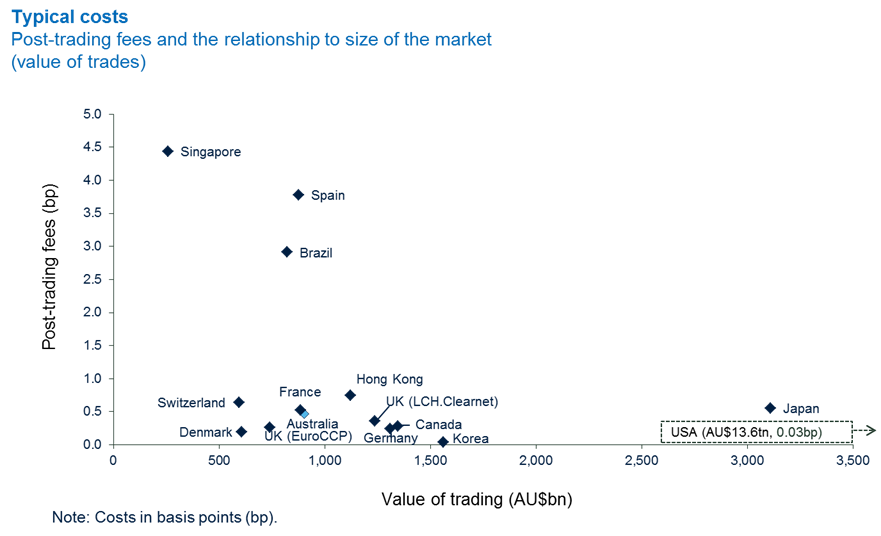

Oxera’s comprehensive cost benchmarking confirms the analysis by the Council of Financial Regulators (CFR) that “ASX’s fees are broadly comparable to those of other markets of a similar scale”, which was published in its December 2012 report Competition in Clearing Australian Cash Equities: Conclusions.

The Oxera report acknowledges that there is a high level of transparency around the pricing, financial performance and international benchmarking of ASX’s cash equity market post-trade services. This transparency has been provided by ASX under the Code of Practice framework.

ASX consulted the (then existing) Forum and the Business Committee, advisory forums established under the Code of Practice, on the scope and methodology of the benchmarking analysis prior to the work being commissioned. The Business Committee was consulted during the project on some of the key elements of the user-profile analysis.

Oxera also directly contacted some members of the Business Committee to discuss their perspectives on the services and fees included on the comparison. Oxera’s discussions with participants assisted in validating a number of assumptions in the analysis. All providers of financial market infrastructure (clearing and settlement services) included in the benchmarking analysis were also contacted by Oxera to confirm their understanding of fees and services provided in each jurisdiction.

Oxera is an acknowledged expert in this area having previously prepared reports using the same methodology for Euroclear (2010), the European Commission (2011) and the Brazilian Securities and Exchange Commission (2012).