Bearish Trade

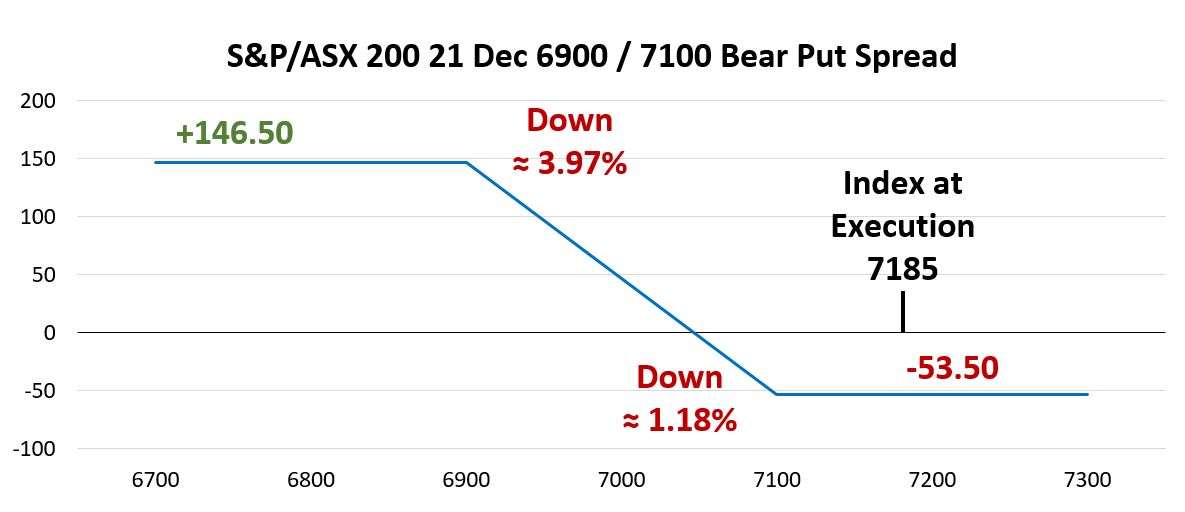

Our bearish representative was executed on 11 September. With the S&P/ASX 200 around 7185 a trader purchased 1200 of the Dec 7100 Puts for 143.00 and sold the same number of Dec 6900 Puts for 89.50. The net result is a cost of 53.50 and the payoff at December expiration depicted below.

Data Source: Bloomberg

The worst-case scenario at expiration for this trade is if the S&P/ASX 200 is not lower by 1.18% or more resulting in a loss equal to the cost of the trade (53.50). The long strike represents the goal of this trade, a drop of at least 3.97% which results in a maximum profit of 146.50.

Bearish-Neutral Trade

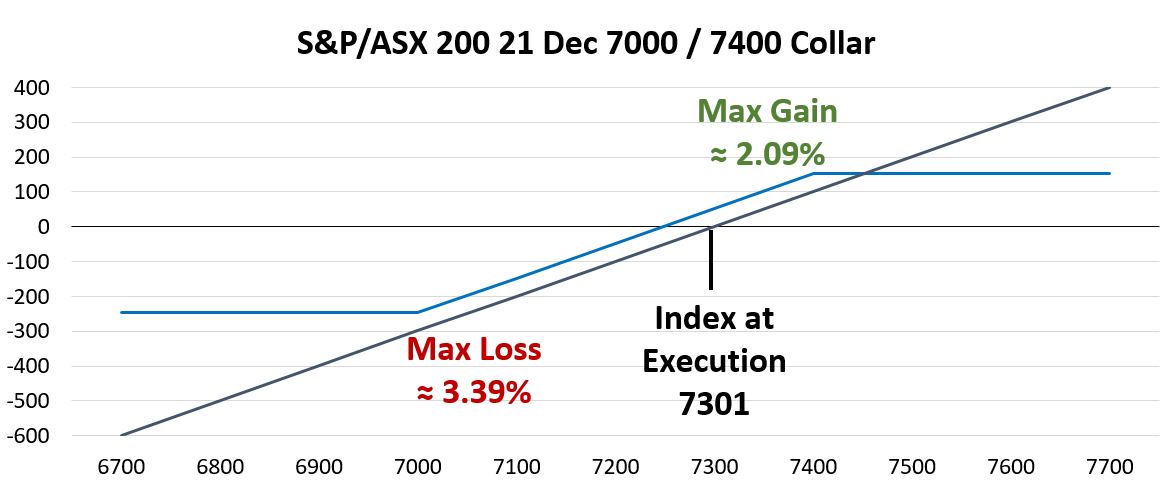

This trade is classified as bearish-neutral as it will profit from both no move or a drop in the S&P/ASX 200. On 4 September, with the index at 7301 a trader sold 700 Dec 7400 Calls for 147.00 each and purchased the same number of 7000 Puts for 95.50. This trade brought in a credit of 51.50 which is realized if the index closes between the two strike prices at expiration. Other significant levels show up below.

Data Source: Bloomberg

This spread starts to make more than the 51.50 credit after moving below the put strike price (7000) which is 4.12% lower than where the index was when the trade was executed. An upside move of more than 1.36%, results in the short 7400 Call in the money and potential losses for this spread.

There is no way of knowing for sure, beyond discussing this trade directly with the entity behind it, but it is quite possible this trade is collaring a long position. A second payoff diagram for this trade appears below which combines the performance of the S&P/ASX 200 with the long put and short call.

Data Source: Bloomberg

Combining the spread with a long position in the index results in profits capped at +2.09%, if the index is over 7400. Losses will be limited to 3.39% based on the long 7000 Put offsetting losses below that level.

Neutral Trade

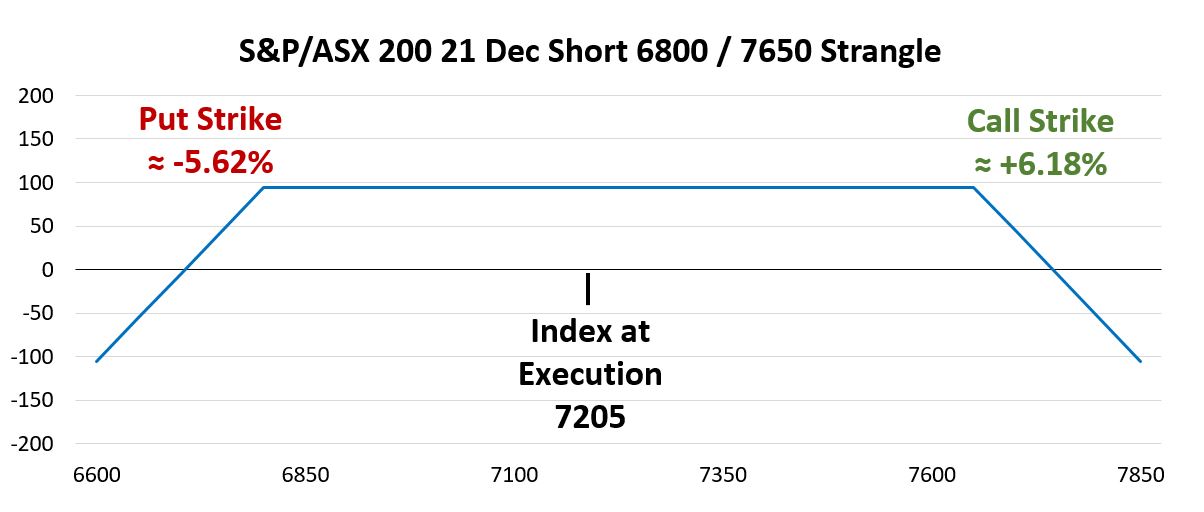

The neutral trade highlighted here consists of shorting 2500 Dec 6800 Puts at 60.00 and shorting 2500 7650 Calls at 34.50, for a net credit of 94.50. This trade was executed on 19 September with the index around 7205.

Data Source: Bloomberg

The maximum profit is equal to the 94.50 credit received at trade execution. The put strike is 5.62% lower and call strike 6.18% higher than the index at execution. This is a very wide range for both options to expire out of the money. The risk is a large move in either direction, plus there is no protection against losses in either direction. For many traders, an iron condor, buying farther out of the money call and put for protection makes more sense than a short strangle.

Finally, on this neutral trade, we decided to look at the strike price levels relative to history. Last time the S&P/ASX 200 was below 6800 was late October 2022 and the all-time high is 7628.92 (August 2021), just below the short call strike of 7650. Anything can happen, but those price levels appear to be based on historical levels that may offer some confidence around the strikes chosen for this short strangle (noting that past performance is not a reliable indicator of future performance).

Bullish Neutral Trade

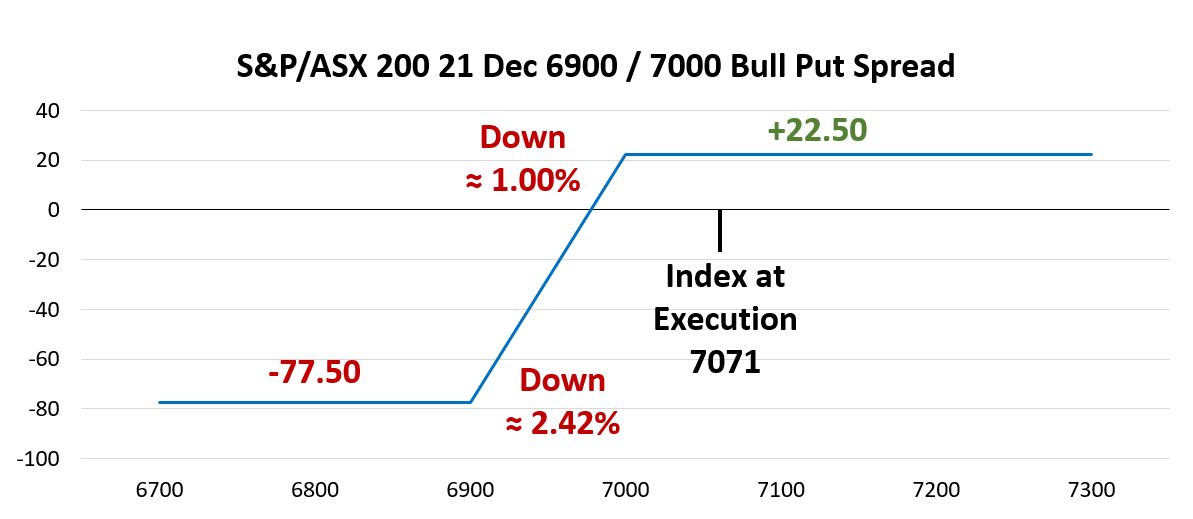

On 21 September, with the S&P/ASX 200 at 7071, a trader sold 500 Dec 7000 Puts for 126.50 and purchased the same number of 6900 Puts for 104.00 taking in a credit of 22.50. This trade profits by the credit received as long as the index is over 7000 at 21 December expiration.

Data Source: Bloomberg

The short put strike (7000) is 1.00% lower than where the index was at execution. This trade realizes the maximum profit of 22.50 if the index does not drop by more than 1.00%. Losses are capped at -77.50 if the index is 2.42% lower or at 6900 or below at option expiration.

Bullish Trade

Finally, the most difficult trade to find among the five categories was a bullish trade. That may be because investors that own stocks are bullish by default. However, on September 21, with the index at 7073, a trader executed an out of the money bull call spread. The specific trade purchased 500 Dec 7300 Calls for 93.00 and sold 500 Dec 7450 Calls for 45.00 resulting in a net cost of 48.00 per spread.

Data Source: Bloomberg

This bull call spread deserves the term ‘bullish’ as the long strike is 3.21% higher than where the index was when the trade was executed. The break-even level is not highlighted on the payoff diagram, but it is 3.89% higher at 7348. A maximum profit is realized if the index rises 5.33% or more, topping the 7450 level.

Other Insights

This is the third article in a series of trading activity observations during the second half of 2023. To receive these insights via email, please subscribe to the ASX Equity Derivatives monthly newsletter.

Disclaimer

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only. Examples used are intended to detail the performance of historic trading strategies. Past performance is not a reliable indicator of future performance. The content does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.