Sources and notes

[i] ASX Investor Study. 6.6 million adult Australians owned shares directly in 2020. In 2000, this was 5.7 million.

[ii] Telstra’s three main stages of privatisation (T1, T2 and T3) ran from 1996 to 2006.

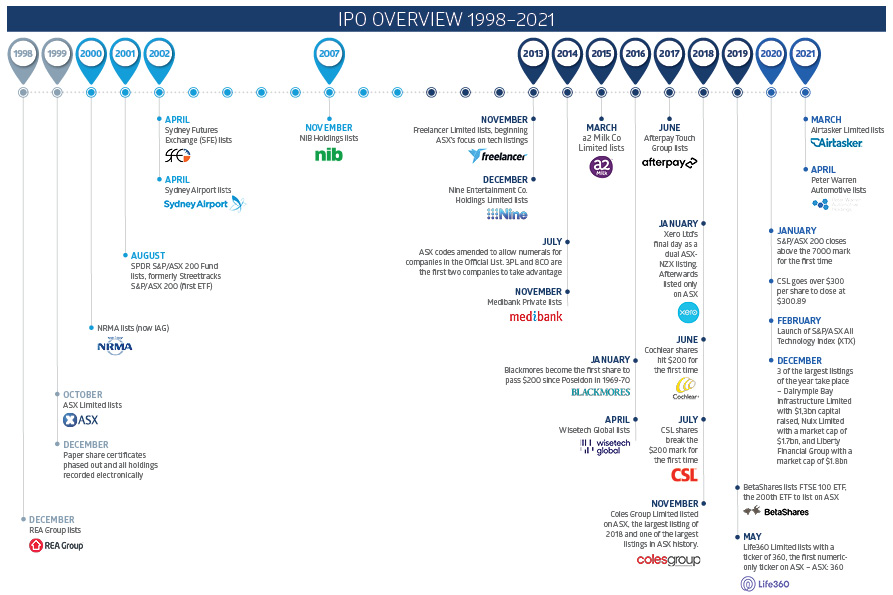

[iii] Xero initially dual listed on ASX through a compliance listing in 2012.

[iv] Based on ASX listings data from October 1998 to March 2021.

[v] Based on ASX listings data from October 1998 to March 2021.

[vi] ASX demutualised on October 13, 1998. It listed on ASX on October 14, 1998.

[vii] Then known as Australian Stock Exchange

[viii] Annual average of new listings on ASX from 2014 to 2020.

[ix] Annual average of IPO capital raised from 2014 to 2020.

[x] Average annual follow-up capital raised from 2014 to 2020.

[xi] Source: Willis Towers Watson Global Pension Assets Study 2020.

[xii] Source: Deloitte and APRA, November 2019. 2019 ^ Projected to 31 December 2038.

[xiii] The ASX Corporate Governance Principles and Recommendations (4th Edition February 2019). Under the Principles and Recommendations, if the board of a listed entity considers that a Council recommendation is not appropriate to its particular circumstances, it is entitled to not adopt it. If it does so, however, it must explain why it has not adopted the recommendation – the “if not, why not” approach.

[xiv] Source: Dealogic. Data at June 30, 2020.

[xv] In 2019. Source: Bloomberg.

[xvi] At 30 June 2020.

[xvii] At April 2020.

[xviii] ASX. Based on IPOs classified in healthcare sector from October 1998 to March 2021. Based on value raised.

[xix] S&P Dow Jones Indices, “Fact Sheet: S&P/ASX 200 Index.” At March 31, 2021.

[xx] S&P Dow Jones Indices, “Fact Sheet: S&P/ASX 200 Index.” At March 31, 2021. Materials had a 19.9% weighting.

[xxi] Closing price April 21, 2021.

[xxii] Source: Dealogic, 1 January to 31 December 2020; Includes placements, SPPs, rights issues. Excludes block trades, convertibles, DRPs, employee share schemes.

[xxiii] At March 2021 rebalance of Index.

[xxiv] Source: BetaShares.

[xxv] Market cap levels at which companies enter and exit indices vary from time to time depending on overall market cap and liquidity levels. These numbers are indicative based on recent historical rebalances.

[xxvi] Indicative values based on eligibility criteria or inclusions at last rebalance. “Company size” is total market cap. Exchange rates at 16 July 2020.

[xxvii] Indicative values based on eligibility criteria or inclusions at last rebalance. “Company size” is total market cap. Exchange rates at 16 July 2020.

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.