This article delves into the details of the top three proposed innovations.

1. Removal of the opening auction stagger

Major global stock exchanges commonly have opening auction mechanisms in place, and ASX is no exception. But what sets us apart is the method we use to stagger the opening times of the cash equity market. This process involves categorising listed companies alphabetically into five groups, each with a designated time slot:

| Group 1 | 10:00:00 am +/- 15 secs 0–9 and A–B |

| Group 2 | 10:02:15 am +/- 15 secs C–F |

| Group 3 | 10:04:30 am +/- 15 secs G–M |

| Group 4 | 10:06:45 am +/- 15 secs N–R |

| Group 5 | 10:09:00 am +/- 15 secs S–Z |

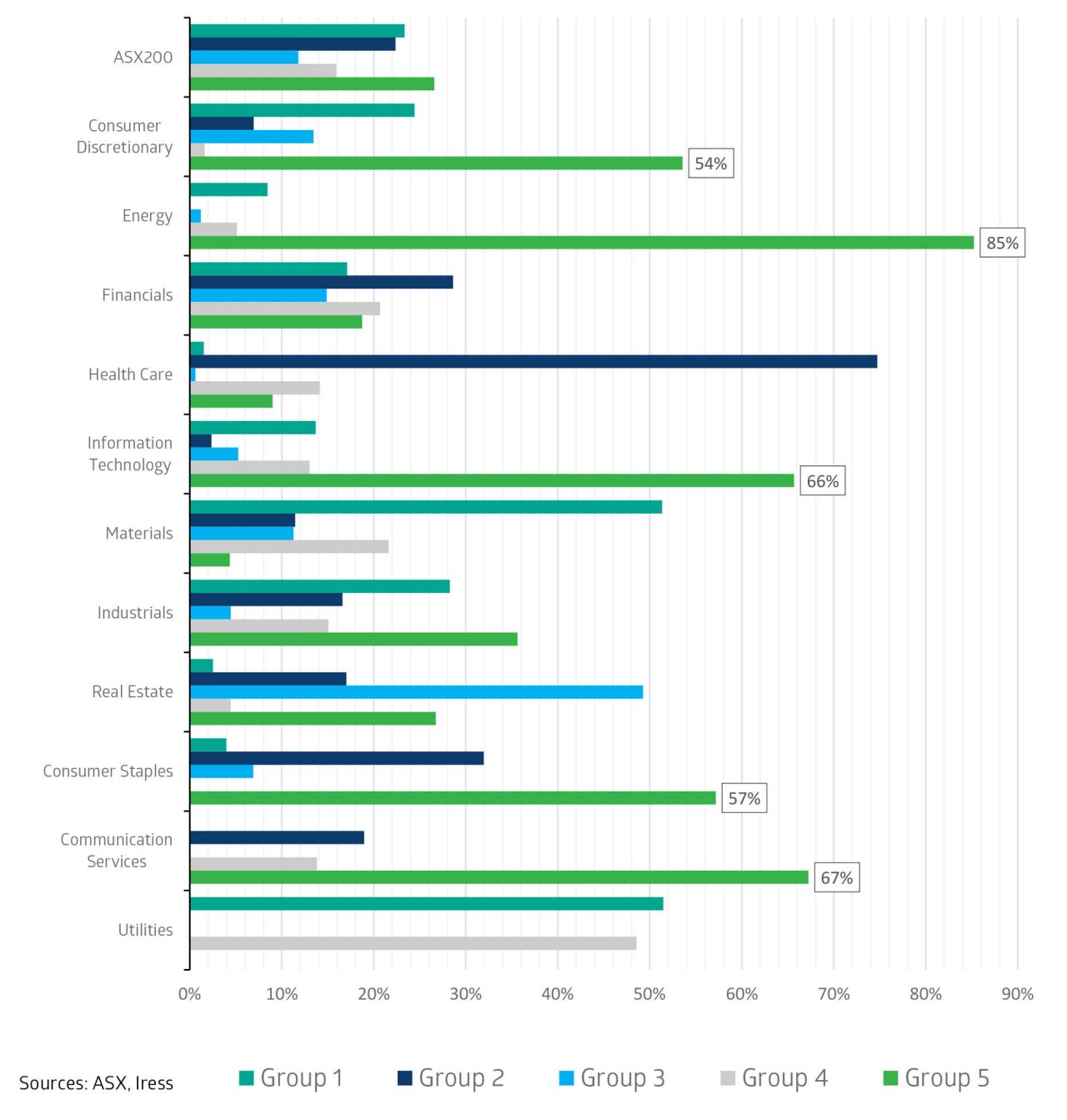

The staggering of opening times happens between approximately 10:00 am and 10:09 am, providing a systematic structure to the process[1]. As Chart 1 shows, this creates unique market features at the start of the trading day.

- Approximately 27 per cent of the ASX200 by market capitalisation isn’t open until Group 5 or around 10:09 am.

- In five sectors – Consumer Discretionary, Energy, Information Technology, Consumer Staples, and Communication Services – more than 50 per cent of their index by market cap isn’t open until Group 5 or around 10:09 am.

- Notably, 85 per cent of the entire Energy sector by market cap isn’t open for trading until Group 5.

With ASX as Australia’s primary listing exchange and where most of the price discovery is formed, moving to a single, randomised open at around 10:00 am means the market will not have to wait until all five groups are fully open to make timely decisions. This change can reduce volatility, increase liquidity, and potentially improve spreads for investors.

Chart 1: ASX Open Auction (Groups) - Distribution by Sector

2. Introduction of a new Post Close trading session

The ASX Closing Single Price Auction (CSPA) at the end of each trading day provides an efficient opportunity for price discovery. It is one of the important liquidity events of the day, accounting for approximately 24 per cent[2] of the total value traded. (Learn more about the benefits of the CSPA.)

Following the completion of the CSPA, there is often a residual balance of liquidity on the bid or offer. ASX’s internal analysis estimates that during the last financial year, $21 billion[3] of unexecuted residual orders remained outstanding.

In response to customer requests, ASX is proposing to introduce a Post Close trading session, which will take place immediately after the existing closing auction schedule.

The proposed changes include the following.

- Residual buy or sell orders left over following the closing auction will automatically qualify for the Post Close session and, importantly, be fully transparent in the lit market.

- The price will be fixed at the same level just set by the CSPA.

- Queue priority for residual orders will be preserved into the Post Close session.

- Existing orders that were in the CSPA but not at the closing price – for example, 1 cent away – will be permitted to amend their price to the (fixed) level and can potentially trade as contra flow or join the existing queue priority.

- Any client wishing to place new orders at the fixed CSPA price will be allowed to do so, adding greater flexibility and choice.

- As illustrated in Chart 2, ASX proposes that the Post Close trading session lasts for 10 minutes after the current CSPA.

Chart 2: Proposed timeline for the Post Close trading session

3. Closing auction enhancements to handle company announcements

Under existing ASX rules, any ASX-listed company publishing a market-sensitive announcement must undergo a brief

10-minute ‘trading pause’, known as PRE_NR (or 60 minutes for announcements relating to takeovers and schemes of arrangement). This pause allows the market to review the new information for full dissemination before the resumption of trading.

If a company issues such an announcement during the existing PRE_CSPA window, the corresponding security essentially misses its own auction due to the aforementioned 10-minute pause. This situation could create unintended frustration for investors who were unable to complete their existing orders.

Internal ASX analysis reveals that this occurred 202 times during the last financial year,[4] with more than 10 per cent of these incidents involving top ASX300 companies.

To address these issues, ASX proposes the following.

- The introduction of a 10-minute Post Close trading session will provide a company that has released a market-sensitive announcement with the opportunity to complete its 10-minute pause. Subsequently, the company will conduct its own closing auction, followed by the remaining time of the Post Close.

- Investors will be able to trade in a fully informed market, enabling them to complete existing orders or place new ones according to their preferences.

Summing up: Enhancing trading efficiency

Proposing new features for opening and closing auctions, implementing mechanisms for efficient price discovery, and reducing platform complexity will ensure a contemporary and resilient cash equities trading platform.

ASX has initiated stakeholder engagements to gather insights on these proposed changes over the coming months. We welcome feedback and encourage members of the Stockbrokers and Investment Advisors Association to contact us directly.

This article was originally published in SIAA Monthly - December 2023 publication.

For more information on any aspect of Service Release 15, please email equities@asx.com.au

1. https://www.asx.com.au/markets/market-resources/trading-hours-calendar/cash-market-trading-hours

3. Internal ASX analysis for the CSPA during FY23 for ASX200 stocks only

4. Internal ASX analysis for companies missing the CSPA due to market-sensitive announcements released during the CSPA

Disclaimer

Information provided is for educational purposes and does not constitute financial product advice. You should obtain independent advice from an Australian financial services licensee before making any financial decisions. Although ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”) has made every effort to ensure the accuracy of the information as at the date of publication, ASX does not give any warranty or representation as to the accuracy, reliability or completeness of the information. To the extent permitted by law, ASX and its employees, officers and contractors shall not be liable for any loss or damage arising in any way (including by way of negligence) from or in connection with any information provided or omitted or from any one acting or refraining to act in reliance on this information.

© Copyright ASX Operations Pty Limited ABN 42 004 523 782. All rights reserved 2023.