A first trade that caught my attention in May coincided with a day where a significant support level was breached. On 3 May, the high, low, and close levels for the S&P/ASX 200 were below 7300. The 7300 level had been a support level for the index over a few weeks, but the price action on this day confirmed that 7300 was no longer a support level.

Data Source: Bloomberg

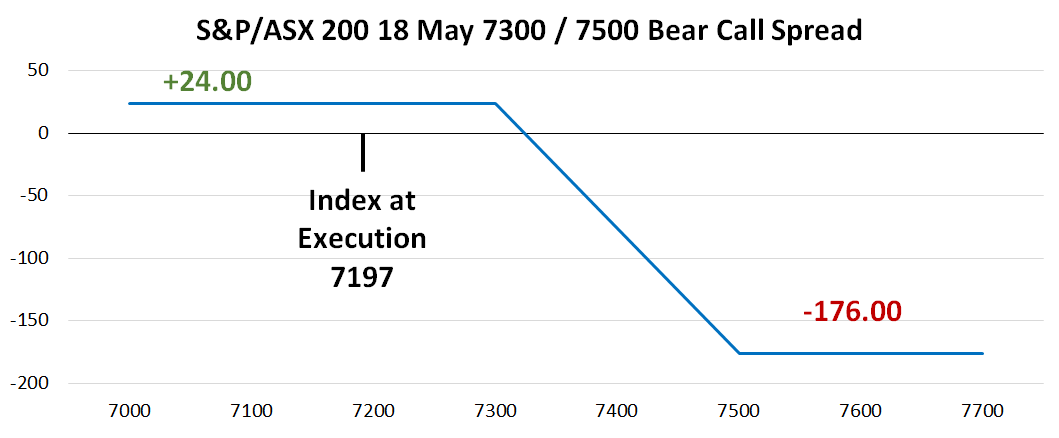

When support is broken, the level becomes resistance and the trade that caught our eye is based on the ASX/S&P 200 remaining below 7300. With the index at 7197 a trader sold the 18 May 7300 Call for 28.00 and purchased the 18 May 7500 Call for 4.00 resulting in a credit of 24.00 points and the payoff at expiration that is shown below.

Data Source: Bloomberg

The reward for this trade equals the credit of 24.00 points. The worst-case scenario sees the index over 7500 at expiration netting a loss of 176.00 points. We know how this trade worked out as the index never moved over 7300 through expiration resulting in a maximum profit for the trader behind this spread.

The following day, 4 May, a trader entered the market selling a strangle based on an outlook that the S&P/ASX 200 would stay in a wide range through the middle of June. With the index at 7170, a trader sold the 15 Jun 6975 Put for 71.00 and the 15 Jun 7400 Call for 35.00 taking in a credit of 106.00. The payoff at June expiration appears below.

Data Source: Bloomberg

If the index falls between 6975 and 7400 this trade will realize a profit of 106.00. This means the maximum profit is pocketed if the index is not 2.7% lower or 3.2% higher than it was at execution. Partial profits would be realized if the index is down more than 2.7%, but less than 4.2% or the index climbs more than 3.2% but is not more than 4.7% higher at expiration.

We reported on a bearish trade, the short straddle is considered neutral since the trade works if the index remains in a range, so now for a bullish trade. Again, on 4 May, with the S&P/ASX 200 at 7197, a large bull put spread was executed. The specific trade sold the 18 May 7000 Put for 39.00 and purchased the same number of 18 May 6800 Puts for 15.00, taking in a credit of 24.00. The outlook for this trade is based on the index remaining over 7000 through expiration.

Data Source: Bloomberg

The dollar risk reward for this bull put spread matches up with the first trade at a potential loss of 176.00 points and a reward of 24.00 points. The key level for this trade is 7000, the short put strike in the spread, a level that was not even tested between execution and option expiration. Since the index never breached the 7000 level and the trade remained open through expiration, like the bearish trade discussed above, this trade realized the maximum profit with the options expiring out of the money.

Other Insights

This article concludes the inaugural ASX equity derivatives insights series from the first half of 2023. I look forward to writing a new series based on trading observations in the second half of the year. To receive these insights via email, please subscribe to the ASX Equity Derivatives monthly newsletter.

For more information, contact

Disclaimer

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and examples used detail the performance of historic trading strategies, and as such past performance is no guarantee of future performance. The content does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.