Although most investors would be familiar with ASX-listed shares to build wealth, ASX’s Investment Product range extends beyond shares and includes:

- Exchange Traded Products (ETPs);

- mFunds;

- Listed Investment Companies and Trusts (LICs and LITs);

- Australian Real Estate Investment Trusts (A-REITs); and

- Infrastructure Funds, which encompass a broad range of investment objectives.

There are currently more than 600 Investment Products available on ASX. To assist investors with their research, ASX publishes a comprehensive Investment Products Monthly Report which is available on the ASX website free of charge and is updated on a monthly basis.

The ASX Investment Products Monthly Report uses data supplied by an array of data partners (such as Iress and Bloomberg), Investment Product Issuers and ASX’s own internal database. It provides data going back to 2017.

So, whether you are a novice or a seasoned investor, the ASX Investment Products Report can be a useful tool that you can use to conduct your research and compare your different investment options.

Exchange Traded Products (ETPs)

ETPs are an open-ended fund available on ASX that provides exposure to a basket of underlying securities.

The ASX Investment Products Report contains a monthly breakdown of the entire ETP market including asset growth, trading activity and asset class breakdown.

The ASX Investment Products Report also includes monthly statistics for each ETP provider, including their total funds under management, inflows/outflows and transaction activity.

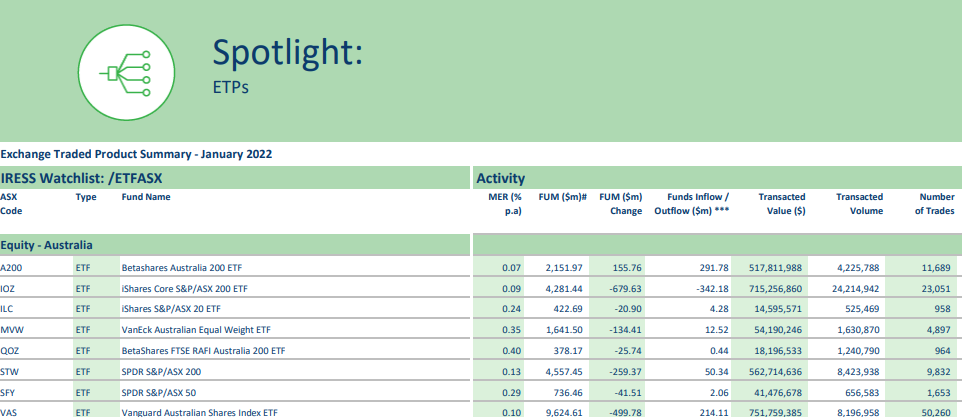

ASX also publishes comprehensive data on each ETP in the ETP Spotlight Table.

The ETP Spotlight Table categorises each ETP by its asset class and includes key statistics such as:

Source: ASX Investment Products report

- Fund size;

- Listing date;

- 1 month, 1 year, 3 year and 5 year performance returns;

- Trading activity and liquidity;

- Historical distribution yield;

- Average bid/offer spread; and

- Management expense ratio.

The ETP Spotlight table is also available in an Excel version which enables ETPs to be filtered by fund size, average bid/offer spreads, performance, trading activity or etc.

Source: ASX Investment Products report

Listed Investment Companies/Listed Investment Trusts (LICs/LITs)

LICs/LITs are a closed-ended vehicle available on ASX that provides exposure to a basket of underlying securities.

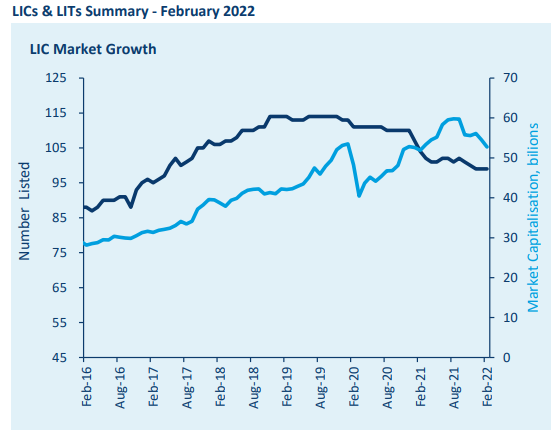

The Investment Products Report contains a monthly breakdown of the LIC/LIT market including market capitalisation growth, asset class breakdown, the most frequently traded LICs/LITs and a graph of the number of LICs/LITs trading a premium or discount to its NTA.

ASX also publishes granular data on each LIC/LIT in the LIC/LIT Spotlight Table.

The LIC/LIT Spotlight Table categorises each LIC/LIT by its asset class and includes key statistics such as:

Source: ASX Investment Products report

- Market capitalisation;

- Listing date;

- 1 month, 1 year, 3 year and 5 year performance returns;

- Premium/discount to Net Tangible Assets (NTA);

- Trading activity and liquidity; and

- Historical distribution yield.

The LIC/LIT Spotlight Table is also available in an Excel version which enables LICs/LITs to be filtered by market capitalisation, performance, premium/discount to NTA, trading activity etc.

Source: ASX Investment Products report

mFunds

mFunds are open-ended unlisted funds available on ASX that provide exposure to a basket of underlying securities.

The ASX Investment Products Report contains a breakdown of the mFund market including funds under management, growth, asset class breakdown and the most frequently transacted mFunds on a monthly basis.

Source: ASX Investment Products report

ASX also publishes data on each individual mFund in the mFund Spotlight table.

The mFund Spotlight table categorises each mFund by its asset class and includes key statistics such as:

- Fund size;

- Admission date;

- Inflows and outflows;

- Returns over a 1 month, 3 month, 1 year, 3 year and 5 year period;

- Transaction activity; and

- Management expense ratio.

The mFund Spotlight table is also available in an Excel version which allows mFunds to be filtered by fund size, performance, transaction activity, management expense ratio etc.

Source: ASX Investment Products report

Australian Real Estate Investment Trusts (A-REITs) and Infrastructure Funds

A-REITs and Infrastructure Funds are a close-ended investment vehicle available on ASX that provides exposure to property and infrastructure assets.

The ASX Investment Products Report contains a monthly breakdown of the A-REIT and Infrastructure Fund market including market capitalisation growth, asset breakdown and the most frequently traded A-REITs and Infrastructure Funds.

Source: ASX Investment Products report

ASX also publishes granular detail on each A-REIT and Infrastructure Fund in the A-REIT and Infrastructure Funds Table.

The A-REITs and Infrastructure Funds Table categories each product by its asset class and includes key statistics such as:

- Admission date;

- Market capitalisation;

- Returns over a 1 month, 3 month, 1 year, 3 year and 5 year period; and

- Transaction activity and liquidity.

The A-REITs and Infrastructure Funds Table is also available in an Excel version which enables A-REITs and Infrastructure Funds to be filtered by market capitalisation, performance, transaction activity etc.

Source: ASX Investment Products report

More Investor Update articles

The views, opinions or recommendations of the author in this article are solely those of the author and do not in any way reflect the views, opinions, recommendations, of ASX Limited ABN 98 008 624 691 and its related bodies corporate (“ASX”). ASX makes no representation or warranty with respect to the accuracy, completeness or currency of the content. The content is for educational purposes only and does not constitute financial advice. Independent advice should be obtained from an Australian financial services licensee before making investment decisions. To the extent permitted by law, ASX excludes all liability for any loss or damage arising in any way including by way of negligence.