Why the ‘set & forget’ approach to financial advice needs to be rethought - Alison Kolb, Ord Minnett

Many would argue that portfolio investing can be as easy as ‘setting and forgetting’. However, the effort of setting a portfolio and putting it in the ‘bottom drawer’ and expecting the investments to continue to grow significantly in value rarely happens.

Benchmark investing [for example, through Exchange Traded Funds] has its place, but financial advice can provide additional returns to staying passive [through ETFs].

This article demonstrates that when receiving sound financial advice, investments can stay current and often beat inactive [passive] investing. Given the changing nature of our economy and underlying businesses that make that up, it follows that investments need to be reviewed regularly and rebalanced to reflect that.

It takes a lot of work to beat the index consistently. For example, extensive research at the micro and macroeconomic levels and staying up to date with market movements. An investor does not need to be always active, however it is about investing for your stage in life and within the current market conditions. An investment account will always need reviewing, as asset allocations can often become skewed and need to be realigned.

Having an adviser to help you determine the level of risk that you are willing to take and where the economy is currently tracking, can be invaluable to building long-term wealth. Many would know someone who has held a company from its highs to its lows and not taken the step of exiting as advice would have recommended.

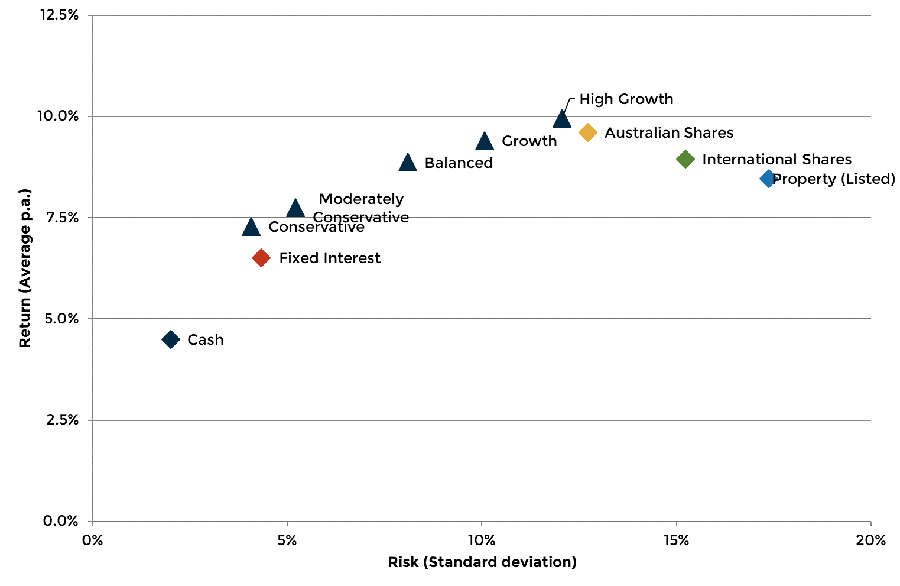

Consider a client who is invested 100% in Australian equities. This is taking on considerable volatility and market risk, as shown in Figure 1.

Figure 1. Asset Classes & Allocations

Returns vs. risk

Source: Bloomberg, Iress, Morningstar. Measured from 1990 to 2021. Allocations are re-allocated at the end of each calendar year.

The question is, is the return versus the risk worth it? When considering your ‘sleep at night’ factor, having the correct asset classes within a portfolio is paramount. An allocation that is tailored to your specific needs may smooth out volatility and streamline income and growth.

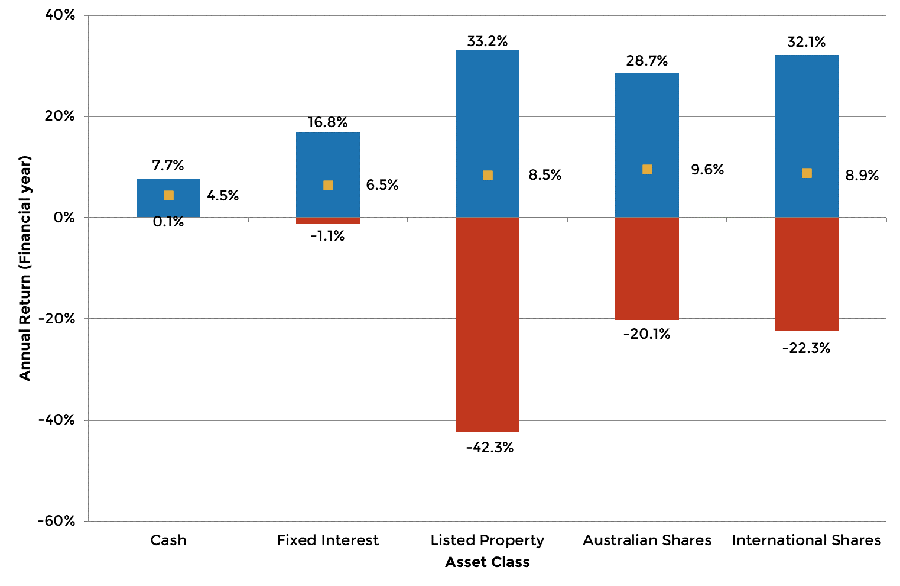

Figure 2 below shows return ranges for each of the asset classes. Being invested all in Australian Equities at the wrong point of the market cycle would be extremely stressful. Even more so if you were nearing or approaching retirement and needing to draw a pension.

Being proactive and choosing the appropriate investments through a diversified and active portfolio, can make a difference.

Figure 2. Asset Classes Return ranges

Source: Bloomberg, Iress, Morningstar. Measured from 1990 to 2021

Markets can be volatile and are arguably more fast-paced than ever due to many influencing factors. If you consider that in the past, we would wait for a letter to be delivered by post or to get the most current news, the paper or radio would be the source. Now, information is instant and all can receive updated news all day via the internet or social media.

However, if you are looking to build wealth for the future, much thought needs to be given to the desired long-term outcome required, but also continued monitoring of the investments. This is where a financial adviser may add value, so that you don’t lose track of your financial goals.

Financial advice should not be ‘set and forget’. As we have adapted over time with different methods to communicate, we also need to embrace change with our investing methodologies.

Accepting new opportunities and switching investments from old world to new world companies, can provide significant growth in your wealth. Portfolios that remain passive (focus on achieving the index return), may miss opportunities.

Power of your Super Fund at any age - Vera Lin, Ord Minnett

Superannuation may be a surprising topic for readers who are under the age of 50 – who may not think of their super funds at all, let alone consider its benefits or its power while they are still far from retirement.

For many investors under 30, a super fund can be their most neglected financial asset. A way to revitalise this association is to remember that for most, around 10% of their income is being diverted to it every year, and this ratio will only increase over time. Although super savings may not be accessible for another 30 or 40 years for this age group, it does not diminish its value today.

Young investors have the advantage of time on their side due to compounding returns. Many can afford to take higher growth positions in their super investments which may help yield better returns over time. Although individual super balances for those under 30 may still be small, their collective force could dictate seismic changes in the investment landscape. Considered investment decisions by future generations could bring a larger focus to global issues such as decarbonisation, increase demand for ethical funds, and compel more companies to employ ESG measures (Environmental, Social, Governance).

For investors between the ages of 30 and 50, between building a career, paying off a mortgage and perhaps raising a young family, their biggest deterrent in considering their super funds as a valuable investment asset is probably their lack of time.

However, if this age group can make the time to review their super funds, it can be quite rewarding for them because these are typically their peak earning years. As a result, their super assets many in many cases grow at their fastest rate during this period.

There are numerous tax-effective strategies that can be implemented through seeking professional advice, which can help manage tax liabilities and maximise returns through a critical growth period. It is also vital for young families to ensure they have adequate life insurance and income protection policies in place to safeguard their future. This strategy can be structured with the help of their super funds.

[Editor’s note: Do not read the following information as tax advice. Do further research of your own or talk to your financial adviser before acting on advice in this article.]

As for investors over 50, the power of their super fund is most evident as it can offer an independent and accommodative way to retire with a comfortable lifestyle. Earnings on investments in Super Funds are taxed at a reduced maximum rate of 15%, which could provide a more favourable environment to accumulate assets compared to personal share portfolios or investment properties, which may be subject to the highest marginal tax rate of 47%.

When a pension commences at retirement, this will apply a zero-tax rate on the super balance up to $1.7 million for each member, and this balance cap will continue to index over time. If a 65-year-old today has implemented the right strategies over the course of their working years and has achieved the maximum balance cap, they can receive a minimum tax-free pension from their super fund of $85,000 per annum.

In comparison, Age Pension for a homeowner couple who qualify for the asset and income test may only receive a maximum combined pension of $37,923.60 per annum.

While it may be possible to maximise super returns up to the balance cap by planning for retirement from age 50, the task becomes progressively easier the earlier it is undertaken.

Investment trend opportunities to look out for on the ASX - Matthew Sonnemann, Ord Minnett

As Australia moves out of its COVID-19 induced lockdowns, what does the investment environment look like for the coming year and what opportunities does it offer to ASX investors?

The idea is to take a broader view of the domestic and global economy and then attempt to outline the impacts this will have for investors approaching the coming year.

[Editor’s note: Do not read the following ideas as stock recommendations. Do further research of your own or talk to licensed financial adviser before acting on themes in this article].

Currently, it appears that there is better relative value in the local sharemarket versus the US sharemarket, even though the latter economy should also record good growth.

Valuation methodologies vary, however it would seem that investors to date have been more cautious about raising the prices of local shares on a relative basis and this may well shift.

The Reserve Bank of Australia has suggested no cash interest rate rises are likely for at least another year. For those pursuing income from their portfolio this is significant, as many investors have increasingly embraced higher levels of risk and moved into higher income producing portfolios. This has been achieved by altering their portfolio mix with less exposure to low-risk assets like cash and fixed interest and more to higher-growth risk assets, such as shares and property. This trend may have more time to play out over 2022.

With inflationary pressures building in the US due to limited production spare capacity, this is leading to higher bond yields. This may have a negative impact on property and infrastructure stock prices. This occurs as the yield on these types of stocks becomes comparatively less appealing for investors from current levels as well as making their use of debt more expensive.

Higher bond yields mean that this will likely have a negative impact on the attractiveness of high growth stocks as the cost of servicing their debt becomes more expensive. For context, the last decade or more has seen a substantial decrease in bond yields. This has meant high growth companies, and particularly those running huge losses whilst in their quest for future profitability, have enjoyed cheaper and cheaper debt costs.

It is possible that we are witnessing the end of this long trend of lower interest rates and the advantage that has seen investors pushing up the share prices of these growth stocks over this extended timeframe. High growth stock prices face this long-term headwind.

Australian companies as an average will provide a higher than usual increase in profitability for the coming year compared to the last financial year, albeit off a low base due to muted market conditions through lockdowns. This will mean that the market’s price to earnings ratio will decrease, making Australian shares comparatively more attractive.

In the coming year the Australian dollar could strengthen considerably. It currently buys around USD 74.5c and could increase to USD 85c. This is based on the on-going commodity boom as well as record external surpluses and the trajectory of economic growth in Australia. By implication, a contrasting impact may occur for investors holding unhedged US equities as they will suffer a loss in relative value if this weakening of the US currency occurs.

Notwithstanding the long-term benefits of broader asset allocation, it may be that exposure to shares that benefit most from an upswing in economic growth may well prove to be the best risk-adjusted approach for Australian investors looking for returns in 2022.

Employee Share Schemes – Cutting through complexity - Robert Gertskis, Ord Minnett

If an employee share scheme (ESS) is a substantial portion of your overall remuneration, your earning potential can be more volatile and complex than a simple salary package.

This article provides a template for the most important considerations to focus on before implementing a wealth and investment strategy that maximises this unique opportunity to preserve and grow your wealth.

Key variables with ESS

The value of your ESS is likely influenced by a combination of:

- Personal, team and/or company-wide performance-based vesting conditions

- The length of time you have been employed in the company (i.e. time-based vesting condition)

- A vesting schedule that determines when you can acquire full ownership of the shares

One of the key benefits of an ESS is the ability to acquire shares at a discount to the market value. This is the amount you are essentially paid to acquire the shares. This forms part of your assessable income and needs to be included in your annual personal tax return.

Depending on the specific structure of the ESS that you have been offered, the discount will either be taxed at the time the shares have been granted or deferred so that any tax is payable at a later time.

Importance of planning

A good starting point to maximising the benefit that your ESS can provide is to map out the relevant dates that dictate your capacity to exercise units, sell shares and fund any tax liability that may arise.

Particularly if you are entitled to company shares through a number of different schemes, ensure that you pay close attention to the vesting periods, holding locks, expiry dates and any relevant trading windows that may restrict your ability to sell any of your shares after they have vested.

If you decide to sell your shares within 30 days after the deferred taxing point, the deferred taxing point becomes the date of that disposal, and this can create cash flow issues that complicate your strategy.

Effective Structuring

If flexibility around owning some or all of your equity in a trust or through superannuation is facilitated by your company, you should consider these options.

Before selecting the right mix of entities to own the shares, you need to ensure that the income and capital gains tax (CGT) implications, asset protection characteristics and access to capital are aligned to your personal situation.

If you have already entered an ESS in your personal name, you can consider transferring the shares to a different entity. However, be mindful of the potential tax implications – for example, you may need to confirm that you remain the controlling person in the entity that accepts the asset.

Seeking specialist advice

Understanding the specific characteristics and tax treatment of your plan can be complex and you should seek specialist advice specific to your personal circumstances before entering into an ESS. However, having a basic knowledge of the primary considerations may help to inform your discussion with a specialist and ensure you have addressed the key issues.

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.