Calendar spread

In a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. This is achieved without the risk of an uncovered sold position.

Calendar spread

In a neutral market, the calendar spread provides a method for the trader to earn income by profiting from time decay. This is achieved without the risk of an uncovered sold position.

| Market outlook | Neutral to first expiry |

| Volatility outlook | Steady to first expiry |

| The calendar spread | |

|---|---|

| Construction | short call X, near-term expiry, long call X, far-term expiry |

| Point of entry | market around strike price |

| Breakeven at expiry | undetermined in advance |

| Maximum profit at expiry | undetermined but limited |

| Maximum loss at expiry | limited to cost of spread |

| Time decay | helps |

| Margins to be paid? | maybe |

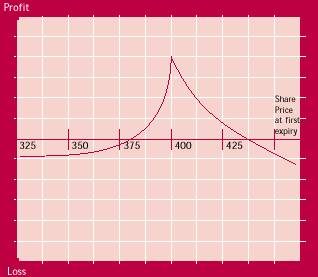

Since the calendar spread involves two expiry months, it is not possible to construct an accurate payoff diagram for the strategy at expiry of the sold option. The value of the long option at this point can only be estimated using pricing models. However, the maximum profit will be realised if the share price is at the strike price of the options at the first expiry. The sold call will then expire worthless, while the long call will have the most possible time value remaining.

The calendar spread benefits from the different rate of time decay of the two options involved. Time decay of the near month option's premium will be faster than that of the far month option. This has the effect of widening the spread between the two prices.

The maximum loss possible is the cost of the spread. This will occur if the long call has very little time value left at expiry, in other words if the share price has either risen or fallen dramatically.

If the market remains steady, the investor may choose to do nothing and let time decay take its course, resulting in the short call expiring worthless. The investor can then close out the long call or perhaps hold on to it if expectations are now bullish. Holding the call converts the strategy to a simple taken option position, with the attendant risks and rewards.

If the stock falls unexpectedly, the investor may choose to close the spread before the long call loses all time value. Otherwise, the position could be left in the hope that the market recovers and the long call improves in value.

In the event of a market rise, the investor must decide whether to close out the spread to avoid exercise or maintain it in the hope that the market retreats and time decay can take effect.

You believe that shares in ABC Limited are likely to remain stable for at least two months, and wish to earn some extra income during this period. However, you are not prepared to expose yourself to the risks involved in writing an uncovered option. You decide to enter a calendar spread.

Sell 1 Dec $4.00 Call @ $0.22 and

Buy 1 Mar $4.00 Call @ $0.38

The information contained in this webpage is for educational purposes only and does not constitute financial product advice. ASX does not represent or warrant that the information is complete or accurate. You should consider obtaining independent advice before making any financial decisions. To the extent permitted by law, no responsibility for any loss arising in any way (including by way of negligence) from anyone acting or refraining from acting as a result of this material is accepted by ASX.

Both courses have 10 modules with each module taking 20-25 minutes to complete

Options are flexible tools that appeal to active investors. Take this course to learn how to magnify profits or protect your portfolio by buying or selling options.

Two monthly trading webinars designed for you to ask questions live while presenters walk through an introduction to options and advanced options trading. (Free Sign-Up)

Challenge your knowledge of options and sharpen your trading skills.

Next game starts on 15 June and ends on 17 July 2020.

Find a broker or adviser

Start putting your investment plans into place.

ASX acknowledges the Traditional Owners of Country throughout Australia. We pay our respects to Elders past and present.

Artwork by: Lee Anne Hall, My Country, My People