Bear put spread

One trader is using options with a moderately bearish outlook for the ASX/S&P 200 in 2024. We usually think of options as short-term trading vehicles, but there are already some expirations in 2025 available for trading. The trade we found interesting uses the standard December options expiring on 19 December.

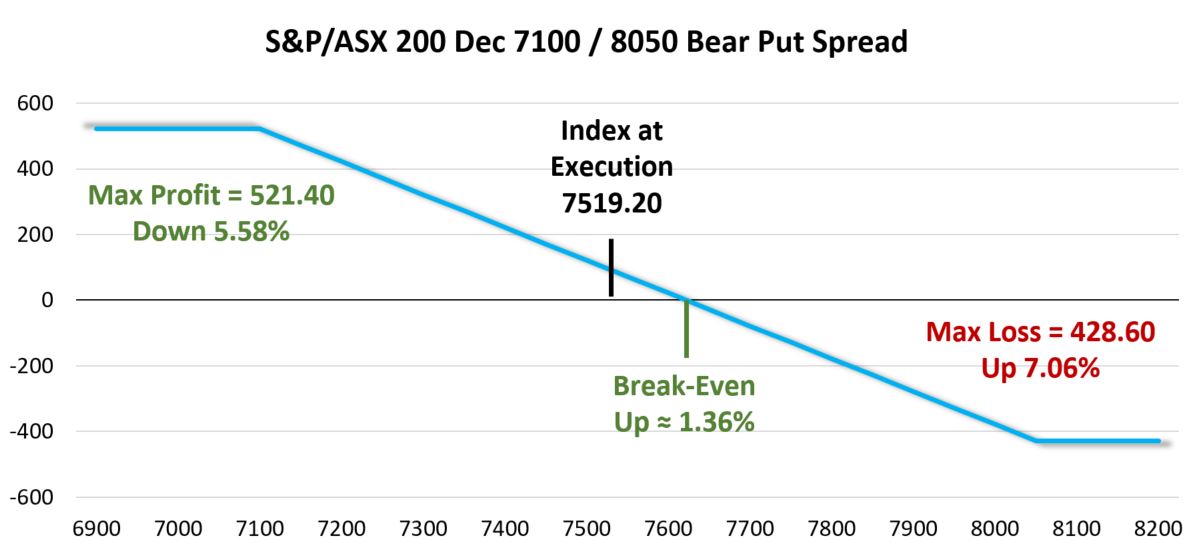

On 24 January, with the ASX/S&P 200 at 7519.20, another trader purchased 490 Dec 8050 Puts for 636.60 and sold 490 Dec 7100 Puts for 208.00, resulting in a cost of 428.60. The payoff the week before Christmas this year is shown below.

Data Source: Bloomberg

The maximum profit for this trade occurs if the index is down 5.58% or more from where it was trading at execution. The risk for this trade is to the upside, in fact even though this is a bearish trade, there is a 1.36% buffer between break-even and the market when the trade was initiated. The worst-case scenario is an ASX/S&P 200 quote at 8050 or higher on 19 December. Most people are bulls, so many would cheer those levels, but this trader would be doing anything but cheering that outcome.

Bull put spread

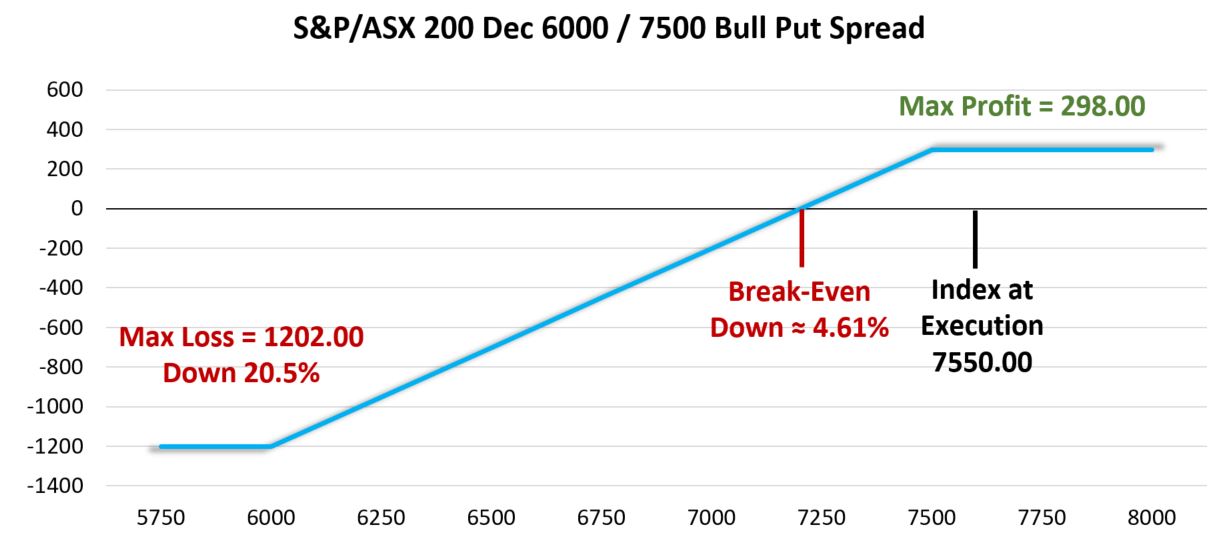

Another longer-dated trade caught our eye at the beginning of the year on 3 January. Again, using the December options, this trader sold 1150 Dec 7500 Puts at 362.00 and purchased the Dec 6000 Puts for 64.00 taking in a credit of 298.00 points. This trade was executed with the index at 7550.00 and the outcome at December expiration is shown below.

Data Source: Bloomberg

Just like the bearish trade discussed above, this trade makes a profit if the market is unchanged at expiration. The downside break-even level is 4.61% lower, which provides a cushion. Market pundits love to talk about markets that are down 20% as this is considered a bear market. In this case a 20.5% drop is needed for the maximum loss of 1202 points. We do not back specific trades, but we think it would be an interesting outcome if both the bullish and bearish trades using December options made a profit. Of course, that would mean a dull market in 2024 and no traders like that.

Butterfly neutral strategy

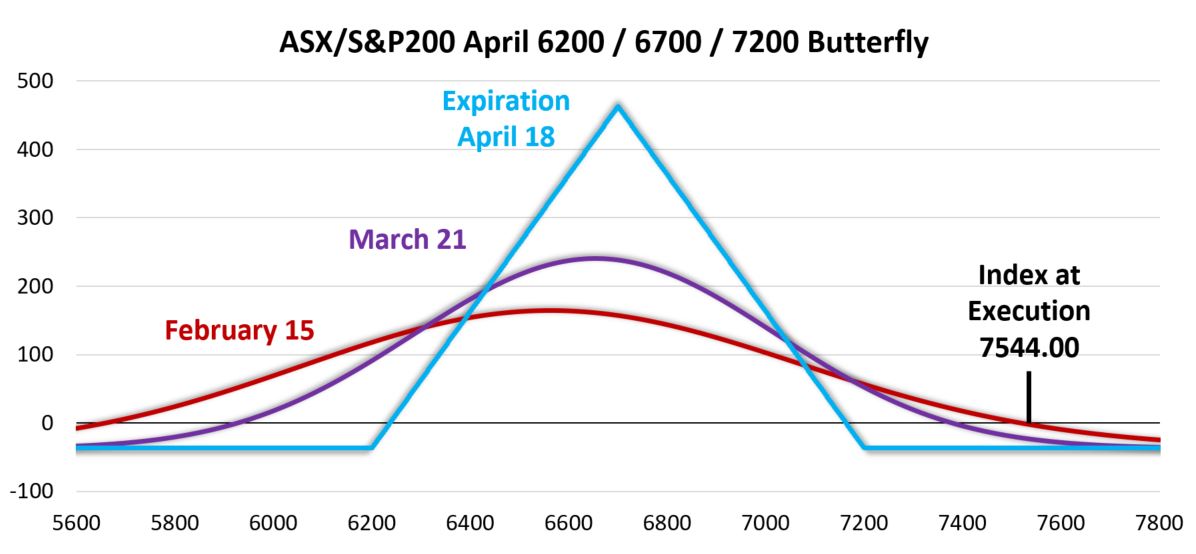

Finally, a more complex trade to finish this month’s overview of interesting option trades. On 25 January, we came across an out of the money butterfly constructed with put options. Specifically, with the ASX/S&P 200 at 7544 a trader sold 1400 Apr 6700 Puts at 13.70 each and purchased 700 Apr 7200 Puts for 59.83 and 700 Apr 6200 Puts for 4.50. The net result is a cost of 36.93.

The payoff diagram below shows the payoff at expiration, but also includes estimated payoffs on 15 February and 21 March. Both those dates are standard option expiration dates.

Data Source: Bloomberg

Typically, a butterfly is put on as a neutral strategy, with the underlying market at a level that would result in a profit at expiration. Note in the payoff diagram, if the index remains at 7544, all the put options expire out of the money at the position loss is equal to the cost of the trade (36.93).

The payoffs on 15 February and 21 March fall short of the maximum payout at expiration, but the range of profitability is much wider. On 21 March, we estimate this trade is profitable between 5935 and 7375. The profitability range widens to between 7520 and 5660. It is likely that if the ASX/S&P 200 approaches 6700 then we will see an exit trade taking profits. Our job is to watch this closely and report back if it appears the trade was exited or was it held through expiration.

Other Insights

This is the first article in a series of trading activity observations in 2024. To receive these insights via email, please subscribe to the ASX Equity Derivatives monthly newsletter.

Disclaimer

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only. Examples used are intended to detail the performance of historic trading strategies. Past performance is not a reliable indicator of future performance. The content does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence. © Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2024.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People