5 Year Bond Future Exchange for Physical (EFP) fees waived

ASX is waiving fees on all 5 year Exchange for Physical (EFP) transactions until 30 June 2022. The fee holiday will support the growth of the EFP of mid curve bonds and swaps to the 5 year future, facilitating a more efficient and effective hedge for mid curve treasury exposures.

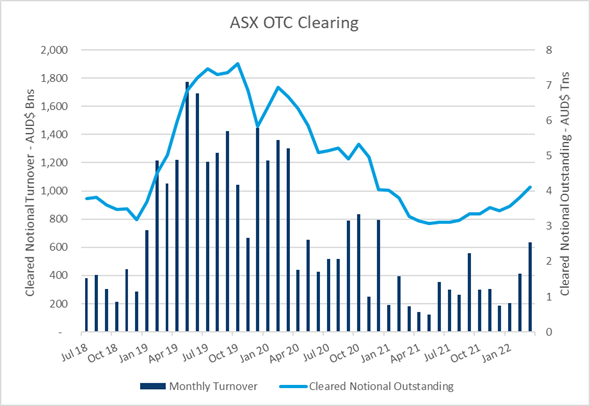

OTC swap volumes

Global AUD OTC swap volumes grew substantially between Q4 2021 vs Q1 2022 as result of substantial growth in shorter-dated interest rate swap and OIS volumes. ASX’s OTC Clearing service has recorded total notional cleared of A$1.25 trillion in Q1 2022, up 62% vs pcp.

Continued growth in longer dated swaps: ASX has grown its activity and market share in longer dated interest rate swaps, with Weighted Average Maturity of ASX Cleared Interest Rate Swaps currently at 2.09 years. This continues to be above the long running average for the service, despite the recent growth in shorter dated swaps with market participants taking advantage of ASX’s lower total cost of clearing and the available cross-margining offsets (average 50% cross-margining benefit across users of ASX’s Margin Optimisation service).

ASX consults on OTC fallback rate provisions and OTC product enhancements: On 21 March 2022, ASX released a consultation paper outlining proposed changes to the ASX Clear (Futures) OTC Rules and Handbook to:

- implement globally standardised benchmark fallback rate provisions in relation to the OTC interest rate derivatives products cleared by ASX; and

- introduce OTC product enhancements to support the Actual/Actual ICMA Day Count Convention for the clearing of Assets Swaps and the IMM AUD roll convention, the industry convention to enable swaps to roll on ASX’s bank bill futures dates.

The ASX public consultation website is located here.

The specific consultation paper can be found here; and the supporting proposed OTC Rulebook and OTC Handbook changes can be found here.