[Editor’s note. Do not read the following commentary as a recommendation to buy GREITs. Do further research of your own or talk to a licensed financial adviser about the features, benefits and risks of including GREITs funds or securities in your portfolio.]

Global property securities, otherwise known as Global Real Estate Investment Trusts (GREITs), affords the ability for investors, large and small, to gain exposure to the returns of some of the world’s best institutional grade real estate in a liquid form, managed by the world’s best-of-breed property management teams.

GREITs can play an important role in investment portfolios - delivering competitive risk adjusted through-cycle returns, including a prominent income component. The income component delivered through rental income is supported by the fact that to qualify as a REIT, they have a legislated minimum dividend payout ratio in many jurisdictions where REIT legislation has been enacted.

This return profile is demonstrated in the chart below where Resolution Capital illustrates the total return composition of GREITs, Global Equities, Global Bonds and Australian Bank Bills. It must be remembered that the risk profile of each asset class can and will vary and the chart is not intended to compare risk.

Furthermore, GREITs can provide diversification versus other asset classes and there are many GREIT sectors that are not highly correlated with the Australian residential market such as warehouses, data centres and healthcare facilities.

25 Year Total Return composition to 31 December 2021

Source:Factset

GREITS: FTSE EPRA NAREIT Developed Index in AUD

Global Equities: MSCI World Index in AUD

Global Bonds: Bloomberg Aggregate in AUD

GREITs against a backdrop of rising inflation

Whilst many market commentators have said REITs are a ‘bond proxy’ and highly correlated to movement in interest rates, we think this is merely a convenient catchphrase. The truth is interest rates matter to all investments and the consequences can be complicated.

Critically, to better understand how REITs will behave when interest rates increase, one must consider the state of the real estate market and the shape of the broader economy - in a nutshell supply and demand, as well as the extent of the sector’s financial leverage (debt levels).

Whilst long term interest rates do affect the cost of capital, and provided there isn’t excessive property vacancy levels, a growing economy should drive higher tenant demand to compete for limited space in which case landlords can increase rents at least equal to or greater than the higher costs.

In addition, higher building construction costs also mean that competitive new supply is more expensive to develop as the ‘economic rent’ a developer needs to underwrite a new project also increases. Hence existing building owners are afforded some buffer to the threat of new buildings.

What Resolution Capital can say with a level of confidence, is that property can deliver competitive returns in inflationary environments, provided the underlying property has certain key ingredients, namely that it is relevant to the needs of a growing and healthy economy, and that supply is constrained.

The key ingredients Resolution Capital look for are attractive supply and demand characteristics that create pricing power, strong balance sheets, as well as quality management teams capable of extracting the most value from the underlying land and buildings.

The Resolution Capital Global Real Estate portfolio is currently focused on economically relevant real estate with strong secular tailwinds which benefit from dominant trends such as the ageing population, housing shortages and growing household formation rates, and the growth in digitisation and ecommerce.

A much-needed additional pillar of portfolio strength

Given the impacts of the COVID-19 pandemic and the responses by central banks, rising geopolitical risks and supply chain pressures we view the economy and capital markets to be somewhat distorted.

We can’t predict the outcomes of rising inflation and interest rates with certainty, and no investor can claim to be prepared for all the knowns and unknowns on the horizon. Nor can we fully appreciate the extent of changes and disruption to society as a consequence of the COVID-19 pandemic. Current events in Russia and the Ukraine further highlight the constant that uncertainties are ever present.

This is why we believe effective portfolio diversification is vital.

Pleasingly, we see limited evidence of heightened risks specific to REITs. In general, commercial property vacancy rates are not excessive, supply is moderate and new constructions costs are increasing. Furthermore, and as a generalisation, REIT balance sheets are sound in terms of moderate debt levels and limited short term debt maturities.

Hence, through allocating a part of your portfolio to some the world’s best property, Resolution Capital believes that investors can unlock additional portfolio strength and diversification with the benefit of liquidity.

For many years, the GREIT investment landscape has been largely dominated by institutions. Resolution Capital hopes this asset class will be considered by a broader range of investors whereby investors are given access to unique investment opportunities and some of the world’s best institutional grade real estate - which is why we’ve listed the only active Global listed real estate investment Fund (The Resolution Capital Global Property Securities Fund. ASX: RCAP) on ASX.

The Fund invests in a select portfolio of between 30 to 60 global listed real estate securities. A profile example of 2 US-listed companies in the fund are listed below.

Welltower Inc. (NYSE: WELL)

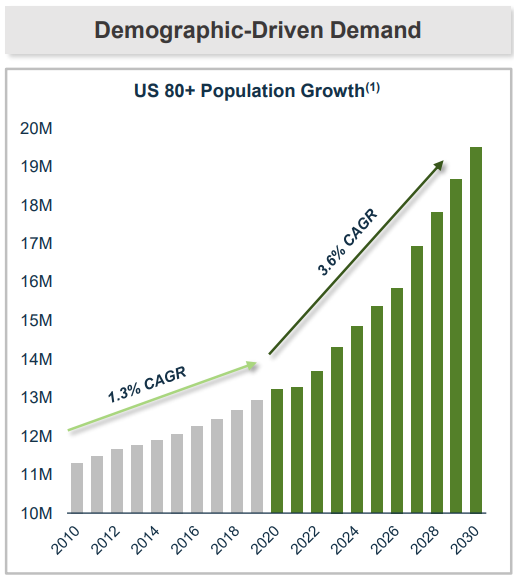

Seniors housing is benefiting from both cyclical and secular tailwinds. Aging populations along with moderating supply caused by COVID-19, rising costs, and less favourable construction finance provides a strong backdrop for existing landlords to grow rents and cash flows in the years to come.

Welltower is the largest diversified healthcare REIT in the US. Around 65% of its portfolio is concentrated in seniors housing.

Prologis Inc. (NYSE: PLD)

The e-commerce trend needs no introduction, and it has led to warehouses seeing unprecedented demand.

Prologis is a global leader in logistics real estate with a property and development portfolio spanning over 90 million square metres located close to major population centres across 19 countries.

Source: Greenstreet

Changes in supply chain management should drive demand for warehouse space along two key thematical lines.

- One, the ongoing reconfiguration of distribution channels to place greater emphasis on proximity to the end consumer. With same day delivery becoming more common, locations that minimise the cost and speed of distribution to the end customer are paramount.

- Two, supply bottlenecks, symbolised by the record number of container ships that were seen sitting off ports around the world towards the end of 2021. This has led to the focus of supply chain management shifting from efficiency to resiliency, with a resultant increase in inventory levels stored in key locations.

US logistics average asking rent % growth (year-over-year)

Source: CBRE Econometric Advisors, Q4 2021.

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.