay and Xero, chose to list reasonably early in their lives.

Companies tend to be able to access significantly more capital in the public markets than they can by relying on private investors. They can also access it within a much shorter timeframe, often within a matter of days.

Many private investors, such as private equity firms, will usually expect reasonably immediate and significant returns on their investment, and can demand a substantial say in how a company runs. This effectively gives the owners less control than if they went public. Private investors often also require regular distributions, which can drain the resources the owners hoped to use to support their company’s growth.

The benefits of listing

By opting for a listing, company owners can get around many of the pitfalls of private funding rounds, gaining rapid access to a deeper pool of capital that allows their company the chance to reach its potential.

Some of the key reasons for listing include:

- Greater access to capital. Listing gives a company the opportunity to tap into more capital both at the Initial Public Offering (IPO) and subsequently through secondary raisings, which can be executed within days.

- More liquidity. A more liquid and diversified capital base gives the company owners greater flexibility as founders and shareholders.

- Stronger public profile. Public companies are required to comply with regulations which provides reassurance to clients, stakeholders and investors. Public companies also tend to attract more interest from the media, analysts and investors.

- Better valuations. The market will more accurately value a company when it is listed, based on all publicly available information.

- Greater purpose. Company owners can reward employees with share offerings, helping create buy-in and creating a shared purpose.

- Preservation of the company’s founder culture and values. Many tech company owners are proud of the company values and culture they have created. Becoming a public company can preserve these values.

While some owners are wary of the ongoing reporting and disclosure requirements associated with being a public company, these can often actually have a beneficial impact on their company’s performance. Going through the process of continuous disclosure often gives them a better understanding of how their company operates, while providing added reassurance to potential clients and investors.

New Zealand tech companies listing on ASX

Some New Zealand tech company owners may be tempted to list in New Zealand. However, the lack of a listed technology sector will mean they are unlikely to receive specialist research coverage. This can impact both how much capital they will raise and the degree of liquidity they will enjoy, potentially limiting their global expansion plans. For this reason, it often makes sense for them to look across the Tasman.

There are currently 65 NZ companies listed on ASX, with an average daily traded value of A$177 million [1].

Forty-seven of these companies are dual-listed on the NZX and have seen an average 106% uptick in trading volumes within 12-months of taking up a secondary ASX listing.

“EROAD’s ASX dual-listing experience has been extremely positive. In hindsight, we should have done it earlier.”

Steve Newman, Founder, CEO, EROAD

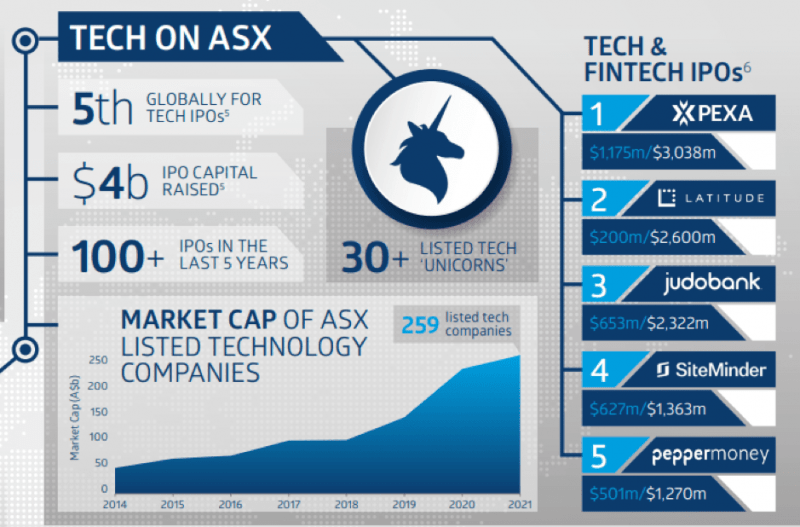

Tech is now the second largest sector now listed on ASX, with over 250 companies. ASX also has the fourth-highest number of tech IPOs of any exchange in the world, with $4 billion of IPO capital raised over the past five years, so that it now boasts 30 tech unicorns.

ASX’s position as the region’s tech exchange was solidified in March 2020 with the launch of the S&P/ASX All Technology index. This ‘all-tech’ index has consistently outperformed other indices of its kind.

“I really welcome the collaboration between S&P and the ASX around the All-Tech Index because what it does is creates more focus on the technology industry, more opportunity for investors and more opportunities for emerging businesses, companies in the sector to gain access to capital.”

– Steve Vamos, CEO, Xero

ASX vs other overseas exchanges

ASX is dynamic - with an average of 120 new listings each year between 2014 and 2020. Over 2020, it led the world in the number of secondary offerings.

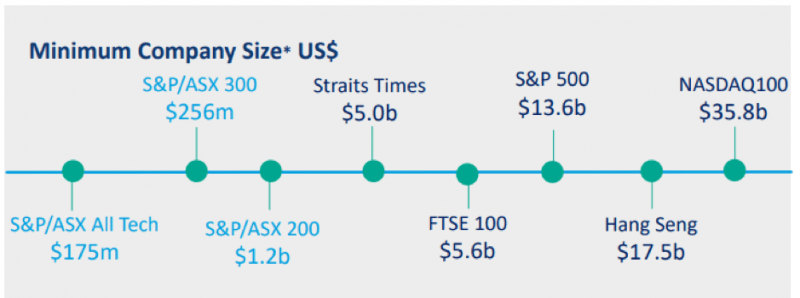

It’s true that there are other tech-focused exchanges, most notably in the United States. However, ASX is a cheaper and quicker route to market for many companies than US-based exchanges. It also allows companies entry into globally recognised indices at a relatively earlier stage.

NASDAQ requires companies to achieve much higher revenues before listing. A company must also have a market capitalisation of US$35.8 billion before entering the NASDAQ 100.

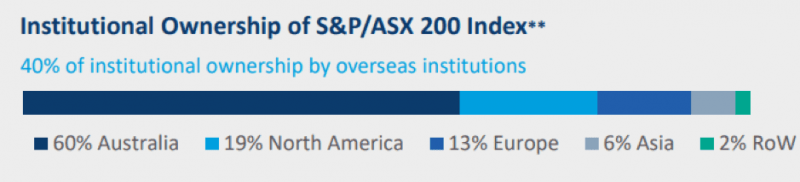

While many of the major ASX investors are based in the United States, Asia and Europe, many company owners are surprised by just how much capital originates from across the Tasman and where that money comes from.

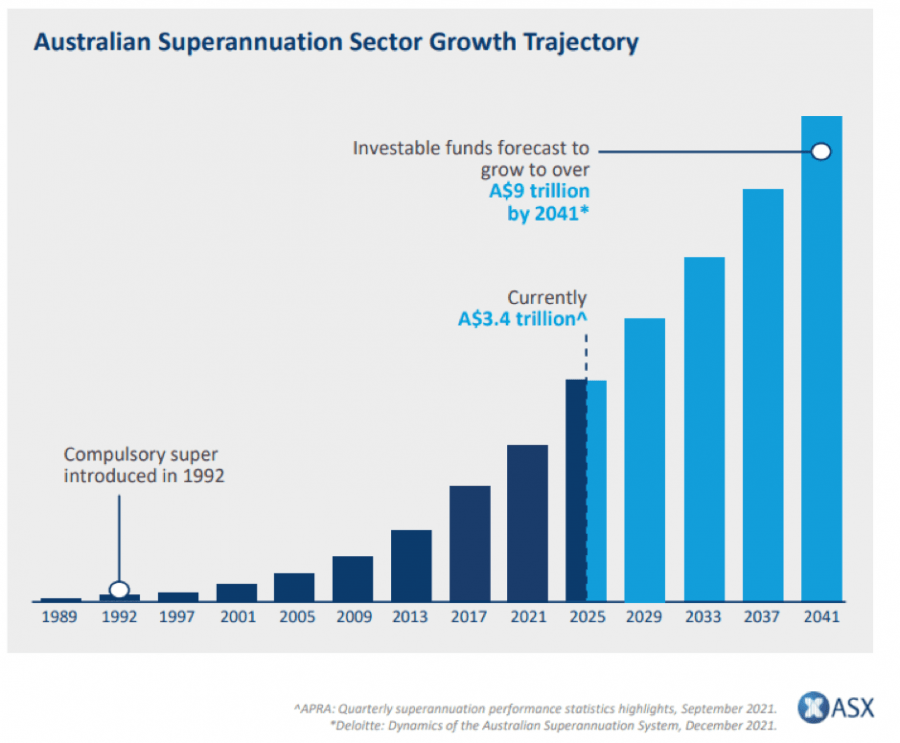

Australia’s compulsory superannuation system means it has the world’s fourth-largest pool of pension capital with A$3.4 trillion in investor assets. As Australia’s compulsory superannuation scheme continues to pull money into this pool, it is on a trajectory to reach $10 trillion within the next 20 years.

ASX vs other overseas exchanges

ASX is dynamic - with an average of 120 new listings each year between 2014 and 2020. Over 2020, it led the world in the number of secondary offerings.

It’s true that there are other tech-focused exchanges, most notably in the United States. However, ASX is a cheaper and quicker route to market for many companies than US-based exchanges. It also allows companies entry into globally recognised indices at a relatively earlier stage.

NASDAQ requires companies to achieve much higher revenues before listing. A company must also have a market capitalisation of US$35.8 billion before entering the NASDAQ 100.

While many of the major ASX investors are based in the United States, Asia and Europe, many company owners are surprised by just how much capital originates from across the Tasman and where that money comes from.

Australia’s compulsory superannuation system means it has the world’s fourth-largest pool of pension capital with A$3.4 trillion in investor assets. As Australia’s compulsory superannuation scheme continues to pull money into this pool, it is on a trajectory to reach $10 trillion within the next 20 years.

A New Zealand tech company that lists on ASX can access this deep and growing capital pool and has the ability to attract the attention of a diverse range of global institutional investors.

The opportunity for rapid growth

Owners can increase trading volumes and gain access to greater capital by becoming part of an index. This means their company will be included in ETFs and other instruments that automatically buy into their stock. Here, ASX offers low barriers to entry to key indices traded around the world. Achieving a place on ASX300 currently requires a minimum market capitalisation of US$256 million.

In short, the ASX offers NZ tech companies the opportunity for rapid growth without many of the same obstacles that are a feature of other leading exchanges.

Case study: Volpara Health Technologies (ASX: VHT)

Volpara (VHT) listed on ASX in 2016 with a market cap of A$31.9 million. Based in Wellington, VHT provides breast imaging analytics and analysis products to help improve early-stage breast cancer detection and clinical decision-making.

By listing on ASX, VHT was able to expand its US sales force, launch enhanced products and support its business development activities. As a result, its market cap now stands at A$214.4 million.

“Having access to capital via ASX at the levels we’ve managed to access it is simply staggering for a New Zealand company. I’m very grateful we’re here [in New Zealand] and I’m very grateful we listed on ASX.”

Ralph Highnam, CEO

Case study: Xero (XRO)

Founded in 2006, Xero is a market leader in accounting software at home in NZ, and in both Australia and the UK. In 2012, the company listed on ASX with A$480 million in market capital. Now, 10 years later it is NZ’s largest company, with a market cap of A$14.04 billion.

While Xero was a dual-listed company, in 2018 it made the decision to consolidate to a single listing on ASX. This allowed it to improve its visibility through increased broker coverage. It also gave Xero the opportunity to improve liquidity and attract greater investment, as investors could acquire shares in greater volumes. Shortly afterwards, Xero entered the S&P ASX100 Index and is now a member of the S&P/ASX All Technology Index and the S&P/ASX 50 Index.

Today, although Xero is listed on ASX, almost half of Xero’s many institutional investors come from the United States, while over a quarter are from Australia and 20% are from the EU.

“The sole ASX listing gives the business better access to capital to fund global expansion…simplifies operations…and has already attracted new shareholders.”

Steve Vamos, CEO

Sources:

ASX Pitch deck

https://www2.asx.com.au/listings/why-list-on-asx/new-zealand

https://www2.asx.com.au/listings/how-to-list/is-listing-for-you

[1] Bloomberg, ‘ASX Listed’ includes ASX and Chi-X trading, 31 December 2021. *Excludes delisted companies and ETFs.

Where to now?

For more information contact ASX Listings Business Development

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People