Once just a place for completing the balance of over-the-day orders, the ASX daily Closing Single Price Auction (CSPA) is now an important tool for efficient price discovery and liquidity formation that’s seeing regular high-value trades of more than $1 million. Even better, the CSPA is transparent and available to all investors.

Volumes at the CSPA now account for around 21 per cent [1] of average ASX daily turnover and can be much higher on days when indexes are being rebalanced. This trend to higher volumes has been seen on many global exchanges, from the New York Stock Exchange [2] to most European bourses, where closing auctions now represent more than 20 per cent of consolidated volumes. [3]

The popularity of CSPAs has risen as the size of equity orders has declined, due to changes brought by electronic trading. One change is the breaking down or ‘fragmentation’ of large equity orders into smaller parcels, with the average trade size shrinking dramatically since the introduction of electronic trading in the 1990’s.

For example, in the March quarter of 2023, the average trade size on the ASX was $4,202.60 [4] for the entire equity market, compared to $5,254 in 2014.

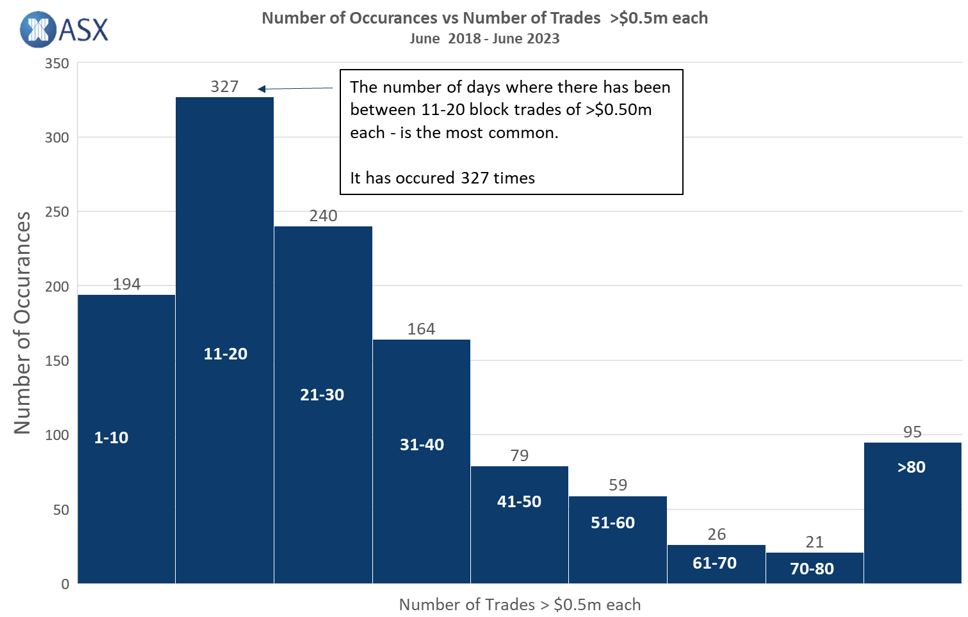

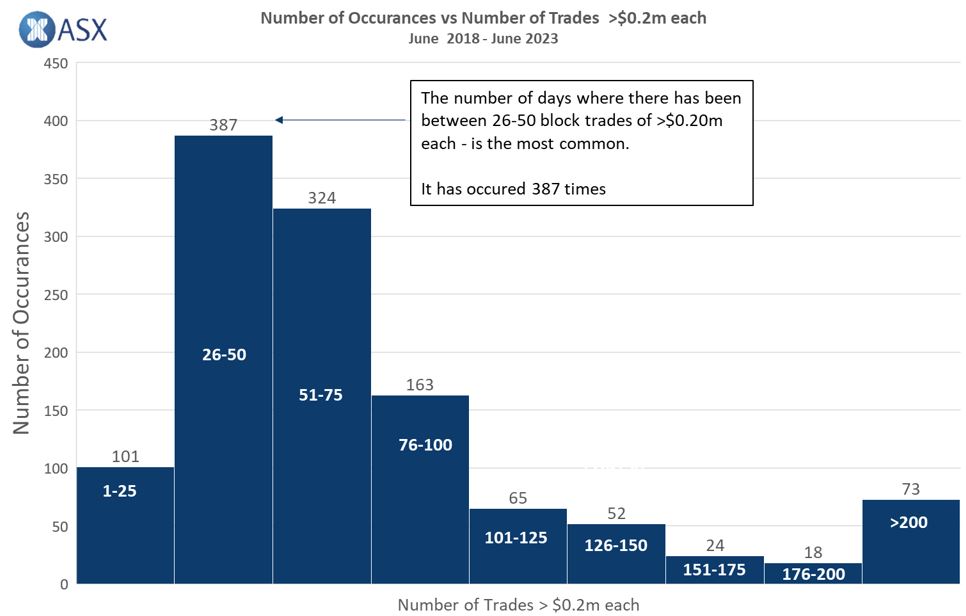

This decline in average trade sizes has made block trades – single high-value transactions, or transactions that represent a high ratio of average daily turnover – more important. The Australian Securities and Investments Commission (ASIC) has categorised them into three tiers: Tier 1 – $1 million or more; Tier 2 – $500,000 or more; and Tier 3 – $200,000 or more. [5]

High-value trades in CSPAs

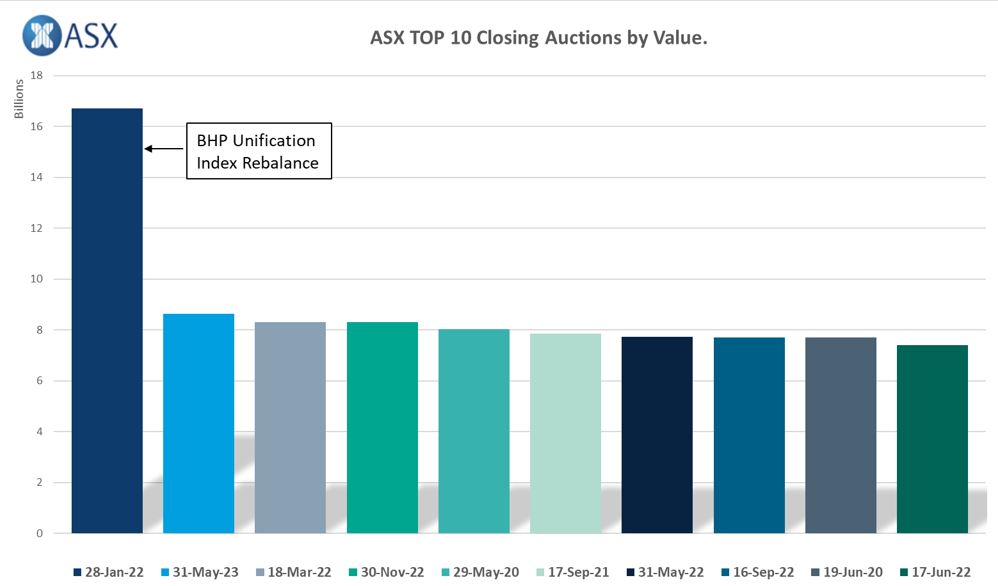

Billions of dollars’ worth of trades take place during the CSPA, with the highest values recorded on key index rebalancing days. Many of these are block trades.

The largest auction day ever was due to BHP Limited’s unification of its corporate structure and delisting from the London Stock Exchange and relisting on the ASX on 28 January 2022.

According to our analysis, the top 10 CSPAs (by value) are all a result of an index rebalance by one or more of the major benchmark providers.

Data source: ASX

Facilitating high-volume trades

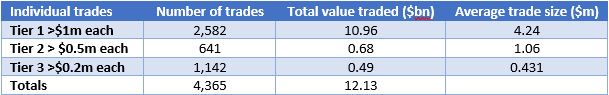

The following table shows the trades on 28 January 2022, the day of the BHP consolidation on the ASX. The volume of Tier 1 trades shows that the ASX CSPA can handle a single line of stock that is around 1,000 times bigger than the average trade on the market, and can do so almost 2,600 times in a single session.

Data source: ASX

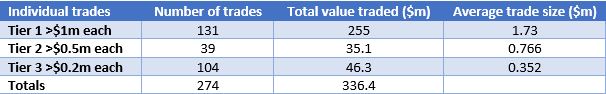

The next table shows the average CSPA over the last five years, to get a more representative picture of the liquidity that regularly occurs.

Data source: ASX June 2018 to June 2023

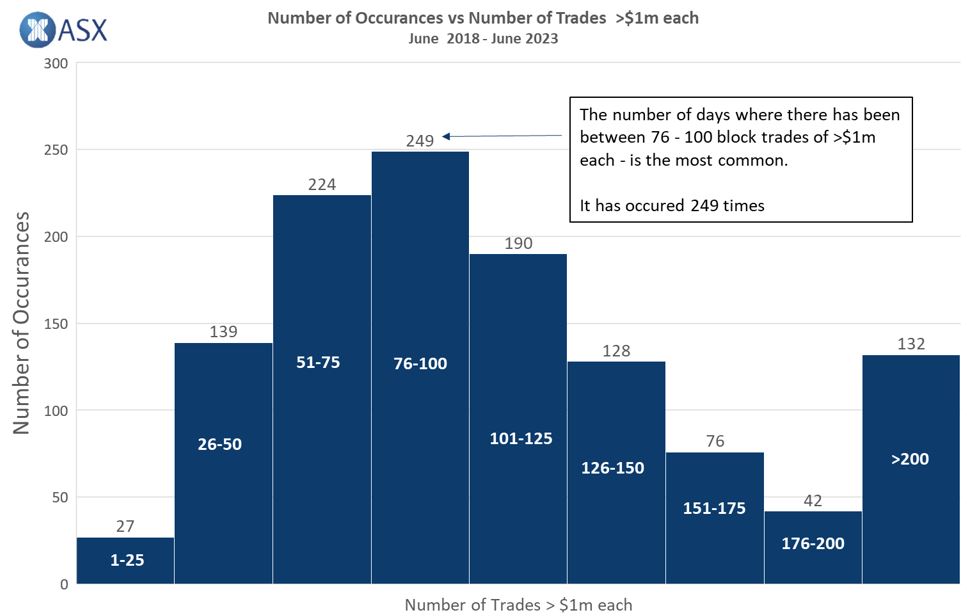

The following chart shows the distribution of Tier 1 block trades for CSPAs.

On a typical trading day, the CSPA will have between 76 and 100 block trades valued at $1 million or more. This makes up a significant portion of the Tier 1 blocks traded across the Australian equity market, supporting the view that the CSPA is an important tool for those seeking consistently available liquidity at the right price.

Data source: ASX

The charts for ASIC Tier 2 and Tier 3 blocks show a similar story regarding the reliable nature of liquidity during the ASX CSPA.

Data source: ASX

Data source: ASX

Finding the best liquidity at the best price

We regularly discuss aspects of the CSPA, including possible improvements, with sell-side participants and buy-side dealers. The overall feedback is that the ASX CSPA is very efficient, specifically where it provides benefits that include:

- transparent expected prices and volumes

- ability to amend or cancel orders until the random close

- no minimum order size

- uncapped limits (up or down).

Market participants also report that the mechanism works efficiently with large orders, showing a price/time priority, and allowing the maximum time for contra order flows to present themselves.

Sell-side participants and buy-side dealers have many options for accessing liquidity on an average trading day. Whether it is on market, or through broker dark pools, exchange midpoint venues or block trading, the challenge is the same – finding the best liquidity at the best price.

With the ASX CSPA representing around a fifth of the average day’s turnover it has become a much more important part of finding and accessing liquidity. And when you’re looking to trade in size across a range of securities, especially during specific liquidity events such as index rebalances, our analysis shows it can be a great tool.

Other Insights

To keep up to date on ASX equity market trends and insights including equity derivatives data, subscribe to the ASX Equity Derivatives newsletter

Disclaimer

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2023.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People