July RBA Monetary Policy decision - Q2 2021

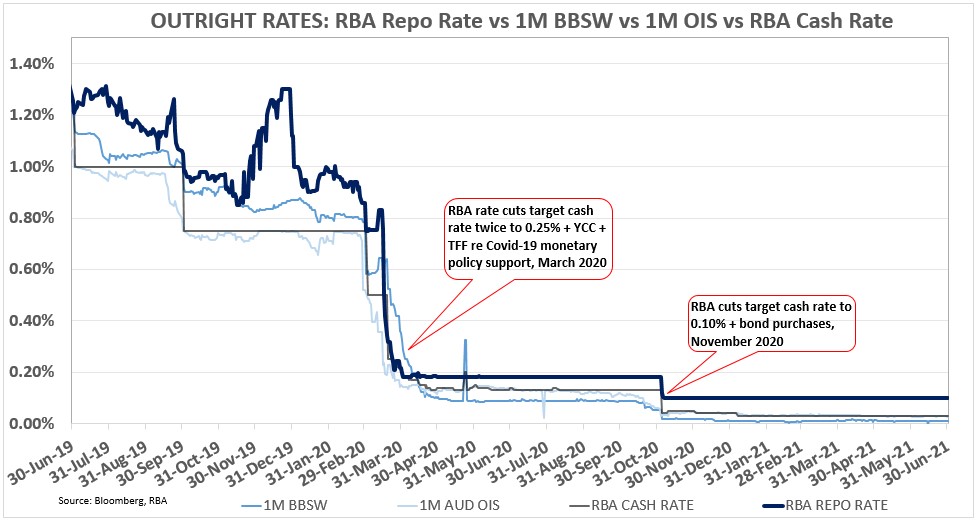

The highly anticipated July RBA monetary policy decision saw the board largely maintain its current policy settings by keeping the April 2024 bond as the 3 Year Yield Target, maintaining the Cash Rate and Yield Target at 0.10% and paying 0% interest on Exchange Settlement Account (ESA) balances. The board also confirmed that while the Bond Purchase Program will end in September, bond purchases will continue until at least mid-November, albeit at a lower rate of $4 billion per week (down from the current $5 billion per week) in order to support inflation and employment objectives with a further review to be conducted in November. The board maintained that it will not increase the Cash Rate until inflation is sustainably within the 2-3% target range and that this condition is not expected to be met before 2024.

Why is this significant?

The board announced in previous statements that it would consider whether to retain the April 2024 bond as the target bond for the 3 Year Yield Target or shift it to the November 2024 bond at the July meeting. Extending the 3 Year Yield Target to the November 2024 line would effectively signal to the market that a Cash Rate rise is not expected until late 2024/early 2025.

In light of better than expected economic data, including recent unemployment figures showing a decline in the unemployment rate to 5.1% in May (down from 7% a year prior), the RBA elected to retain the April 2024 bond as the Yield Target. This is in line with the Bank’s ‘central scenario for the economy’ which is that inflation will not be sustainably within the 2-3% target range before 2024.

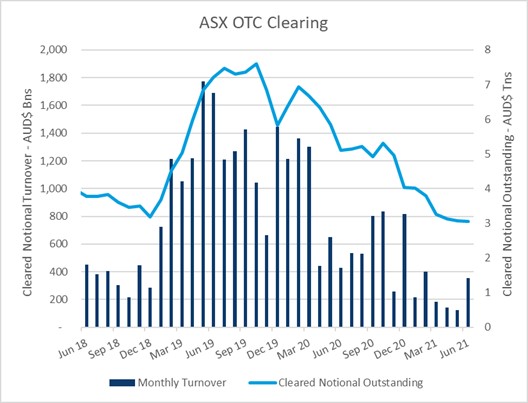

This decision was also significant for the basket of bonds that underpin the ASX 3 Year Treasury Bond Futures contract with the December bond basket now free of any Yield Target bonds.

How did the market react?

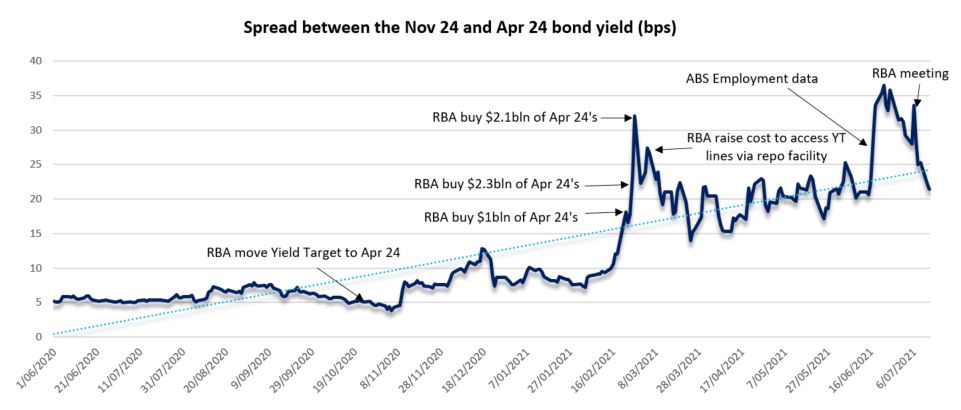

Going into the meeting, the market largely expected the 3 Year Yield Target to be retained on the April 24 bond given stronger than expected economic data. This is evidenced in the below chart that shows the widening spread between the April 24 and November 24 bond lines as the April 24 bond remains anchored to the 0.10% Yield Target.

The Bank Bill Futures and Cash Rate Futures yield curve steepened following the announcement with the market pricing in the first interest rate rise by late 2022, significantly earlier than the RBA’s 2024 projection. Following the RBA announcement, the yield on the 3 Year Bond Future increased by 7.5 basis points while the 3’s/10’s curve flattened to below 100bps (reaching 98.5bps) for the first time since February.