Marco Anselmi, VGI Partners

Understanding and seizing opportunities in Asia is of growing importance for investors.

In 2019, VGI Partners established VG8, a portfolio of long and short investments in Asia, on the back of our investment team’s growing optimism in the region.

While Covid has created uncertainty in the world, and there are other risks specific to Asia, we remain buoyed by the opportunity for long-term investment in the rising number of high-quality companies in this part of the world.

In recent decades, Asia has grown to become the largest economic region in gross domestic product (GDP) terms, according to the International Monetary Fund (IMF).

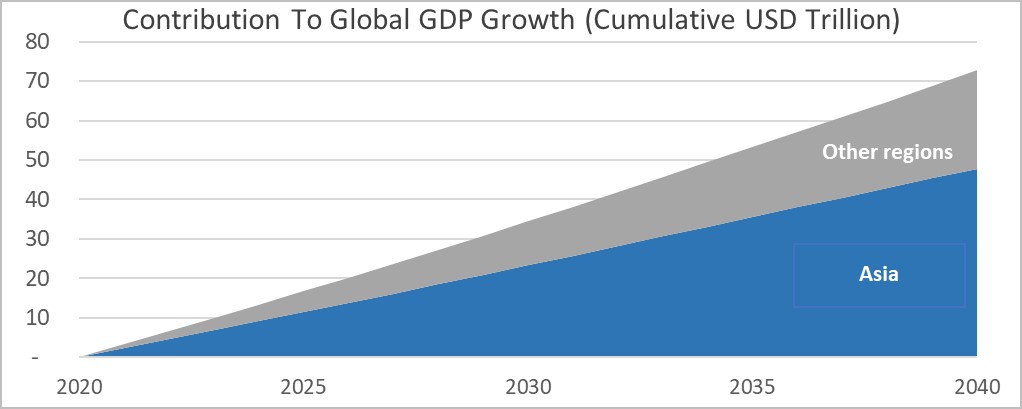

This trend looks set to continue, with the Organisation for Economic Co-operation and Development (OECD) forecasting that the region will contribute around two thirds of global GDP growth in the coming decades.

Source: OECD Real Long Term GDP Forecasts and VGI Partners

Higher economic growth rates in Asia are not just a function of the region’s more favourable demographic trends, but also the virtuous cycle that comes with a rising middle class. Improvements in household prosperity are coinciding with higher education standards and technological advancement.

Half of the world’s 10 largest technology companies, by revenue, already come from Asia. Asian companies are also dominating in areas of sectoral growth, such as automation and electric-vehicle battery cells.

Modern entrepreneurship is also on the rise in Asia. Historically, Asian countries have tended to adopt technological trends that started in other nations. However, in recent years we have seen innovative new business models first spawning in Asia and then being adopted in western markets. Notable examples include social e-commerce and new forms of digital payments.

VGI Partners’ investment process is to focus on high-quality companies that benefit from sectoral growth trends. It is likely that an increasing proportion of these opportunities will be in Asia.

Unlocking value

What is also interesting about Asia is the prevalence of companies with high-quality core businesses that are exposed to this sectoral growth but are underappreciated by the market.

This is particularly the case in Japan, where many companies have been keenly focused on providing superior products for their customers, but less focused on raising profit margins through leaner cost structures for the benefit of shareholders. This can lead to hidden value being trapped within some stocks.

Thankfully, we are seeing a real shift towards shareholder alignment within Japan, which is increasingly unlocking this hidden value.

[Editor’s note: Do not read the following ideas as stock recommendations. Do further research of your own or speak to a licensed financial adviser about ideas in this story, which are based on VGI’s opinions].

Olympus, for example, is a company that dominates the gastrointestinal endoscope market, with over 70% market share globally. Its distribution and physician training networks across Asia are well-positioned to benefit from the rising affluence in other emerging nations. As the number of patients that can afford endoscopic surgery grows, so will Olympus.

A change of leadership in 2019 has seen Olympus embrace reform, commit to higher profitability targets and sell the poorly performing camera division to private equity.

Private equity managers are in a better position to merge low-margin businesses spun out from competing players and slash costs to turn them around.

With record amounts of dry powder [committed but unallocated capital] among private equity funds, and swathes of Japanese companies with non-core assets to spin-off to improve earnings, we think this trend has only just begun.

Encouraging change

VGI Partners also engages directly with companies we invest in to encourage change where we feel it is required.

One recent example is Yakult, a leading global probiotic beverage manufacturer. One of VGI's key concerns was that Yakult lacked an effective social media presence. This meant the company was not translating its strong global brand image into the level of sales we felt it should be achieving, particularly in the US market.

After multiple engagements with management, we now feel Yakult is beginning to move in the right direction. While it is still early days, Yakult’s new social media campaign in the US appears to be highly effective in creating intent-to-buy among the target audience.

Shannon McConaghy, VGI Partners

We will continue to engage with management as we feel Yakult should also expand its premium product range outside of Japan and improve its capital-allocation policy. By our calculation, the company could increase its dividend up to four times the current level just by no longer adding to its already strong net cash balance.

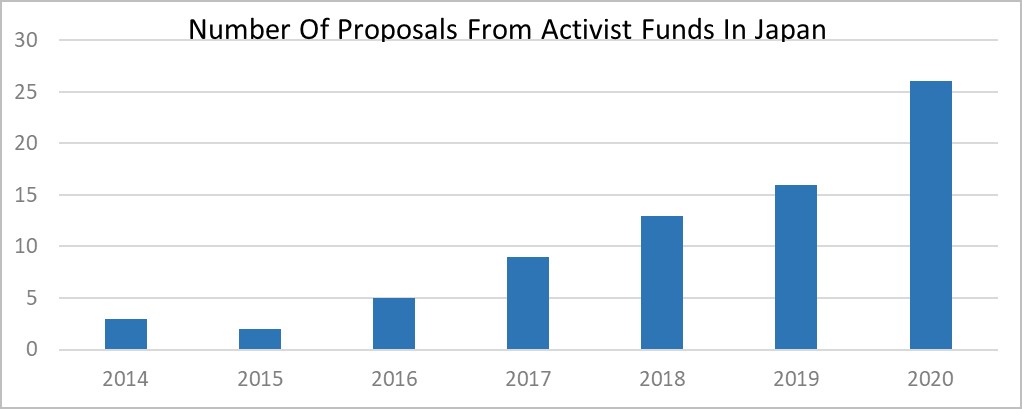

More broadly, Japan is seeing a surge in activist proposals which we anticipate will drive a greater awareness among its corporate managers that change is required.

Across Asia, governance standards are rising, which creates a growing number of opportunities to invest in companies where value is being unlocked.

Source: CLSA, IR Japan

Finding opportunities, navigating risks

Some markets within Asia come with higher risks than others. VGI Partners’ policy is to be prudent and focus on opportunities in countries with strong accounting standards, reliable regulators, and a robust legal system.

To that end, we are not constrained in only investing in companies listed in Asia to access Asian growth. Richemont (SWX: CFR), for example, is listed in Switzerland but has a high exposure to Asian consumption in its luxury jewellery and watch brands (from Cartier and Van Cleef to Panerai and IWC). Richemont’s Asia Pacific sales last year were double that of its home European market.

Just as in other global markets, one of the best practices for managing risk in Asia is to focus on long positions in quality businesses with a margin of safety in the valuation.

On the flip side, we also look to generate returns from our short book by focusing on low-quality businesses we feel are materially overvalued. This helps to manage risks in the portfolio and the process of short selling hones our attention on looking for negatives as well as positives. This is very additive in understanding how to best look for risks in the companies we invest in.

While Asian companies do tend to have less sophisticated disclosure, this can be both a risk and create an ability to gain an edge. To truly understand what is driving a company’s earnings in Asia often requires more channel checks and conversations with industry experts. We find that collecting scuttlebutt to augment deep fundamental analysis pays its rewards over time.

Where Asia sits in investor portfolios

With Asia forecast to contribute most of the world’s GDP growth in decades to come, it makes sense for long-term investors to increasingly allocate towards the region. VGI Partners will continue to focus on finding the best opportunities to leverage Asian growth and unlock hidden value while managing the risks that are unique to this region.

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.