- publish

A verification email has been sent.

Thank you for registering.

An email containing a verification link has been sent to .

Please check your inbox.

An account with your email already exists.

Understanding capital raisings

- Thu 23 April 2020

ASX changes helping listed entities raise equity capital in volatile markets

The Australian Securities Exchange (on 22 April 2020) released a Compliance Update that updated previously announced (31 March 2020) regulatory relief and guidance to support ASX-listed entities and investors during the Coronavirus (COVID-19) pandemic.

ASX has made the changes after discussions with the Australian Investments & Securities Commission (ASIC) and investor groups. The main changes relate to the temporary lift in placement capacity from 15% to 25% in emergency capital raisings. This is currently conditional on ASX-listed entities either doing a follow-on accelerated pro rata entitlement offer or a placement followed by a share purchase plan (SPP) offer at the same or a lower price than the placement.

This is so retail shareholders get to participate in the overall capital raising at a price at least as favourable as the placement.

The latest (22 April) changes allow entities to do a placement followed by a standard rights issue as well - a change intended to benefit smaller listed entities that do not have a substantial base of institutional security holders.

Of particular note to retail investors (who participate in SPPs) is a requirement that entities that take advantage of the capital-raising relief disclose why there is a limit on the amount to be raised under a follow-up SPP offer (if there is a limit) and how it was determined in relation to the total proposed fundraising.

Other changes include entities disclosing reasonable details of the approach they took in identifying investors to participate in a placement and how they determined their respective allocations.

ASX Chief Compliance Officer Kevin Lewis said: “ASX is providing this package of temporary relief and updated guidance to assist listed companies manage their disclosure obligations and to help investors remain informed during this challenging time.

“With the emergency capital-raising provisions, ASX is offering companies the rule flexibility to deal with urgent financial needs, while ensuring ongoing fairness and protection for retail investors. We believe these measures are necessary and pragmatic, and will help ensure Australia’s capital markets continue to be well-functioning.”

Read more about S&P/ASX300 Announcements from 1-22 April 2020

Capital-raising debate

Emergency equity-capital raisings sparked debate during and after the 2008-09 Global Financial Crisis (GFC) and have again in the COVID-19 pandemic.

Proponents of such capital raisings argue that the ability to raise funds efficiently via ASX during periods of high sharemarket volatility is vital to help listed entities weather crises – and that ASX is among the world’s best-performing exchanges in this regard. During the GFC, many ASX-listed entities raised equity capital to survive that downturn.

Critics contend that emergency equity capital raisings favour institutional investors too much at the expense of retail investors. Eligible retail shareholders may not able to buy enough stock in a capital raising and the value of their shareholding can be diluted. Capital-raising fees can be another issue.

Ultimately, boards of ASX-listed entities have to weigh up the pros and cons of emergency capital raisings for their organisation – and consider the interests of different stakeholders. These include small and large shareholders, as well as employees, customers, suppliers and other stakeholders that rely on the company and its survival.

John Price, Commissioner, Australian Securities & Investments Commission (ASIC), said in media release on March 31, 2020: “… Directors need to ensure the capital raising is in the best interests of the company and companies need to make sure they are keeping the market informed via continuous disclosure announcements, even when they are in suspension.”

To help retail shareholders understand the capital-raising changes, ASX Investor Update canvassed legal, capital markets, governance and retail-shareholder experts for their perspective. Their views appear later in this article.

Capital-raising terminology can be complex, so the commentary below begins by explaining key terms, updates readers on capital-raising trends during COVID-19, and provides examples to help retail investors understand how capital raisings work.

Capital-raising changes and terminology

An important change in the ASX regulatory relief is the temporary uplift in the 15 per cent placement capacity rule (in ASX Listing Rule 7.1) to 25 per cent, subject to there being a follow-on accelerated pro rata entitlement offer or Share Purchase Plan (SPP) offer.

- A placement is an allotment of shares made directly from a company to investors, to raise equity capital. Only Sophisticated, Professional or Experienced Investors (as defined by The Corporations Act 2001) can buy shares through placements.

- A pro rata entitlement offer means a company’s shareholders are entitled to buy more shares in the company on a pro rata basis. A 1-to-5 offer for example, provides an entitlement to buy one new share for every five currently owned.

- A renounceable pro rata entitlement offer means shareholders can trade or sell their “entitlement” or “right” to buy shares in the capital raising to other investors.

- A non-renounceable pro-rata entitlement offer means shareholders cannot trade or sell their rights to buy shares in the capital raising.

- A Share Purchase Plan allows eligible current shareholders to buy a capped amount of shares in a company’s capital raising at a pre-determined price. SPPs are often used alongside a placement in capital raisings. Retail investors buy shares through the SPP and institutional investors, such as fund managers, buy through the placement.

- An underwritten offer is one where a party, such as an investment bank, agrees for a fee to buy any unsold shares in an equity capital-raising offer.

Simply put, ASX-listed entities are now temporarily able to raise more equity capital without shareholder approval, in response to COVID-19, provided certain conditions are met.

The effect of these conditions is to ensure all security holders, including in particular retail security holders, are offered the opportunity to participate in the capital raising at the same or a lower price than security holders participating in the placement.

How investors can access equity capital raisings

Retail investors who want greater access to equity capital raisings should consider whether they meet the Sophisticated Investor test as required under Section 708 of The Corporations Act 2001.

A Sophisticated Investor has:

- gross income of $250,000 or more per annum in each of the previous two years, or

- net assets of at least $2.5 million

You need a Qualified Accountants Certificate to show you are a Sophisticated Investor.

It is possible that some retail investors might not realise they could meet the test to be a Sophisticated Investor and invest in listed-company capital raisings through online platforms such as Fresh Equities, which aggregates access to public-market placements in one place.

Fresh Equities says it offers access to more than 50 per cent of deals for all eligible Sophisticated/Professional investors regardless of their existing broker relationships.

Fresh Equities (pursuant to the Corporations Act) can only deal with people who qualify as Wholesale clients and are Sophisticated or Professional investors.

Eligible retail shareholders who cannot meet the Sophisticated Investor test can still participate in the offer’s SPP or rights issue and should ensure they follow company announcements on the capital raising and are receiving shareholder correspondence from their company (through up-to-date contact information).

Capital raisings during COVID-19

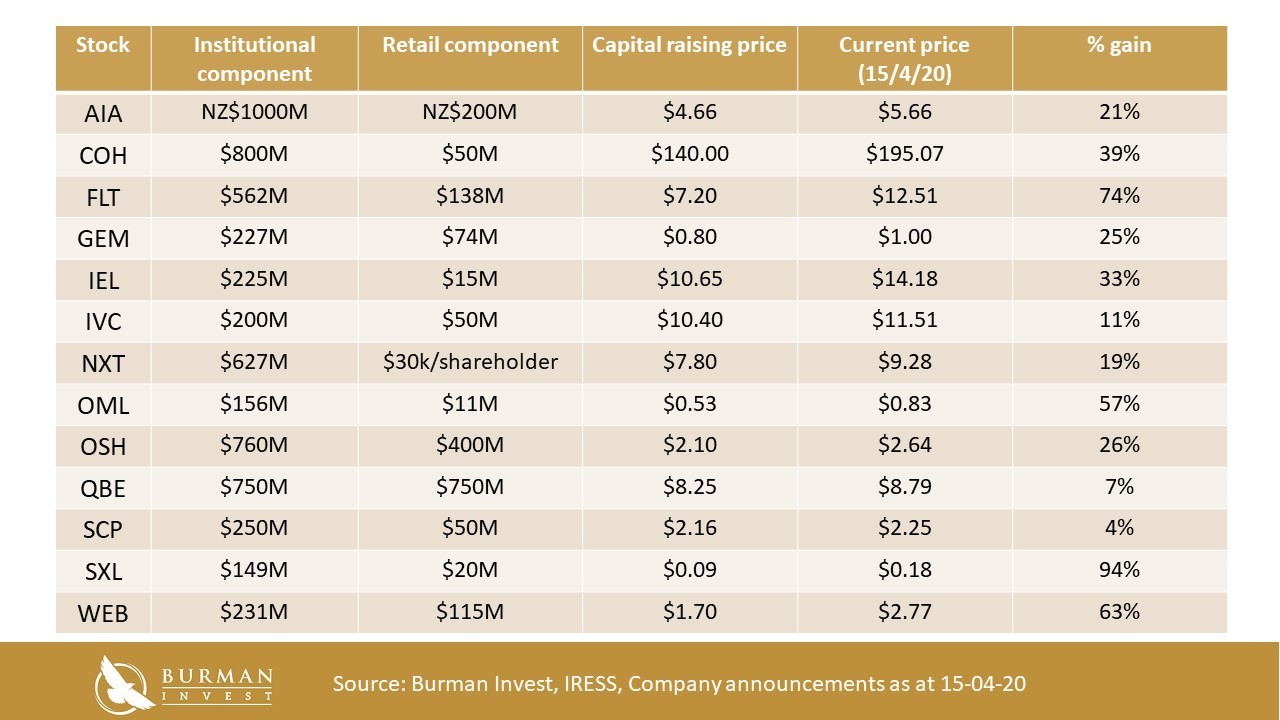

The table below shows how more than a dozen companies in the S&P?ASX 200 index have raised (or are seeking to raise) equity capital during COVID-19, as at 15 April 2020.

Hearing-device manufacturer Cochlear (ASX Code: COH), for example, on 26 March 2020, announced it raised $880 million from a successful fully underwritten institutional placement (the offer size was increased from the expected $800 million due to investor demand).

On 1 April 2020, Cochlear announced an SPP for Cochlear shareholders up to a maximum of $30,000 new fully paid ordinary shares per eligible shareholder (without incurring brokerage or transaction costs).

The SPP aimed to raise up to $50 million. Eligible retail Cochlear shareholders can subscribe for shares at $140 each – the same price offered to institutional shareholders through the placement. The SPP was not underwritten.

Cochlear expects its SPP offer to close on 23 April 2020. The company said it may decide to accept applications that result in its SPP raising more or less than the targeted $50 million.

Why companies issue more stock to institutions in capital raisings

In the following hypothetical example, a listed company needs to raise capital quickly to strengthen its balance sheet during the COVID-19 pandemic. Market volatility is high, the company’s share price has halved and uncertainty about COVID-19 is rampant. The Board is concerned the company might not survive the crisis as its revenue falls.

The fastest way to raise capital is to offer shares to the company’s largest shareholders – typically institutional investors such as Australian superannuation funds, through a placement.

The investment bank that raises capital for the company underwrites the placement because it is confident institutional investors will buy the shares at the offer price.

The company offers less stock in the capital raising to its retail shareholders through an SSP because their collective ownership of the company is far less than that of institutional shareholders. Also, it takes longer to raise capital from retail shareholders and there is no guarantee they will subscribe for all the shares in an SPP.

Due to greater market uncertainty with the SPP, the offer is not underwritten.

The company estimates that 80 per cent of its shares are owned by institutions and 20 per cent by retail investors. It allocates $400 million of its $500 million targeted equity capital raising to institutional investors and $100 million to its eligible retail shareholders.

The successful equity capital raising means the company now has more shares on issue, some of which were issued at a significant discount through the offer.

Institutional and retail investors who bought stock at a discount to the share price (before the offer) benefit if the share price rises.

But some retail shareholders find the value of their shareholding has been “diluted” because there are now more issued shares. Dilution of retail shareholders is a recurring criticism of emergency capital raisings.

Deciding when and how much capital the company should raise, and how to balance the needs of different stakeholders in the offer – in conditions of high uncertainty during the COVID-19 pandemic – is a complex decision for boards.

Following are three industry perspectives on the capital-raising changes.

Kirsty Mactaggart, Independent capital markets adviser with more than 25 years’ experience, non-executive director and governance adviser

“In announcing emergency capital-raising relief measures, ASX is providing an important tool to companies to accelerate access to equity capital and to reduce capital-raising risks. ASX has pro-actively relaxed the framework for Australian listed entities to help them navigate volatile markets during COVID-19.

The onus remains with the boards of individual companies to decide how they operate within that framework.

Boards must balance the company’s needs to survive the COVID-19 crisis with the needs of majority and minority shareholders - securing access to guaranteed equity capital may be the number-one governance priority for some companies.

Boards must also consider how the capital raising affects all stakeholders; for example, if raising equity early helps more employees keep their job, customers get access to products or services they need, suppliers get paid on time, it will also help the company to emerge stronger, post crisis. This issue is not only about the impact on shareholders in the short-term - all stakeholders should become re-aligned in the long-term.

In my experience and to date, the majority of boards are managing to get the best possible result for all shareholders. They are not blindly following the advice of bankers or corporate advisers, and are cognisant of market scrutiny of the company’s capital-raising approach during the COVID-19 crisis.

From mid-March, equity capital raisings were via placements and almost all of them attached a share purchase plan to ensure retail shareholders were offered participation at the same price as institutional investors in the placement.

From early April when a few deals got done and market volatility settled, most Boards have opted to raise the majority of equity via rights offerings.

Rights offerings were simply not an option at the start of this crisis as there was no appetite from banks to underwrite over the three-week retail rights offer period. This may change again and will move with market performance and volatility. Boards will have to react and approve what is appropriate, at that time.

I believe companies so far have done a much better job during COVID-19 than they did in the GFC in terms of explaining the full suite of measures that have been taken to address the impact of COVID-19. There have been detailed investor updates from companies on their debt facilities, dividend policy and initiatives to reduce operating and capital expenditure. The equity capital raising should always be the final part of a full package.

I am, however, concerned that large shareholders who have board seats on a company (and are deemed ‘insiders’) cannot participate in placements. In my opinion, such shareholders should be able to participate, at least for their pro-rata and not have dilution forced on them. It sends the wrong message when a key shareholder is prohibited from participating in, and supporting, a placement in a crisis.

Overall, the capital-raising changes offer Boards the flexibility required and should help ASX-listed companies during the COVID-19 pandemic.”

“King & Wood Mallesons had a significant role in advising on equity capital raisings during the 2008-09 GFC. It was clear from the GFC experience that the ability of listed Australian companies to raise equity capital efficiently and effectively via ASX was a valuable advantage when you do a global comparison.

I believe the same will be true during COVID-19. ASX and ASIC have announced strong and sensible measures to help listed entities raise equity capital during a period of immense uncertainty and volatility resulting from the COVID-19 pandemic.

David Friedlander, Head of Australian public mergers and acquisitions, King & Wood Mallesons

It is easy to speculate on whether some investors benefit too much at the expense of others or criticise the changes in hindsight, but the measures are weighted towards broader participation. Ultimately, all shareholders benefit if a company survives because it raised sufficient equity capital via ASX.

Retail shareholders have more opportunity in COVID-19-related capital raisings compared to those during the GFC. The maximum entitlement available to an individual securityholder through an SPP over a 12-month period is $30,000 (after ASIC doubled the amount in August 2019. The cap was $5,000 until June 2009) and can even be refreshed.

The $30,000 cap is a significant amount, particularly for smaller retail shareholders who would get less opportunity in a rights issue.

Also, the changes are designed to ensure eligible retail shareholders can participate in the equity capital raising at the same or a lower offer price as institutions. I think the positives far outweigh any negatives in the changes.

We advise many boards on equity capital raisings and have watched directors agonise over fairness questions in these offers. In my opinion, boards are cognisant of the need to balance the interests of small and large shareholders in capital raisings, and alert to the problem of diluting retail shareholders who do not participate in offers or are scaled back.

The board’s base case is usually to do a renounceable rights issue so that all shareholders are treated equally, but volatile markets are rarely conducive to renounceable offers.

The least dilutive capital-raising option from a discount and opportunity perspective is a placement to institutions and an SPP to retail shareholders, where all eligible shareholders are able to subscribe for new shares at or below the institutional price.”

Julia Lee, Chief investment officer and founder of Burman Invest and well-known sharemarket commentator and educator for retail investors

"There has been a much larger allocation of capital raisings going to institutional investors and retail investors have been missing out. I suspect retail investors would be disappointed with the amount of stock being offered given the big share-price gains since the capital raisings.

Some offers are better than others. NextDC (NXT) is one of the better ones in my opinion, where the retail allocation is uncapped and retail investors can get the full $30,000 if they apply for it."

"Other capital raisings indicate that they will scale back retail-investor allocations if there is too much demand. In some offers, less than 10 per cent of new stock has been allocated to retail investors.

That said, I recognise these are difficult, volatile conditions for companies to raise funds and that speed to market is vital with capital raisings.

I understand why companies go straight to their largest shareholders when they need more capital, but that is no excuse to allocate too small a proportion of the raising to retail shareholders, some of whom might have large sums to invest.

I also recognise that the institutions that receive most of the stock in capital raisings are often investing superannuation money, so small investors benefit in that sense. But companies should not overlook the needs of retail shareholders who invest actively and directly in shares.

It would be great in this technology-driven age if there was a platform that allowed shareholders to bid for stock at the same time as institutional investors so that companies can get access to capital quickly and retail investors do not necessarily have to miss out.”

S&P/ASX300 Announcement summary, 1 – 22 April 2020

- 39 companies provided business updates surrounding COVID-19 impact (refer to table below)

- 13 companies updated or withdrew FY20 guidance (ABC, REG, TLC, CGC, HPI, ADI, SVW, CPU, CIP, CMW, COF, HSN, NSR)

- 7 companies deferred their dividend (HLS, FXL, GEM, BOQ, SEK, MVF, REG)

- 1 company cancelled their dividend (HVN)

- Across all ASX-listed companies, 44 companies raised capital totalling $5.6bn (refer to table below)

- Crown Resorts (CWN), Downer EDI (DOW) and Sydney Airport (SYD) announced new bank loan facilities

- Virgin Australia (VAH) entered Voluntary Administration

- Telstra (TLS), Unibail Rodamco (URW) and Atlas Arteria (ALX) issued Eurobonds to a combined value of €2.4b

- Wesptac (WBC) and Oceana Gold (OGC) announced new appointments of CEO, with Insurance Australia Group (IAG) announcing their CEO will retire by year end.

Search and view market announcements

| COVID Update | |||

|---|---|---|---|

| A2M | BSL | MAH | SGF |

| AD8 | CCL | MMS | SGR |

| ALG | CGC | MVF | SKC |

| AMA | CWN | MYR | SVW |

| APT | FNP | NIC | TAH |

| APX | HT1 | NWL | TWE |

| ASB | HVN | OGC | VRT |

| AUB | IEL | OSH | WSA |

| AVH | IVC | QUB | WTC |

| BEN | JIN | SEK |

| Capital Raise | |||

|---|---|---|---|

| AEI | EOS | MP1 | REH |

| AIA | ESE | MTS | RHC |

| ATU | FLT | MX1 | RHP |

| BAP | GEM | NCZ | SCP |

| BRN | HGL | NTU | SO4 |

| CAJ | IEL | NXT | ST1 |

| CDY | INF | OSH | STM |

| CIP | IPD | PAR | SXL |

| DCN | IVC | PET | VGL |

| DGO | KMD | PPE | VHT |

| EOL | KZA | QBF | WEB |

About the author

Tony Featherstone, ASX Investor Update

Tony Featherstone is a former managing editor of BRW, Shares and Personal Investor magazines. He has been Consulting Editor of ASX Investor Update for more than a decde. The views expressed in this article are his alone.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People