A key observation on options market trading was that it reflected equity index activity, but examining the market by flow type reveals some variations in bullishness and bearishness.

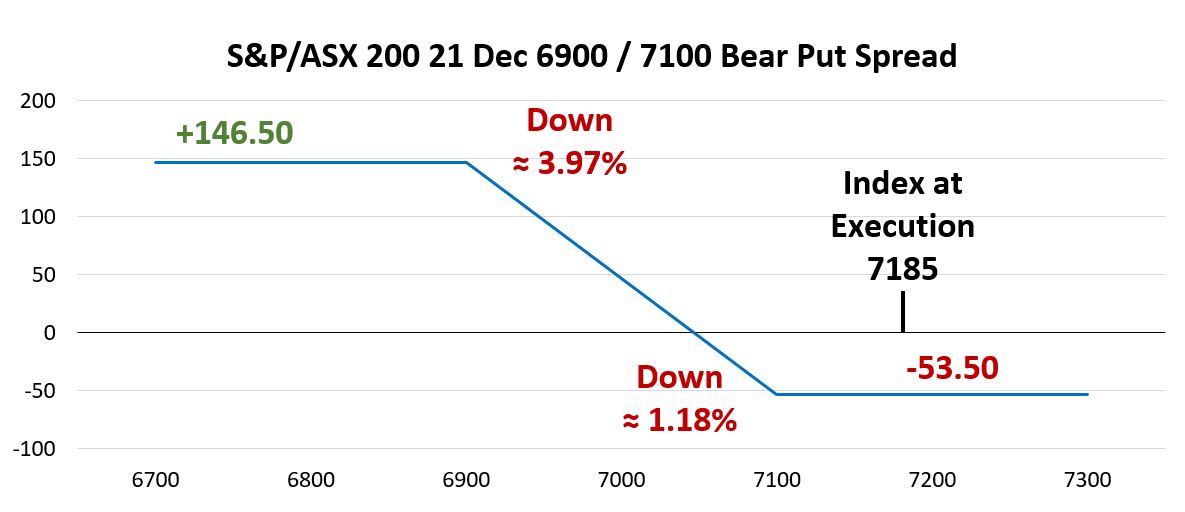

Bearish Sentiment in October 2023 - Executed on 11 September, with the S&P/ASX 200 around 7185, a trader purchased 1200 of the Dec 7100 Puts for 143.00 and sold the same number of Dec 6900 Puts for 89.50. The net result was a cost of 53.50 points – markets have since retreated to 6,800 points with the position now worth 143 points (close to the maximum profit for the trade).

Data source: Bloomberg

Neutral sentiment in September 2023 – Executed on 17 August was a condor, with the index at 7146, a trader sold the 19 Oct 6850 Put for 70 and 19 Oct 7600 Call at 13. The iron condor was completed as the 19 Oct 6650 Put was purchased for 40 and 7700 Call at 9. The net result was a credit of 34 points. The index at expiry opened at 6983 leaving the trader with a maximum profit of 34 points.

Data source: Bloomberg

Trending markets in August 2023 – Trades were recorded between 3 April and 30 June with the S&P/ASX 200 range bound between 7100 and 7400. One of the potential functions performed by options is the ability to profit from a neutral market environment.

The chart below is the daily price action for the S&P/ASX 200, with the dates when trades of interest were executed. Highlighting when markets were neutral iron condors were placed, when charts trended bullish – bear call spreads were implemented, and finally when charts turned lower bull put spreads were placed.

Data source: Bloomberg

While many investors may not have the skills or appetite to implement these trades – having a view as to what options investors are putting their hard earned dollars towards can help give signals as to what may happen in equity markets moving forward.

Our series of investment insights blogs will start up again with Dr Russell Rhoads in early 2024.

Other Insights

To keep up to date on ASX equity market trends and insights including equity derivatives data, subscribe to the ASX Equity Derivatives newsletter

Disclaimer

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2023.