Customer benefits

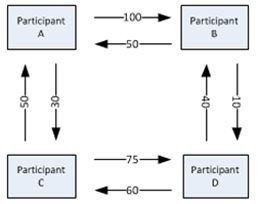

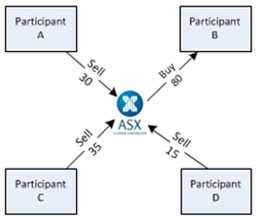

ASX Clear services are provided to clearing participants (who are typically brokers or clearing and custody service providers) and Approved Market Operators. The two key benefits to clearing participants are netting efficiencies and counterparty credit protection. Approved Market Operators benefit from clearing and settlement arrangements for transactions executed on their trading platforms.