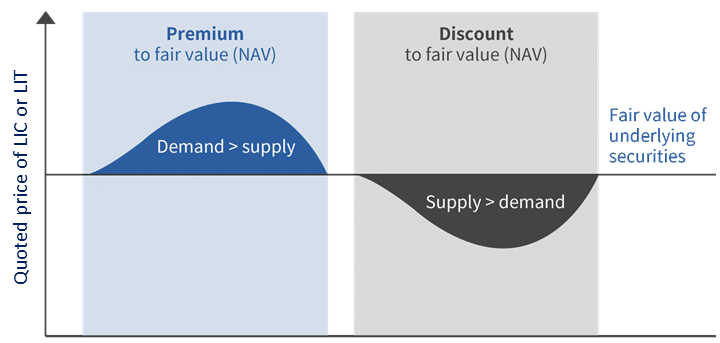

LIVs often trade at a premium or discount to the value of their underlying assets.

The value of a LIV’s shares is usually referred to as the fund’s net tangible assets (NTA). A fund’s performance is usually assessed on a combination of the performance of the underlying investments and the market premium or discount to the fund itself.

The on-market price of a LIV is closely related to its NTA, but can be impacted by a number of factors, independent of the NTA, such as investor sentiment and market cycles. There are a range of reasons why a LIV may trade at a premium such as market perceptions of sound management. If you decide to pay a premium, it is important to have reasons for doing so.

When a LIV trades at a discount, it could be due to poor performance, market concerns about management, low liquidity or other factors. When your LIV trades at a substantial discount, it can be difficult for you to sell your holding for a price that you would like.

The ASX requires LIVs to publish their NTA within 14 days from month’s end.

Read more