Much has changed in the world over the last 18 months as governments worldwide have battled the devastating effects of the COVID-19 pandemic with historic monetary policy easing. What has not changed is a need among investors for income on which to live and retire.

But with interest rates close to zero on cash and government bonds investments offering minuscule yield, investors have been forced to look elsewhere.

To complicate matters further, the monetary response has raised the chances of an inflationary outbreak, which has the potential to expose risk-free bonds as anything but free of risk. That leaves investors facing an unavoidable dilemma – to play it safe and earn next to zero income on cash or bonds, or to take on more risk in return for a reasonable income.

The quest, then, for investors that refuse to accept no income is to take an intelligent risk by finding pockets of opportunity in the financial markets. It is in this environment, Exchange Traded Funds (ETFs) potentially offer yield-seeking investors solutions to which they may otherwise not have access.

Some of these ETFs can offer relatively attractive income, for commensurate risk, in VanEck’s view. Thus, it is easy to see why more investors using ETFs as an income solution.

ETFs filling void

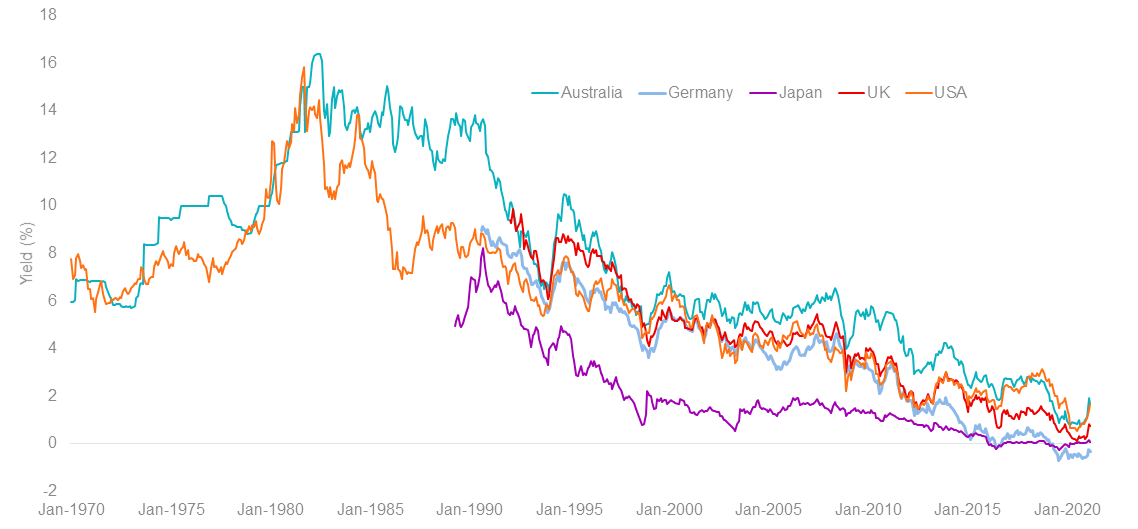

Interest rates have been falling globally for decades. In 1990, the 10-year Australian Government bond yield was 13% and the RBA cash rate was 14%. At that time, inflation was also much higher at 7%.

Today, the 10-year Australian Government bond yield is much, much lower, close to 1%, reflecting the huge amount of quantitative easing, as Chart 1 below shows.

Chart 1: The fall of government 10-year bond yields

Source: Bloomberg

Clearly, investors must search for yield outside government bonds and term deposits. Since the 2008-09 Global Financial Crisis, Australian investors have sought yield from assets such as shares and property that expose them to more risk than term deposits. The Australian banking sector has been particularly popular for yield-chasing investors.

However, bank shares have been volatile, unlike the principal of a term deposit, which retains its value. Moreover, as we saw during the height of the COVID-19 pandemic in 2020, some of the big banks stopped paying dividends.

To help smooth income and lower risks associated with equities, investors are diversifying into ETFs which are listed on ASX and designed specifically to provide income from more reliable sources. There are defensive cash and fixed interest ETFs as well as property and infrastructure ETFs, which provide defensive income that is paid even during economic downturns and often linked to inflation.

Moreover, ETFs are tradeable on ASX and require less paperwork than unlisted funds.

Below are some of the income solutions investors are using through ETFs:

Asset class | Portfolio Application | Additional VanEck ETF insights |

Floating rate notes (FRNs) | The coupon payments of FRNs will increase if market interest rates rise or fall if interest rates go down. | |

Australian Fixed Income | The yields from corporate bonds are generally higher yield than term deposits and government bonds. | |

Australian Subordinated Debt | Offers higher yield relative to cash, term deposits and traditional bonds for slightly elevated risk. | |

Emerging market bonds | Emerging markets bonds generally pay higher interest than developed markets bonds, offering investors an opportunity to broaden their income horizon with elevated risk | |

Global Capital Securities | Global capital securities can be used by Australian investors to diversify portfolios beyond local banks that dominate corporate bonds, equity income and hybrid allocations. | Global capital securities – an income alternative/complement to local hybrids

|

Infrastructure | Income from infrastructure assets is typically more stable compared to equities and higher than traditional defensive assets such as bonds. | |

Australian REITs | Stable rental income is a potential hedge against inflation by including increases in line with CPI (the Consumer Price Index). | |

Global REITs | Diversify beyond A-REITs which account for just 3% of the world’s REIT opportunity. | |

Equity income | Income from quality Australian companies. |

Source: VanEck

Many of these asset classes are not readily available to Australian retail investors. ETFs are democratising the investment landscape, giving investors unprecedented choice and access to global fixed income assets which they have not had before.

Accessing international opportunities

Two areas of the global investment market where relatively higher income exists are in emerging market bonds and global capital securities. The universe of each is large. The total size of the emerging bond market is estimated to be around US$26 trillion as borrowers from populous nations with large economies source financing.

The market for capital securities, issued by banks to shore up their equity positions to withstand losses, stands at around US$1.5 trillion. Yet both international and local investors often overlook these two markets, in VanEck’s view.

[Editor’s Note: Investors should understand the features, benefits and risks of investing in emerging markets, which historically can have periods of higher volatility].

Investors have long memories and while emerging markets economies have been the source of crises in the past, nations and institutions have taken significant steps to de-risk. Emerging markets are not a monolith, and some emerging markets are in a better financial position than developed markets, in VanEck’s view.

Yet that has not been reflected in risk premia commanded by the market. For investors that know how to navigate these markets, income rewards exist in a world mostly devoid of yield.

It is where active management in emerging markets bonds can come to the fore. This style of investing allows a manager to avoid those countries with weaker fundamentals and invest in economies that are better managed and therefore better insulated from the shocks of a COVID-19 event that restricts international trade.

The VanEck Emerging Income Opportunities Active ETF (Managed Fund) (ASX: EBND) is an actively managed ETF with a targeted yield of 5% per annum. EBND pays income monthly.

In terms of global capital securities, since the Global Financial Crisis (GFC), the banking universe has improved its fundamentals through higher capital ratios and balance sheet de-risking. However, global capital securities are difficult to access; they are only available in over-the-counter markets to institutional clients.

VanEck, together with leading credit and fixed interest specialists Bentham Asset Management, have created a global capital securities opportunity on ASX: the VanEck Bentham Global Capital Securities Active ETF (Managed Fund) (ASX: GCAP).

A quick note on tax and distributions

Income received by ETFs is paid to investors, just like income from unlisted funds. As with unlisted funds, it is best to choose your fund manager carefully, and how they treat income is an important consideration.

Recent tax changes can have a significant impact on the level of income you receive from your managed funds. The first change is known as ‘AMIT’, which stands for the Attribution Managed Investment Trust rules. The other change is known as ‘ToFA’, or the Taxation of Financial Arrangements.

These two tax changes are important because some investors have recently received an abnormally high 30 June distribution while other investors, in funds they rely on for income, did not receive a distribution at all.

For some fund managers, it was simply too expensive or too hard to implement these tax changes. VanEck has adopted these new tax treatments to smooth out fund distributions and maximise the reliability of income for investors.

In an environment of unprecedented large-scale central bank intervention, which has suppressed interest rates, investors have little choice but to take on additional risk. Van Eck believes savvy investors can still earn an income that rewards them for the risk they’re willing to take, and ETFs can provide that opportunity.

Investors can buy and sell units in an ETF on the ASX at any time in the trading day. As long as you have an account with a broker, you can buy and sell units on ASX, without the need for paperwork or having your money locked away for fixed periods.

ETFs can also diversify your portfolio as a single ETF typically holds a lot more securities, obtained more cost-effectively, than an investor doing it themselves.

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.