When to Use?

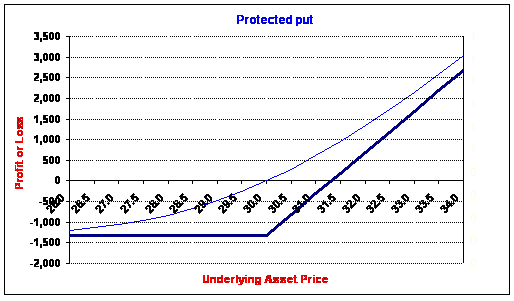

The investor employing this strategy generally has unrealised profits on their shares and is concerned about risk in the near term. Purchasing puts while holding shares is a bullish strategy because ultimately the shareholder would like to see their shares go up even though this would mean the put option expires worthless. The put option acts as insurance or a stop loss order that can be executed at the discretion of the holder. The strategies is especially important for margin lending clients where an across the board fall in the market could trigger margin calls.