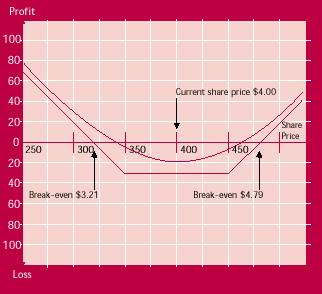

Profits and losses

The success of the long strangle depends on a dramatic increase in the volatility of the underlying shares or a sharp move in the share price. Profits will be made towards expiry if the share price has moved far enough past the strike price of either option to cover the premium paid. As with the long straddle profits can be taken early in the life of the strategy if there has been a big enough move in the share price.

Other considerations

- Time decay: as with the long straddle, the long strangle is exposed to time decay. Since both options are out-of-the- money, they consist entirely of time value. As expiry approaches, time decay accelerates. For this reason, the strangle is generally unwound well before expiry.

- Volatility: since the strangle is constructed using out-of-the-money options, it costs less than the straddle. The disadvantage is that the share price must move further for the strategy to be profitable. The investor must be expecting a significant move for the long strangle to be considered. If the expected increase in volatility or change in share price does not eventuate, both options will expire worthless.

Follow-up action

The strangle should not be held too close to expiry. If the expected move in the share price has taken place, the position can usually be unwound at a profit well before expiry. If the stock's direction becomes clear, it may be appropriate to close out the leg that is losing its value and hold the profitable leg.

If the expected increase in volatility has not taken place, it may be advisable to close the position out before time decay starts to seriously damage the strategy.

Points to remember

- Choose options over shares whose price you expect to move strongly in either direction.

- Always be aware of the effects of time decay and do not hold the position too close to expiry.

- Choose expiry months that allow enough time for the underlying shares to move.