Historically, private equity investments have primarily been accessible to large and sophisticated institutions, endowment funds, family offices, and a limited number of ultra-high- net-worth investors.

Due to the inherent characteristics of private equity, this group of investors accepted inflexible investment terms, limited access to the invested capital, and a general lack of transparency, in return for exposure to an asset class that (the data clearly shows) has consistently outperformed listed shares – before and after allowing for risk – while providing additional diversification benefits.

Private-equity portfolio allocations have ramped up even further over recent years, with this trend expected to remain an ongoing theme, supported by influences such as near-zero interest rates, elevated valuations in traditional markets and the opportunities presented by emerging markets, innovation and disruption.

At the same time, long-term return expectations continue to favour private equity relative to listed equities, particularly for the subset of private equity fund managers that have demonstrated a consistent ability to achieve top-quartile returns.

By enabling access to global private equity investments via securities traded on major stock exchanges, listed private equity addresses certain aspects of global private equity that have previously deterred, or even excluded, some investors.

Listed private investment is available on ASX through the Pengana Private Equity Trust (ASX: PE1). PE1 is Australia’s only listed portfolio of global private equity investments.

Understanding private equity

PE investing is typically characterised by several factors that, to date, have limited retail investors from being able to access this asset class. Risks include:

- Large minimum investment amounts make it difficult to gain access, and harder still to achieve diversification. Excess demand for top-performing private equity managers means these funds are also generally oversubscribed.

- Long-term illiquidity, whereby PE investments often require a substantial minimum commitment that may be “locked up” or inaccessible for 10 years or more.

- Inflexible timing, as PE funds are often closed to investors and may remain uninvested for some time as they await underlying investment opportunities.

- Lack of transparency, with PE investors having limited information on target companies and receiving infrequent valuations.

- Absence of clear price discovery, meaning transaction pricing in private markets depends substantially on negotiations.

- Reduced separation between ownership and control, which elevates the role of manager resources and expertise.

However, two further characteristics are observed:

- Outperformance of private equity compared to public equity. Conceptually, this follows from PE investors requiring compensation for accepting the complexities and illiquidity of PE.

- Ability for skilled private equity managers to distinguish themselves through superior performance.

Private equity performance

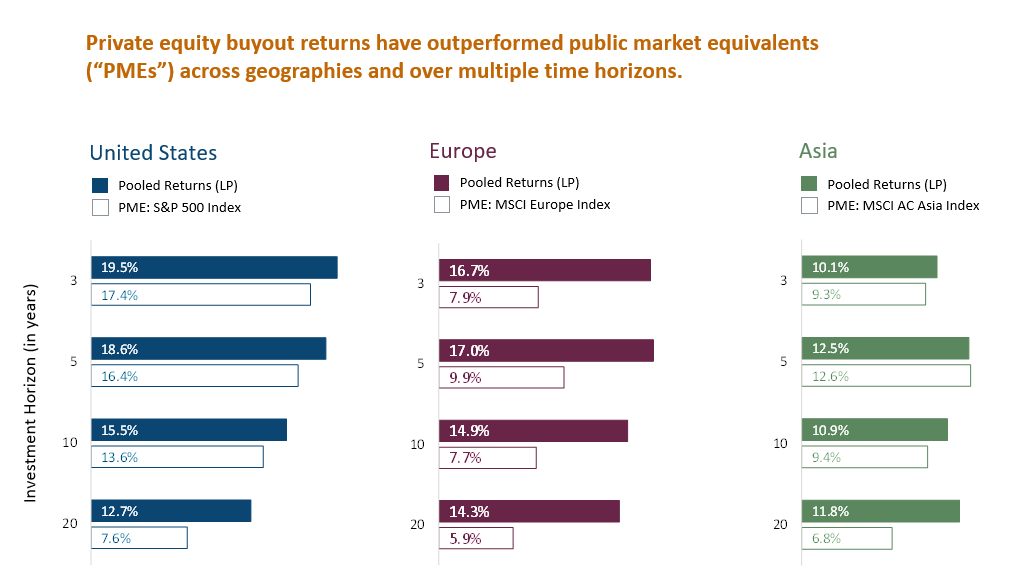

Looking at returns, the outperformance of private equity versus global listed shares is widely acknowledged (see chart 2 below).

Less well known is the portfolio-diversification benefit associated with including PE in a traditional portfolio of bonds and equities.

If a 20% allocation to private equity was made to a traditional portfolio of 60% equities and 40% bonds, thereby creating exposure of 50%/30%/20% (equities, bonds, PE), the new portfolio historically generated increased returns with reduced volatility. This is an important result as higher investment returns are usually accompanied by higher risk.

Where higher returns are accompanied by lower risk, as in the case of private equity, that asset class becomes compelling, in Pengana’s view.

Chart 1 below illustrates the higher returns and lower risk of private equity compared to global equities. Moreover, by displaying the ratio of return to risk, the chart shows the superiority of risk-adjusted PE returns relative to both shares and bonds.

CHART 1: Superior risk-adjusted returns [1]

Source: See footnote 1.

More consistent return comparison

However, comparing the performance of PE to sharemarket index returns could be misleading, due to the uncertain and variable timing of cashflows that characterise private equity investments.

To create a more valid comparison, one technique is the calculation of a ‘Public Market Equivalent’ (PME) equity return series that replicates private equity cashflows in a sharemarket index.

Using this approach, Chart 2 below shows a performance comparison between PE buyout returns and local market equities.

Over time horizons from three years to five, 10 and 20 years, PE returns are again superior – in some cases, by a large margin.

CHART 2: SUPERIOR LONG-TERM RETURNS [2]

Source: See footnote 2

Listed private equity: An innovation for Australian investors

In response to the superior returns offered by PE, while at the same time addressing aspects of the asset class that have previously deterred investors, listed private equity enables private equity investment via publicly traded securities listed on major stock exchanges.

Accordingly, within this listed framework, Listed Private Equity (LPE) overcomes several of the challenges of “traditional” PE. These include:

- As an exchange-traded product, traditionally high minimum investment amounts are no longer applicable, reducing this barrier to entry.

- The listed structure allows ready access to a “permanent” portfolio of underlying PE assets (since the proceeds from investments can be recycled into new transactions) without liquidity, size or timing constraints.

- The flexibility of LPE means exposures can be adjusted dynamically in response to investor preferences, market conditions and the investment exposures of the underlying portfolio.

- LPE can provide diversification of PE exposures across a range of maturities, styles, sectors and geographies with less “cash drag” than traditional PE (whereby performance is typically curbed by capital remaining uninvested early – and often for years – in the investment term of an unlisted fund).

- Transparency is significantly enhanced with LPE, not only by the availability of daily market prices but also due to the strict disclosure, reporting and governance requirements associated with listing on a regulated exchange.

- LPE securities are generally able to provide more predictable cash flows as listed trusts typically pay regular distributions.[3]

PE1 currently holds investments in more than 350 underlying private companies, including six of the world’s top-10 most valuable private ‘unicorns’ (valued at more than US$1 billion).

Companies like Instacart, Stripe, SpaceX, Wise, Uber Freight, ByteDance, and Cotiviti make up some of PE1’s largest positions.

[1] Annualised return (%) (the vertical axis) versus annualised standard deviation (%) (the horizontal axis), 20 years ending 30 September 2019. "Annualised Standard Deviation" is a measure of how much the price of an asset or the return of a portfolio of assets has fluctuated (both up and down) over a certain period. If a portfolio of assets has a high Annualised Standard Deviation, the return of the portfolio of assets has historically fluctuated vigorously. If a portfolio of assets has a low Annualised Standard Deviation, the return of the portfolio of assets has historically moved at a steady pace over a period of time.

Portfolio calculation assumes quarterly rebalancing of stock and bond allocations. Index returns assume reinvestment of coupons. “Global Equity Allocation” represented by MSCI World Index, “Global Bond Allocation” represented by Bloomberg Barclays Global Aggregate Bond Index, “Private Equity Allocation” represented by Burgiss private equity pooled time-weighted returns.

Source: The above graph was prepared by GCM utilising certain information obtained from Burgiss. The graph is based on published 3Q 2019 benchmark data.

Burgiss sources their data from MSCI, Bloomberg Barclays and private equity funds worldwide (the “Burgiss Manager Universe”). The Burgiss Manager Universe includes data from 8,772 global private funds. GCM uploads data into its system used to prepare the above graph one-time each quarter; however, the data service may continue to update its information thereafter. Therefore, information in GCM’s system may not always agree with the most current information available from the data service. Additional information is available upon request. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used to create indices or financial products. This graph is not approved or produced by MSCI. Burgiss, MSCI, and Bloomberg Barclays have not provided consent to the inclusion of statements utilising their data. Past performance is not necessarily a guide to future performance. No assurance can be given that any investment will achieve its objective or avoid losses.

[2] Sources: MSCI, S&P and BURGISS (BURGISS data as of March 31, 2021, downloaded July 21, 2021). United States returns are stated in USD. Europe returns include investments with a focus on the developed world and are stated in EUR. Asia returns include private equity expansion capital investments and are stated in USD. All “Public Market Equivalent” returns were calculated using the Long-Nickels methodology and were obtained from Burgiss. All data shown as net to Limited Partners, unless otherwise noted. Pooled Return (LP): The pooled IRR calculation uses pooled cash flows over the specific horizon period, meaning the data for the funds are aggregated and the return is calculated on the single stream of aggregate cash flows. No assurance can be given that any investment will achieve its objectives or avoid losses. Past performance is not necessarily indicative of any future results.

[3] S&P Dow Jones Indices (2019)

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.