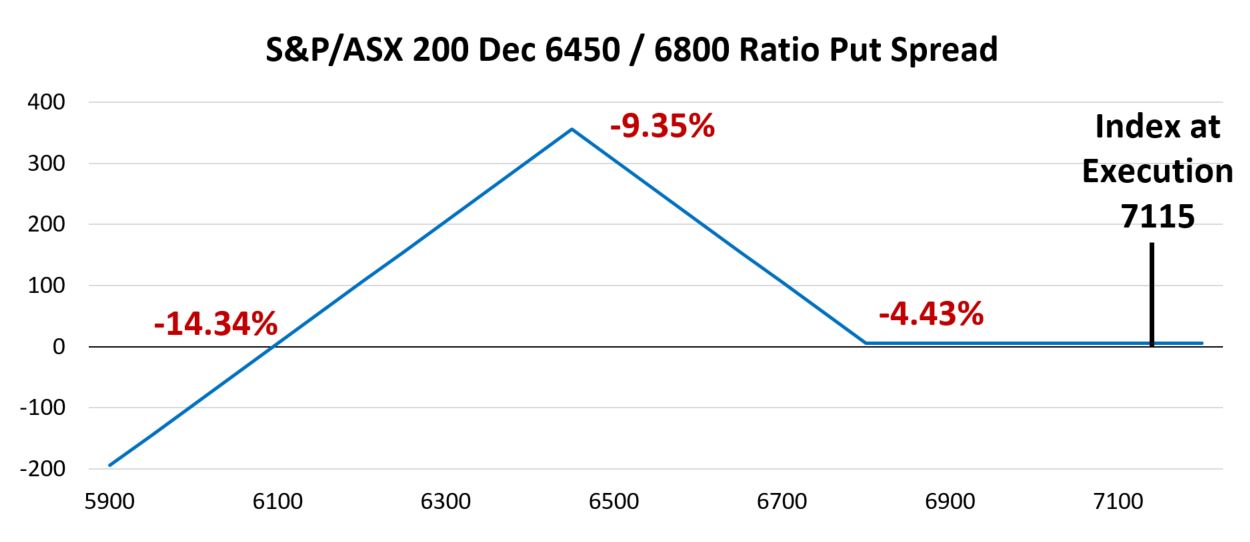

A trade possibly guarding against losses or speculating on a lower S&P/ASX 200 into the end of the year hit the tape on 21 August with the S&P/ASX 200 at 7115. In two lots a trader bought 500 21 Dec 6800 Puts for 117.60 and sold 1000 21 Dec 6450 Puts for 61.60 each resulting in a credit of 5.60 for each 1 x 2 ratio spread.

Data Source: Bloomberg

This ratio spread payoff is 5.60 if the index does not drop more than 4.43% into late December. The best-case scenario is December settlement at the short 6450 strike price. This represents a drop of 9.35% and a maximum profit of 355.60. Finally, this trade breaks even just under 6100, or if the index is more than 14.34% lower than it was when the trade was executed.

We were particularly interested in a couple of trades that were executed less than ten minutes apart on 17 August. With the S&P/ASX 200 around 7143 a trader initiated a condor by selling the 21 Sep 6825 Put for 37, also selling the 21 Sep 6850 Put for 41. The spread was completed by purchasing the 21 Sep 7050 Put and 6625 Put for 93 and 18 resulting in a debit of 33 points and a payoff that is depicted below.

Data Source: Bloomberg

This trade is moderately bearish with a profit at expiration if the index is down between 1.76% and 6.79%. The maximum possible profit of 167 occurs if the index is between 6825 and 6850 at expiration. Of course, if the index rises the maximum loss of 33 points per spread would be realized as would if the S&P/ASX 200 falls below 6625 (a 7.25% drop).

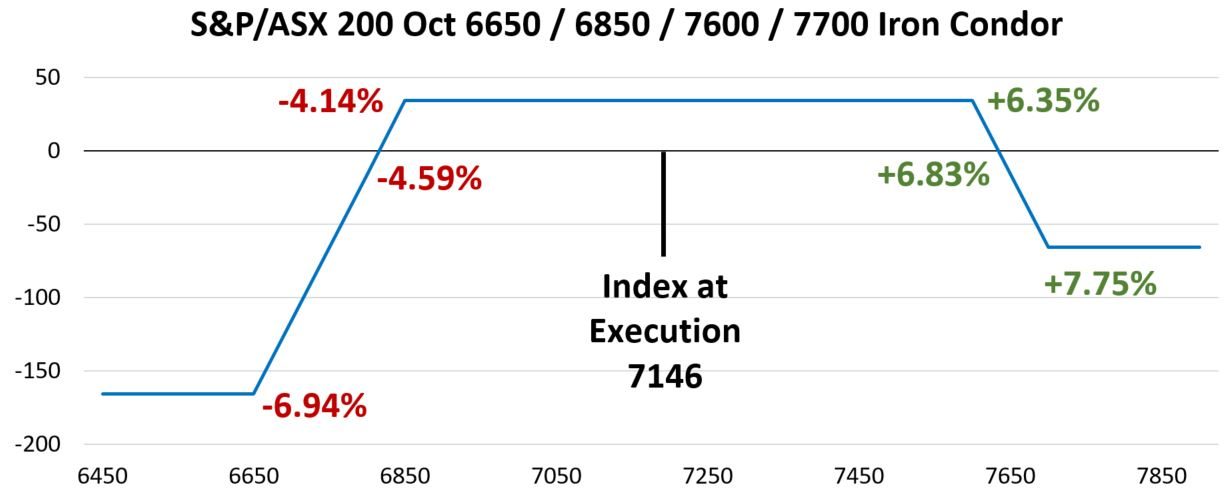

The other 17 August that caught our eye was the same size as the previous spread and is a condor, but this trade is more market neutral and uses the 19 October series. With the index at 7146, a trader sold the 19 Oct 6850 Put for 70 and 19 Oct 7600 Call at 13. The iron condor was completed as the 19 Oct 6650 Put was purchased for 40 and 7700 Call at 9. The net result is a credit of 34 points. The payoff in mid-October shows up below.

Data Source: Bloomberg

First, for clarity, this is officially a broken wing iron condor as the long strikes are not equally distant from the short strikes. On the downside the long 6650 put is 200 points lower than the short 6850 put while the long 7700 call is only 100 points higher than the short 7600 call. This means that the maximum risk on the upside is 66 points, while the risk to maximum loss on the downside and for the trade is 166 points.

The best-case outcome for this trade is the S&P/ASX 200 falling between the short strikes by not losing more than 4.14% or gaining more than 6.35%. There is a little room for partial profits in each direction. The worst-case upside scenario has the index 7.75% higher while a drop of more than 6.94% would result in the maximum loss of 166 points.

Finally, a quick wrap up on a covered call trade from April that we have been tracking in this space. Back on 11 April when Steadfast Group (SDF) closed at 5.98 there was a sale of 55,000 SDF 17 Aug 6 Calls for 0.30 each. The trade is completed, and the options were held until they expired out of the money. The daily price chart below for SDF covers 31 March through 23 August.

Data Source: Bloomberg

The trade date and option expiration data are both highlighted along with the call strike price (6.00). We have a few observations about this trade. First, the 0.30 credit per contract is also the profit for the option trade. The stock closed at 5.98 on the day of the trade in April, so this represents just over 5% of SDF’s share price. Note over the life of the trade the closing high for SDF was 6.16 on 20 June. The offer price for the SDF 17 Aug 6 Call was 0.30 on that day, so the short could have been covered for no loss. Finally, SDF closed at 5.73 on 17 August, 0.25 lower than 11 April, so the 0.30 income offset the lower stock price. Any way you look at it, this was a great call sale.

Other Insights

This is the second article in a series of trading activity observations during the second half of 2023. To receive these insights via email, please subscribe to the ASX Equity Derivatives monthly newsletter.

Disclaimer

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and examples used detail the performance of historic trading strategies, and as such past performance is no guarantee of future performance. The content does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People