ASX Rates Highlights

OTC, Futures, Benchmarks and Repo - August 2020

ASX Rates Highlights

OTC, Futures, Benchmarks and Repo - August 2020

A significant amount of Treasury Bonds sit in between the lines that currently underpin the 3 and 10 Year Bond Futures. This represents approximately $200 billion in physical exposure that could be more effectively hedged using a 5 year contract. Given record issuance from the AOFM, including the recently issued $17 billion November 2025 line, there is heightened need and demand for a 5 year point on the curve.

ASX believes that the 5 Year contract will support the market by providing an additional liquidity point and hedging tool that will allow participants to manage their risk exposure in a more efficient and effective manner.

The target launch date is late Q4 2020, subject to regulatory approval, internal and external readiness. The first expiry month is expected to be March 2021.

Contract specification details can be found in the Market Notice 0677.20.06

Further details on test bed availability, data vendor codes, the underlying bond baskets and go live date will provided over the coming months.

Learn more: Helen Lofthouse interview with KangaNews

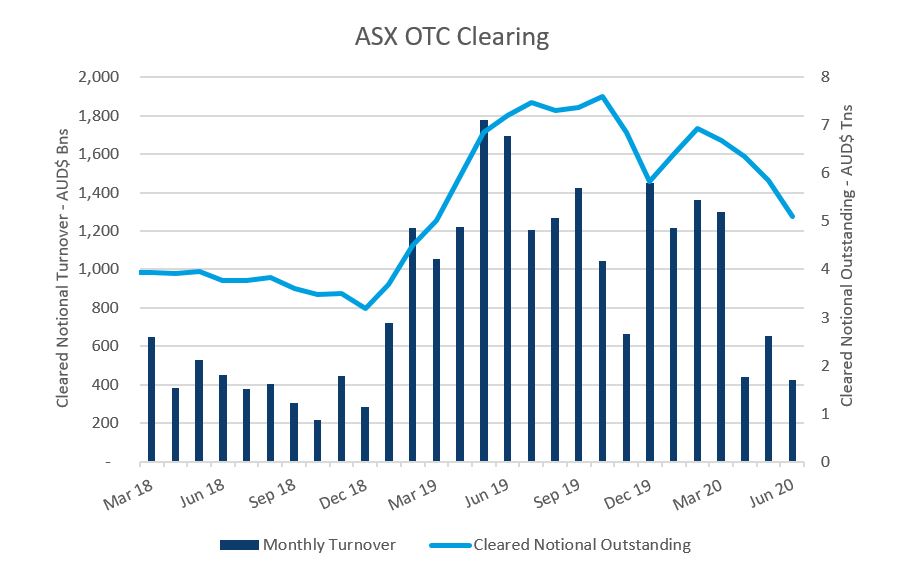

ASX achieved record OTC clearing volumes during the financial year ending June 2020, clearing A$12.4 trillion notional value up 28% on the previous financial year.

In the final quarter of the financial year (April-June 2020) ASX OTC clearing volumes and notional outstanding fell in accordance with the global decline in A$ denominated interest rate swap activity, particularly Overnight Index Swaps, following the implementation of a significant package of changes by the RBA in March.

ASX’s OTC clearing service continues to provide significant cost and capital efficiency to its users with an average cross-margining benefit of 40% across the financial year for users of ASX’s Margin Optimisation Service which provides fully automated Futures vs OTC cross-margining.

A$12.4 trillion

Total notional cleared in FY 20

↑ 28%

in total notional cleared

FY 20 vs FY 19

A$5,098 billion

Cleared notional outstanding

↓29%

in total cleared notional outstanding Jun 20 vs Jun 19

40%

Average Cross-Margining benefit across users of ASX’s Margin Optimisation Service.

Automated Futures vs OTC cross-margining

Rates futures volumes for the period Q2 2020 reached 26.7 million contracts, a decline of 37% on the same period in 2019. The drop in volume was primarily driven by a decrease in activity in the front end of the yield curve. Volatility declined in this part of the curve as a result of the impacts from both the low rates environment and the RBA’s package of measures which have the effect of flattening the yield curve from 0-3 years.

Bond EFP activity during Q2 2020 increased, largely driven by the increase in issuance by the AOFM. Bond EFP volumes reached 4.12mln contracts, compared to 3.4mln for the same period in 2019. From mid-March through to end of July 2020, the AOFM have issued A$131bln into new and existing bond lines. New bond lines, including a new 30 year benchmark bond constituted A$64bln of the total issued since mid-March, following the Government’s announcement of a series of packages to support the economy during the COVID pandemic.

Open interest in the 3 Year Bond Futures contract increased during July from 998,000 contracts to 1.25mln contracts. The increase in open interest was largely driven by the issuance of a new benchmark bond (17bln in a November 2025 line) by the AOFM. Open interest in the 10 Year Bond Futures contract also increased from 1.2mln contracts to 1.4mln contract on the back of ongoing issuance, underlining the important role that bond futures play in hedging exposure and interest rate risk.

ASX Benchmarks has published a Consultation Paper on proposed enhancements to the transaction layer of the BBSW methodology with the objective of increasing the frequency with which BBSW rates are calculated under the primary layer of the waterfall, while also ensuring the quality of the rate.

The proposed enhancements to the BBSW calculation methodology outlined in the Consultation Paper are to:

The formal consultation closes on 27 August 2020. See Market Notice 0840.20.07.

Results of the consultation and next steps will be issued via market notice in September 2020.

Multilateral compression is an important service that provides users with the ability to reduce their outstanding notional value and individual trade line items that support an economically equivalent market position – leading to a reduction in capital costs and operational risk.

On 6 July OTC Rule and Handbook amendments supporting multilateral compression became effective, and TriOptima AB became the first “Approved Compression Service Provider” of ASX. Please refer to ASX Market Notice 0722.20.07

ASX is now working with TriOptima and its OTC Participants to schedule the first multilateral compression cycle.

On 30 June 2020, ASX released Market Notice 0693.20.06 reminding market participants of the implementation of the reduced tick increments for the 3 and 10 Year Bond Futures, commencing with the September 2020 roll. A fact sheet was included with the market notice to provide further details on price examples, rounding rules and order purging that will occur with the new bond roll tick increments.

The Operating Rules Procedures received regulatory clearance and were published to the market on 3 August 2020 via ASX 24 Market Notice 0878.20.08. Included in this market notice was the notification of the extension of the cessation date of the existing class no action for certain Trading Participants pertaining to the Conditions of Licence for Market Operator Software contained in the ASX 24 Operating Rules and Procedures to limit the number of PTRM message rejects that can occur.

Market participants are reminded that the 90 Day Bank Bill Futures contract for September 2020 expiry and all other subsequent expires will be cash settled. The cash settlement price will use 3 month BBSW published at 10.30am on the Last Trading Day.

During the completion of internal readiness activities, a technical limitation was identified with the cash settlement contract specification as previously published. This limitation has required a change to the contract expiry time on the Last Trading Day.

The contract expiry time:

Please refer to ASX 24 Market Notice 0890.20.08 for the updated contract specification and updated expiry timetable.

Participants should note that the contract is tradeable via the outright and spread markets until the expiry time of 8.29am.

In June 2020, ASX Collateral reached a new record high balance of $43.7bn, up 16% from the previous quarter high balance of $37.5bn in March 2020.

See charts for further information on repo rates, spreads, balances and collateral segmentation

Find out more on ASX Collateral

On Wednesday 3 June 2020, ASX published Market Notice 0563.20.06 advising details of Austraclear Service Release 10 (SR10) scheduled for 23 November 2020.

The key changes will include:

Benefits to Participants include:

Enhanced market repo functionality is planned to be released in the November 2020 Austraclear SR10 and Austraclear participants can utilise the enhanced market repo module in advance of required market wide adoption by 22 November 2021.

As a reminder, ASX published Market Notice 0338.20.04 on 17 April 2020 advising all Austraclear participants that the no action relief for use of the Market Repo module to settle repo transactions was extended to 22 November 2021, from November 2020.

This was based on feedback from market participants with respect to the time required to make the changes to support the use of Market Repo for settlement and the need for Austraclear to complete aspects of its own readiness.

UPCOMING EVENTS

12 August 2020 - FIA webinar, Resilience and adaptability: The key to meeting the new challenges for ETD markets in Asia-Pacific

CHARTS