[Editor’s note: All data in this article is provided as at 11 March 2022 unless stated otherwise. Do not read the following commentary as a recommendation to buy gold. Do further research of your own or talk to a licensed financial adviser about the features, benefits and risks of including gold in your portfolio. For example, gold doesn’t generate income.]

Gold bullion has started 2022 strongly, up 9%, with the price rising toward US$2,000 a troy ounce and A$2,700.

Multiple factors have driven this year’s rally. The most notable is Russia’s invasion of Ukraine. Other contributors to the gold’s move higher this year include:

- Renewed equity market volatility. The S&P 500 Index in the US is down by 12% year-to-date. In Australia, the S&P/ASX 200 Index has fallen by just over 5% in that period.

- Heightened inflation fears. Soaring oil and commodity prices have sparked fears that we could have higher inflation in 2022.

- Rising global recession fears. The Atlanta Fed’s GDPNow forecast for 8 March suggested first-quarter growth in the United States will be just 0.5%, down from almost 2% in February.

- The fall in the price of Bitcoin. Coinciding with the pullback in sharemarkets, Bitcoin has fallen by more than 40% since peaking in November 2021, according to CoinDesk data. Although it is sometimes marketed as ‘digital gold’, Bitcoin’s price fall highlights that when it comes to a genuine safe-haven asset, real physical gold still has no peer.

Why allocate to gold?

Gold’s strong performance in 2022 is another illustration of the protective qualities it historically offers investors during heightened market volatility.

While gold doesn’t always go up when equities fall or inflation rises, it has a better record than any other single asset class in these environments, as the table below shows.

Historically, gold has delivered returns of more than 15% per annum in years when inflation was 3% or higher, according to Perth Mint analysis.

A study from The Perth Mint analysing five decades of market data found that gold delivered returns of almost 9% in Australian dollars in the quarters that the local equity market fell fastest. Gold also outperformed bonds and cash in those quarters.

Australian asset class returns (%) in 10 worst quarters for equity markets

| Asset Class | Equities | Bonds | Cash | Gold (AUD) |

|---|---|---|---|---|

| Average of 10 worst quarters | -15.0 | 5.5 | 1.8 | 8.8 |

Source: The World Gold Council, Reuters, The Perth Mint

While gold’s protective qualities are widely understood, there is a growth element to gold that deserves attention, reinforcing why it can play a strategic role in diversified portfolios.

Firstly, from a return perspective, the gold price has risen by almost 9% per annum over the last 50 years, according to Perth Mint analysis, outperforming cash, most bonds, and indeed most individual share prices in that time.

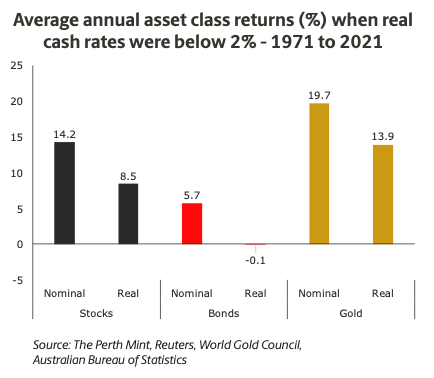

Historically, gold has also been a market leader, outperforming stocks and bonds in environments where real interest rates are 2% or lower, like they are today, with average nominal returns of almost 20% per annum – as the chart below shows.

Finally, it’s worth noting that over the last decade, almost 90% of global gold mine supply is purchased by consumers and central banks in China, India and other emerging markets, according to World Gold Council data. Thus, gold is positively correlated to demand from these regions, which continue to grow at faster rates than more mature, developed market economies.

But isn’t gold volatile?

[Editor’s note. Gold also has investment risks. It does not generate an income, its price can be volatile and it is not always an effective hedge against inflation or a safe haven in times of high market volatility. Currency movements are another consideration for Australian investors who invest in gold funds that are not hedged against currency.]

Alongside the fact that gold doesn’t generate an income, some investors worry about its volatility. While this is understandable, gold has historically been negatively correlated to falling equity markets. Therefore, gold, in theory, typically helps protect portfolios when equities fall.

Long-term gold outlook

Several factors suggest the outlook for gold in the next 10 years is positive, in Perth Mint’s view:

- Expensive financial markets: The S&P 500 ended 2021 trading near record highs based on a range of valuation metrics, while the real yield (after inflation) on a 10-year US treasury bond was below -1%.

- Inflation risks: Inflation is at its highest level in decades, hitting 7.9% annualised in the US in February 2022. Rather than being transitory, spiking commodity prices, continued supply chain issues, onshoring of productive capacity, and Environmental, Social and Governance factors all add upside inflation risk going forward, in Perth Mint’s view.

- Higher interest rates: Contrary to popular opinion, gold typically rallies when interest rates are rising.

Finally, while not a base case, the world could enter another period of stagflation (high inflation, low economic growth). If we do, gold, which averaged returns of more than 20 last time the world faced such an era (in 1973 as the table below shows, may be one of the few assets to not only maintain, but increase in value.

Average real (inflation-adjusted) year on year total returns in stagflationary environments since 1973 (%)

| US Equities | US Treasuries | US T-Bills | Commodities | Gold | REITs |

|---|---|---|---|---|---|

| -1.5 | 0.6 | 0.4 | 15.0 | 22.1 | 6.5 |

Source: Schroders

How to invest in gold

While demand for physical gold coins and bars remains robust, investors are increasingly turning to gold Exchange Traded Funds (ETF) as a way of gaining exposure to the precious metal in their portfolios. There are multiple factors responsible for this trend:

- Ease of access: If you are reading this article you likely already have a brokerage account and trade shares. Via that account, you can add a gold ETF to your portfolio, removing the need to have a separate account just to buy gold or other precious metals.

- Costs: It is typically much cheaper to buy and hold a gold ETF versus buying gold directly.

- Fractionalisation: Gold ETFs make it easier to invest a specific dollar amount into the precious metal. Fractionalisation is particularly relevant for smaller investors, making it easier for them to include gold in their portfolios.

In Perth Mint's view, given the ease of access provided by gold ETFs and the positive price outlook for the precious metal, it would not be a surprise to see demand for gold rise in the years ahead.

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People